Second mini-budget gets NA nod amid protest

Govt allows non-filers to purchase luxury cars; extends super tax indefinitely

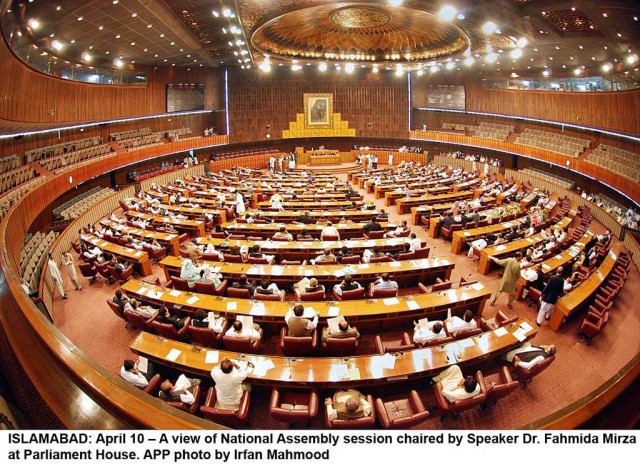

National Assembly of Pakistan. PHOTO: APP

Although Finance Minister Asad Umar described his second mini-budget in five months as a reform package that will also boost industries and trade, he has taken certain measures that would promote culture of tax evasion besides putting additional burden on companies.

The International Monetary Fund (IMF) has already expressed its reservations on the mini-budget, which according to the fund does not address the issue of shortfall in tax revenues.

The charged opposition accused the government of bulldozing the process by denying legislators to speak on the budgetary measures. Only three opposition leaders were allowed to speak on the budget.

The government got the Finance Supplementary (Second Amendment) Bill 2019 passed after the opposition parties staged a walkout from the house. The opposition was demanding to present a resolution against Federal Minister for Water Resource Faisal Vawda.

Prime Minister Imran Khan did not attend the assembly session.

Full text of PTI govt’s second mini-budget

The first Finance Supplementary Amendment Bill was approved in September last year but that did not address revenue challenges faced by the government. So far three budgets have been passed during the current fiscal year 2018-19 that itself is a record.

However, despite these budgets, the Federal Board of Revenue (FBR) sustained Rs237 billion shortfalls in tax revenues during the first eight months of the fiscal year.

In a major retreat, the government allowed the non-filers of the income tax returns to purchase cars of any engine capacity. When the finance minister introduced the second mini-budget in January, he had proposed to allow the non-filers to purchase up to 1300cc cars.

But this restriction has been completely removed. This would erode the government's moral authority, as it preferred revenue collection from non-filers over bringing them in the tax net.

The PTI government facilitated the non-filers despite shrinking tax base in tax year 2018. The last Pakistan Muslim League-Nawaz (PML-N) government had imposed a complete ban on purchase of vehicles by non-filers in a bid to force them to come in the tax net.

In order to address the concern of local manufacturers of motor vehicles, the non-filers have been allowed to purchase locally manufactured vehicles irrespective of engine capacity, according to the Federal Board of Revenue (FBR).

In another revenue measure, the government imposed 10% federal excise duty on locally manufactured motor vehicles of the engine capacity of 1700cc and above.

Super Tax

In yet another major step, the government has extended the Super Tax indefinitely. The tax had been imposed from 2015 for only one year to raise funds for rehabilitation of temporarily displaced persons.

But former finance minister Ishaq Dar kept on extending it every year, as it became one of the main revenue sources for the FBR. The Super Tax was going to lapse in 2020, which has now been extended 'onwards', according to the Second Supplementary Finance Bill passed by the National Assembly.

The Pakistan Peoples Party's (PPP) Parliamentary Leader in the NA Bilawal Bhutto Zardari criticised the PTI government for protecting rich at the expense of poor and claimed despite presenting second mini-budget, the government has made no efforts to make Pakistan economically sovereign.

Bilawal said: "There is relief for the rich but only promises for the poor. The government has unleashed an electricity bomb, a gas price bomb and inflation and has failed to give a direction to the economy."

The PML-N leader and former minister for planning Ahsan Iqbal said two mini budgets in a short period suggested that the PTI government did not do homework before coming into power.

Another PML-N leader and Punjab former finance minister Dr Ayesha Ghaus-Pasha said: "The PTI's economic policies would push 5 million more people below poverty line, as these policies would make rich people richer."

Umar, however, rejected opposition's criticism and blamed them again for the current economic crisis.

Directorate General of International Tax Operations

The National Assembly also passed an amendment bill to establish Directorate General of International Tax Operations aimed at recovering taxes from the offshore jurisdictions and dealing with Organisation for Economic Cooperation and Development (OECD) and other countries.

The government also streamlined the process of giving tax credits and gave the responsibility of paying sales tax refunds to the FBR by floating bonds. Earlier, these promissory notes were to be issued by the central bank.

It has now been decided that the proposed bonds shall be issued by the FBR Refund Settlement Company (Pvt) Limited, a fully owned company of FBR.

The government exempted business income of the green field industrial undertaking for a period of five years but introduced certain conditions to stop its misuse. It also exempted advance tax on profit paid on Pakistan Banao Certificate, Sarmaya-e-Pakistan Limited and Duty Drawback Bonds.

The NA also approved tax incentives for banks on advancing loans for agriculture, low-cost housing and micro, small and medium enterprises. The government exempted dividend income derived by a company if it availed group relief according to the proportion of shareholding of the company.

In order to provide further incentive to the industrial undertakings set up in the Special Economic Zones, exemptions from customs duty and advance income tax on import of firefighting equipment have also been approved.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ