Shell Pakistan reports loss of Rs1.10b in 2018

Decline comes on back of surge in other expenses and higher administrative expenses

PHOTO: REUTERS

The oil marketing firm had booked a profit of Rs3.18 billion in the previous year, the company said in a notification to the PSX.

Accordingly, it booked a loss per share of Rs10.30 in the year under review compared to earnings per share of Rs29.74 in the preceding year. Shell’s share price dropped 3.66%, or Rs10.89, and closed at Rs286.44 with 17,200 shares changing hands at the PSX.

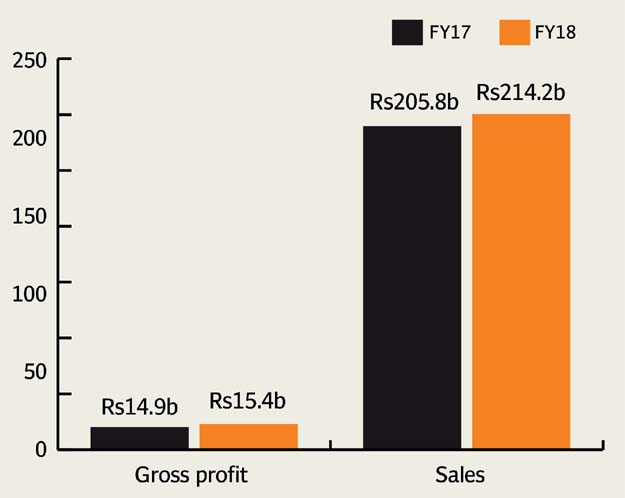

Net sales of the fourth largest oil marketing company - in terms of its market share at 9% - had grown 10% to Rs186.20 billion in the year compared to Rs168.84 billion last year.

However, exorbitant other expense, which surged 3.6-time to Rs5.02 billion mainly due to currency exchange losses compared to Rs1.41 billion last year, did not let the net sales translate into profit.

Similarly, the administrative expenses increased to Rs5.02 billion from Rs4.14 billion last year.

Finance cost enhanced to Rs370 million compared to Rs235 million. On the flip side, share of profit of associates (net of tax) improved to Rs974 million compared to Rs838 million in the previous year.

Published in The Express Tribune, March 7th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ