True VIPs are those who pay taxes, says PM Imran

Premier dines with top taxpayers, including those facing NAB inquiries

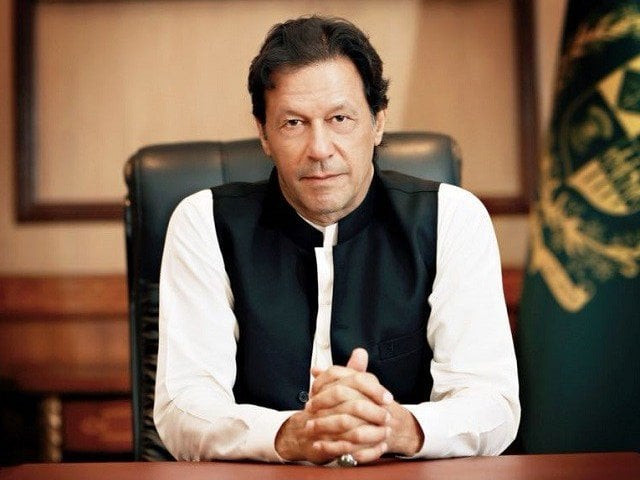

A file photo of Prime Minister Imran Khan. PHOTO: PID

Prime Minister Imran Khan on Wednesday gave appreciation certificates to the top nine taxpayers of the country, and ironically some of the recipients in the individual category face inquiries in the National Accountability Bureau (NAB) and also allegedly own offshore companies.

In yet another surprise, none of the known big names were among the top three taxpayers of Pakistan in the individual category. Mrs Saima Shahbaz Malik and her father-in-law Muhammad Yasin Malik were Pakistan's top two taxpayers respectively. Yasin Malik received the appreciation award on behalf of his daughter as well, as she was out of the country.

Two other members of the family that is in the pharmaceutical business also featured in the list. Shahid Yasin Malik was the 11th highest taxpayer – a notch above Arif Habib, one of Pakistan's most influential businessman. The family's fourth member, Shahbaz Yasin Malik, was the 26th largest taxpayer of Pakistan.

However, a handout of NAB, dated January 3, 2019, stated that the bureau had launched an inquiry against "Shahid Malik, Shahbaz Yasin Malik, Saima Shahbaz Malik, owners of a pharmaceutical company and others". The press release did not mention the charges against them. Furthermore, Shahbaz Yasin Malik's name also appeared in Panama leaks.

A NAB official did not comment about nature of allegations against Malik family.

The Express Tribune contacted Shahbaz Malik for his comments on the NAB inquiry and alleged offshore company but did not receive a reply till the filing of the story.

The same press release also mentioned that the executive board of the anti-graft body had approved an inquiry against former prime minister Shahid Khaqan Abbasi on alleged illegal appointments in Pakistan State Oil.

Abbasi, who is a senior leader of the opposition Pakistan Muslim League-Nawaz, is also the country's fifth largest taxpayer. He was also invited to the reception but skipped the event, which was poorly managed.

PM Imran arrived one hour and ten minutes late at the gathering and the business executives had to wait for him. The speeches were in Urdu, although some foreign nationals were also present.

The prime minister had invited 150 top taxpayers of the country but gave awards to only nine taxpayers. He chose to give awards to only three from each of three categories namely, individuals, association of persons (AOPs) and companies.

Initially, it had been decided that the PM would give awards to all 150 top taxpayers but later on the list was reduced to only 9. Pakistan's noted billionaire Mian Mansha was a conspicuous absence from the list of top 30 individual taxpayers. Instead, his two sons featured on the list, with Hassan Mansha ranked fourth, while Mian Umer Mansha was the country's 13th highest taxpayer.

In the second category, the first and third appreciation certificates went to the two government owned companies. The Oil and Gas Development Company Limited was the top taxpayer, followed by United Bank Limited and Government Holding Private Limited. In the AOP category, the appreciation certificates were given to three joint ventures.

Former premier Nawaz Sharif had also awarded 'privilege and honour cards' to about 200 top taxpayers four years ago.

While addressing the ceremony, PM Imran said the true VIPs of Pakistan were those people who pay the most tax and such citizens should be facilitated and honoured. He also said there was a need to change the mindset under which wealth creation was considered a "sin", so that people could be encouraged to invest in Pakistan.

He said only 72,000 people from across the country declared an income of over Rs200,000, but added that it was "understandable" why people shied away from paying taxes because of their concern that their money would not be fully utilised for the uplift of the lower segments of society.

Imran said that he has cut expenditures of the PM House by 30 per cent, which translated into savings of Rs150 million.

He reiterated that the government was making efforts to develop a tax paying culture, including through reforms in the FBR and by moving towards e-governance to minimise the interaction between the tax collector and the taxpayer.

Once the system is fixed, the Prime Minister hoped that the Federal Board of Revenue's (FBR) annual tax revenue could increase to Rs8 trillion from current annual target of Rs4.5 trillion.

Meanwhile, Finance Minister Asad Umar censured the FBR over poor performance.

However, despite such public displays of dissatisfaction, Umar has not yet made changes at the top level in the FBR. The finance minister urged the FBR to go after parliamentarians who own luxury vehicles but their assets declarations did not match with their lifestyles.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ