Weekly review: KSE-100 slides for sixth successive week, loses 643 points

Concern over IMF, hike in gas prices and economic developments keeps investors away

Concern over IMF, hike in gas prices and economic developments keeps investors away. PHOTO: FILE

The negative trend was mainly due to the government’s downward revision of the FY19 GDP growth target to 4%. Investors braced for stringent measures as the finance minister hinted on the finalisation of an International Monetary Fund (IMF) bailout package within a month’s time.

Investors cautiously navigated through murky waters as in addition to the recent hike in gas prices, market participants anticipated a hike in interest rates and power tariffs could be on the cards before the bailout deal.

On the political front, productive talks on the Kartarpur corridor suggested that relations with India seem to have started to normalise after a tense few weeks.

Moreover, refineries came under pressure after reports that the International Maritime Organisation (IMO) will impose emission standards limiting the marine sector to using furnace oil with sulphur content of less than 0.5% from January 2020, thereby curbing the already weak demand for the oil in the country.

Investor participation weakened as average daily trading volumes during the week declined 18% to 93 million shares, whereas average daily traded value fell 21% to $27 million.

Sector-wise negative contributions came from commercial banks (down 149 points), cement (120 points), oil and gas exploration companies (109 points), oil and gas marketing companies (76 points), power generation and distribution companies (53 points). On the other hand, positive contribution came from tobacco (up 48 points) and textile composite (7 points) sectors.

Market watch: KSE-100 dives 502 points as investors offload stocks

Scrip-wise, major laggards were LUCK (down 68 points), MCB Bank (50 points), POL (49 points), Habib Bank Limited (48 points) and Oil and Gas Development Company (39 points).

Foreign selling continued this week as well, clocking-in at $15.6 million compared to a net sell of $3.5 million last week. Major selling was witnessed in exploration and production ($13.4 million) and cement ($1.5 million).

On the domestic front, major buying was reported by insurance ($8.3 million) and companies ($3.6 million).

Interloop raises Rs5.032b from investors at Pakistan Stock Exchange

Among major highlights of the week were; overseas Pakistanis remitted $14.35 billion in the first eight months of the current fiscal year, trade deficit narrowed 11% to $21.5 billion during July-February FY19, foreign reserves held by the central bank increased to $8.12 billion, largest hosiery producer - Interloop - went public, govt failed to secure a $3.2 billion deferred oil facility from the UAE and hike was seen in car prices by Indus Motor and Honda Atlas.

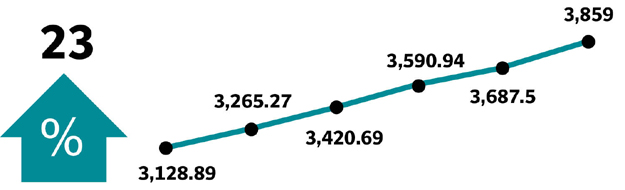

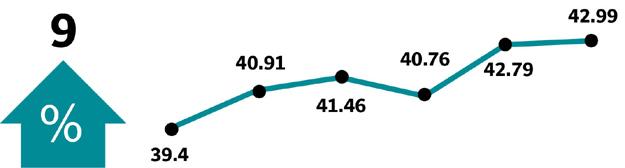

Winners of the week

Philip Morris

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Kohinoor Textile Mills

Kohinoor Textile Mills Limited produces textiles. The company weaves, dyes and prints natural and synthetic fibres.

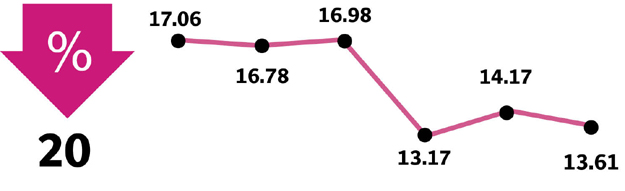

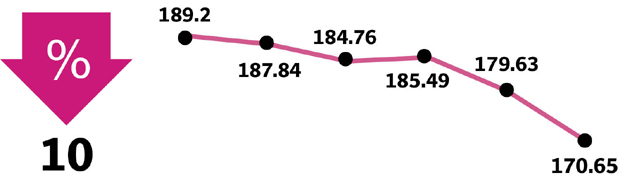

Losers of the week

Unity Foods

Unity Foods Limited is an agri-business company, with principal activities covering the entire value chain from procurement to crushing of multiple oilseeds.

National Refinery

National Refinery Limited manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Published in The Express Tribune, March 17th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ