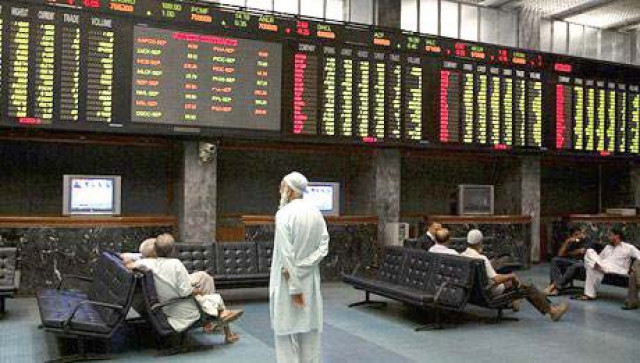

Govt implements capital gains tax to stabilise stock market

The CGT for stocks sold from six to 12 months after being bought will be taxed at a rate of 7.5 per cent.

The 10 per cent capital gains tax (CGT) on shares sold within six months of their purchase will increase market stability, reducing the ups and downs that the stock market was especially prone to, according to analysts.

It should increase the cost of short-term stock trading, said Faisal Shahji, Head of Research at Standard Capital Security. He said that it would make it more expensive for punters - speculative traders - trying to make quick profits from the daily movement of the market.

A punter’s approach is to speculate rather than invest. They are not concerned with the fundamentals of an investment. Instead, they attempt to make quick profits by selling to somebody else at a higher price.

Dealers said that this would not affect long-term investors as it would only apply to stocks sold within a year of being bought; as stocks sold a year after their purchase are still exempt from the CGT.

“There are very few people in Pakistan who are long-term investors and almost nobody invests for more than a year,” said Invest Capital Investment Bank’s analyst, Nauman Khan.

Until now, listed company share sales were exempt from the CGT. The Karachi Stock Exchange had reached an understanding with the government in February, according to which a 10 per cent CGT had been agreed on.

Recovery

The government budget is aimed at consolidating the stock market’s recovery since last year. “The government’s fiscal policy is tight this year and intends to increase revenue and decrease expenditure,” said CEO Topline Securities Muhammad Sohail.

“This is for the first time a government has announced that they will try to reduce its current expenditure,” he added but was of the view it was probably not possible given Pakistan’s history and political situation.

No surprises

“Most of the things that were pertaining to the stock markets were already expected and everyone has probably adjusted to them by now,” said JS Global Capital’s analyst, Farhan Rizvi.

Published in the Express Tribune, June 6th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ