Pakistan Banao Certificate: A viable solution for economic stabilisation

The government launched amnesty scheme PBC effectively secures $20 million from Pakistani diaspora

The PTI government has had to tackle countless colossal economic crisis situations left by the previous government for Imran Khan to inherit since the day he was sworn as the 22nd Prime Minister of Pakistan in 2018. During this challenging state of affairs, Khan is making astounding efforts to steer Pakistan’s struggling economy out of the crisis by fostering economic development in the long run.

Currently, Pakistan’s expenditure on imports is far greater than the amount it receives on exports due to which the current account deficit has risen from $2.7 billion in 2015 to $18.2 billion in 2018. With the domestic industry in ruins, Pakistan has not been able to rely on consistent foreign investment for more than stopgap measures. This may point out why Imran Khan has been campaigning against the corruption that has been eating away our economy. Similarly, it highlights the drastic reforms the government is forced to contend with given Pakistan’s current crippling foreign debt situation. Unfortunately, these such reforms have pushed Imran Khan into imposing measures such as widened tax bases and raised utility prices that are proving to be politically unpopular.

Promoting manufacturing by creating a more investment-friendly environment, broadening its tax base, and encouraging innovation and modernisation in export-led industries are few viable solutions to address the current account deficit. Though, the depreciating rupee that has made imports costlier, low foreign investment caused by Pakistan’s security and political challenges has also severely hit the country’s foreign exchange reserves. Understanding the intensity of the situation, PM Imran Khan and PTI are taking innovative steps towards debt servicing, figuring out ways to address our national debt crisis through new deals with countries, and implementing fundraising initiatives to minimise the cost of borrowing.

PM successfully instigated considerable assistance from friendly countries, three billion dollars parked in State Bank of Pakistan (SBP) for a year by Saudi Arabia, another two billion dollars from the UAE (with an additional one billion dollars pledged) and around six billion dollars as deferred oil payment facility – three billion dollars each from Saudi Arabia and UAE and the remaining two and a half billion dollar loan being negotiated from China.

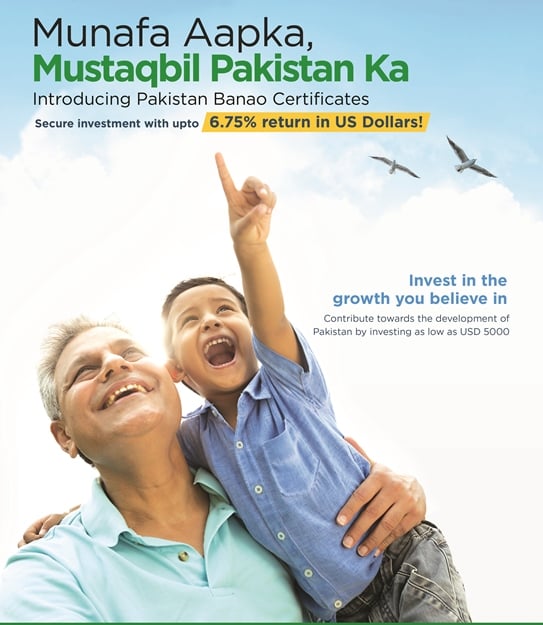

To make a significant impact on the current account deficit, Pakistan needs to ensure an investment-friendly environment that attracts more foreign direct investment (FDI), instead of relying so heavily on foreign aid. Up till now, the Crown Prince of Saudi Arabia, Mohammad bin Salman has signed seven Memorandums of Understanding (MoUs) with Pakistan, pledging up to $21 billion worth of investment over the next six years. Imran Khan is tackling the debt issue by reaching out to Expat community through implementation of amnesty scheme for mobilisation of foreign exchange resources – the ‘Pakistan Banao Certifications (PBC) with maturities of three and five years.

PBC, a true nationalistic motive allows the government to raise financing without having to rely on other countries or governments, or in turn their political demands. Similarly, it opens the avenue of FDI by prominent overseas Pakistanis abroad. The PBC is an initiative that unlocks doors for overseas Pakistanis who can contribute to their homeland at minimal personal risk or hassle, as compared to other previous or existing national investment opportunities. Additionally, it helps raise critical foreign reserves with lower political pressure and provides a reserve amount that is not pressured by state or international lending organizations, rather micro-lenders borrowing at a lower comparative rate.

The Pakistan Banao Certificate is a primary market instrument, and these dollar-denominated certificates’ are being offered at higher yields than foreign bonds. Moreover, this latest offering is 100 percent guaranteed by the government and their minimum investment limit is $5,000 with no upper limit.

According to a working document by the State Bank of Pakistan, PBC offers 6.25% profit for a three-year certificate and 6.75% respectively for its five-year version. These rates are much higher than what one can earn from a similar investment in the US bond market or similar instruments in Saudi Arabia. The government has designed these certificates in such a way that it not only is favourable for Pakistan’s looming balance of payment crisis, but also aims at delivering fruitful profit to anyone who invests in this scheme.

To facilitate the expats, the government has also created an official PBC portal, which makes the entire process online smooth and quick. One of the key differences is that the initiative is online (website) driven and has a much easier process than any other opportunity that has existed in the market previously. Moreover, though this portal, Imran Khan wants the investors to opt for rupee encashment because it will assist in shoring up the dollar reserves. Therefore, if investors take the route of rupee encashment, they will receive another 1% when their PBC matures.

PBC is a great opportunity for the potential investors who can join hands with the government of Pakistan in order to seek long term solutions to the economic woes of the country that have been subject to ad hoc measures over the decades. Enthusiastic investment in these certificates will certainly enable the revival of Pakistan’s economy, at this critical juncture while the investors enjoy handsome profits as the Pakistan Banao Certificates seem equally promising for both, the investor and the investee. Pakistani expats will get a legit opportunity to diversify their assets away from their adopted countries which in the long run reduces investment risk. Since these PBC’s have a promised fixed rate of return, they eliminate the volatility risk of the floating rate and currency devaluation.

If Pakistan is to curtail its current account deficit in the long run, the government must take substantial steps to improve the macroeconomic conditions of the country and modernise its industrial sector to become more competitive in international markets. PBC is a great opportunity and its one of the solutions that help decimate debt, without overly exaggerating its effect on the overall picture.

The coming months, perhaps seem to be tough for the current government as well as the citizens considering that the rupee is expected to depreciate further, causing inflation to rise. And support from the IMF and friendly countries like Saudi Arabia, China, and the UAE will only provide some breathing room in the short term to its shattered economy. Therefore, it is important to apprehend that Pakistan’s economic crisis cannot be resolved overnight. Nevertheless, PM Imran Khan’s latest venture, the Pakistan Banao Certificates seems like a promising solution that to an extent will alleviate the economic situation of the country.

1641820759-0/download-(3)1641820759-0-100x90.webp)

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ