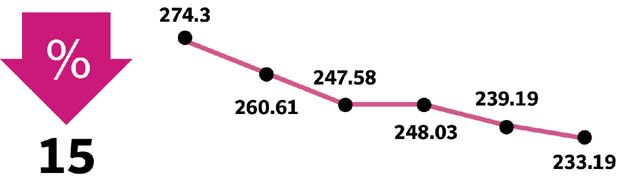

Stocks endure volatile week, plunge 1,128 points

Developments on economic front caused the decline in index

Developments on economic front caused the decline in index. PHOTO: FILE

Trading kicked off on a negative note despite inflows worth $2.2 billion from China to bolster the fast-depleting foreign exchange reserves. The announcement of the monetary policy over the past weekend also added to the grim mood as the central bank raised the key interest rate by 50 basis points, which increased pressure on leveraged industries.

The KSE-100 was further dented by higher-than-expected inflation readings, which clocked in at a five-year high of 9.41% for March. The downward trend continued as the index finished in the red on Wednesday on back of concerns on the macroeconomic front. Matters were further aggravated on Thursday as the report by the Asian Development Bank (ADB) worried investors.

The bank painted a worrying picture of Pakistan’s economy, saying economic growth would slow down to 3.9% with higher inflation and there would be continued pressure on the exchange rate and current account deficit. Delay in finalisation of the International Monetary Programme (IMF) and the continuous depreciation of rupee against the US dollar also took a toll and fuelled bearish sentiment.

The tide changed on Friday as the index inched upward in an overall lacklustre session, amid weak interest. According to a Topline Securities report, equities posted 16-week highest loss, with four sessions in red and one in green.

Market participation also dipped during the week with 7.5% decline in average daily traded volume to 119 million shares, while average daily traded value was down 20.4% to $25 million.

Contribution to the downside was led by commercial banks (down 383 points) due to foreign selling, fertiliser (134 points) amid announcement of 100,000 tons of urea import, oil and gas marketing companies (35 points) on account of slowdown in petroleum off-take by 17% year-on-year in March 2019, pharmaceuticals (92 points), and power generation and distribution (67 points). On the other hand, positive contribution came from miscellaneous (up 57 points).

Scrip-wise, major losers were HBL (down 122 points), UBL (71 points), PPL (58 points), ENGRO (51 points), and PSO (47 points).

Foreigners offloaded stocks this week clocked worth $3.7 million compared to a net buy of $0.5 million last week. Major selling was witnessed in fertiliser ($1.6 million) and power generation ($1.6 million). On the local front, buying was reported by individuals ($5.5 million) followed by banks/DFIs ($4.7 million). Mutual funds were sellers of $3.2 million.

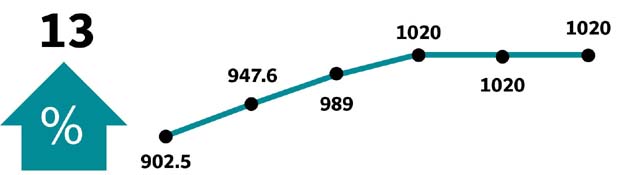

Weekly review: KSE-100 index posts gains for third successive week

Among major highlights of the week were; policy rate hiked to 10.75%, rupee slid to keep inflation upward, petrol price increased by Rs6/litre, inflation jumps to a five-year high of 9.41% in March, a new stock Interloop limited (ILP) was listed on the PSX, the prime minister is scheduled to perform ground-breaking of housing projects in Islamabad and Quetta, and the government plans another amnesty scheme for non-filers.

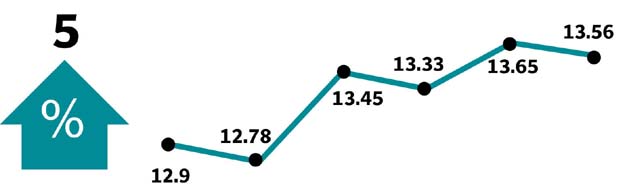

Winners of the week

Pakistan Services Limited

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

Unity Foods

Unity Foods Ltd is an agri-business company, with principal activities including the entire value chain from the procurement and crushing of multiple oil seeds.

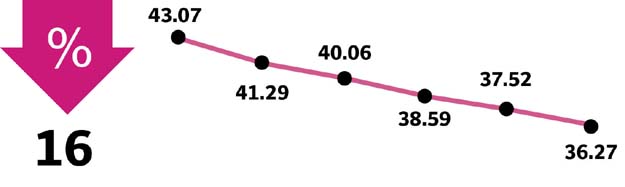

Losers of the week

Amreli Steels Limited

Amreli Steels Limited is a Pakistan-based steel manufacturing company. The company is engaged in the manufacture and sale of steel bars and billets. The company offers a range of steel bars for all construction needs.

Pak Suzuki Motor Company

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

Published in The Express Tribune, April 7th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ