Major concession : Excise duty abolished, sales tax reduced for importers

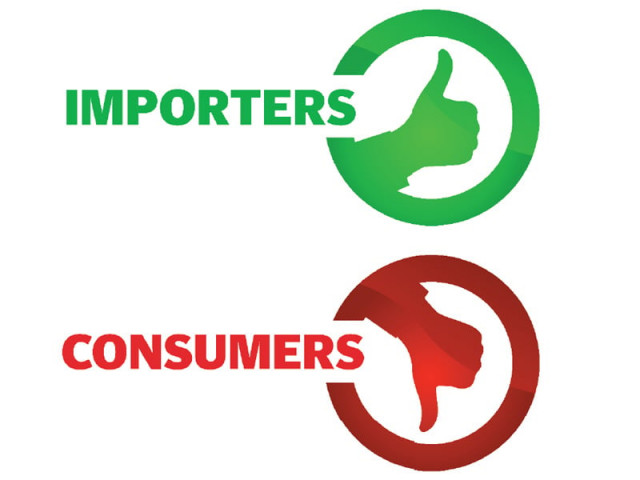

Step aimed at encouraging importers to get cargo cleared before June-end, consumers get short end of the stick.

The government on Tuesday provided a major concession to importers as it abolished 2.5 per cent special excise duty and reduced sales tax to 16 per cent with immediate effect, which will cause a loss of Rs13 billion to the national kitty.

The move was aimed at encouraging importers to get their consignments cleared which they had delayed until after June to benefit from reduced taxes as announced in the budget for 2011-12.

The decision shows how desperate the government is in achieving the annual tax collection target, as it went to the extent of creating two sales tax regimes for the next 10 days. The decision would prove a windfall for the importers who would get a total tax relief of 3.5 per cent, but end-consumers would still pay 2.5 per cent special excise duty besides 17 per cent sales tax until June 30.

Finance Minister Dr Abdul Hafeez Shaikh approved the revised sales tax rate, said a spokesperson for the Federal Board of Revenue (FBR). In response to queries, the spokesperson said “after importers stopped clearing their cargo, revenues of Rs30 to Rs40 billion got stuck in the process, making it difficult to achieve the tax collection target.”

The finance minister, in his budget speech on June 3, had announced a reduction in sales tax rate from 17 to 16 per cent and abolition of special excise duty being charged at a rate of 2.5 per cent from July 1 – the beginning of next financial year 2011-12.

In June 2010, the government had increased sale tax rate to 17 per cent just for three months on the pretext of coping with losses it would incur for not levying Reformed General Sales Tax until September 2010. Later on March 15, 2011, it increased special excise duty to 2.5 per cent from 1 per cent to make up for less-than-expected revenue collection.

“With a view to further facilitating the trade and industry in difficult times, it has been decided to give effect to these two measures on imports from June 20, 2011. Consequently, there will be no special excise duty on imports and the rate of sales tax on imported goods will be 16 per cent,” said a brief statement of FBR.

The issue of negative revenue implications of withholding consignments at ports first came to light in a meeting of the Senate Standing Committee on Finance and Revenue during scrutiny of Finance Bill 2011. Senior FBR members told the committee that the authorities were considering implementing the decision from June 10.

Sources said the FBR chairman was not ready to take a revenue hit of Rs27 billion (the 20-day impact) on account of these two measures. One per cent sales tax fetches Rs36 billion monthly while special excise duty brings an estimated Rs2.5 billion.

The FBR chief eventually agreed to the move in a bid to achieve the tax target but it would cause a loss of Rs13 billion by giving concessions at the import stage.

At the start of 2010-11, parliament gave a tax collection target of Rs1,667 billion to FBR. However, during the course of the year, FBR and the finance ministry revised the target downwards to Rs1,588 billion besides levying Rs53 billion in new taxes. Until June 20, tax collection stood at Rs1,430 billion, requiring FBR to collect Rs158 billion in remaining 10 days.

Published in The Express Tribune, June 22nd, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ