SSGC posts profit of just Rs43.16 million

Core business in trouble; earnings aided by other income, lower finance cost

Core business in trouble; earnings aided by other income, lower finance cost.

PHOTO: FILE

However, it was the result of a notable increase in income from other than core utility business and a massive reduction in finance cost.

Core business of gas sales remained in trouble. Thanks to the receipt of a meaningful other operating and non-operating income, such as gains from interest income and dividend income, as by excluding these receipts, the state-owned company would have continued to run into losses.

The firm had posted a loss of Rs9.37 billion in the same nine-month period of the previous year.

New acting heads of SNGPL, SSGC appointed

It posted earnings per share (EPS) of Rs0.05 in Jul-Mar 2016-17 compared to loss per share of Rs10.65 in the corresponding period of previous year, the company reported to the Pakistan Stock Exchange (PSX).

Along with the nine-month result, the public gas utility also announced results for three separate quarters, which had been due for a long time.

SSGC's share price inched up Rs0.07, or 0.29%, and closed at Rs24.59 with trading in 2.43 million shares at the PSX.

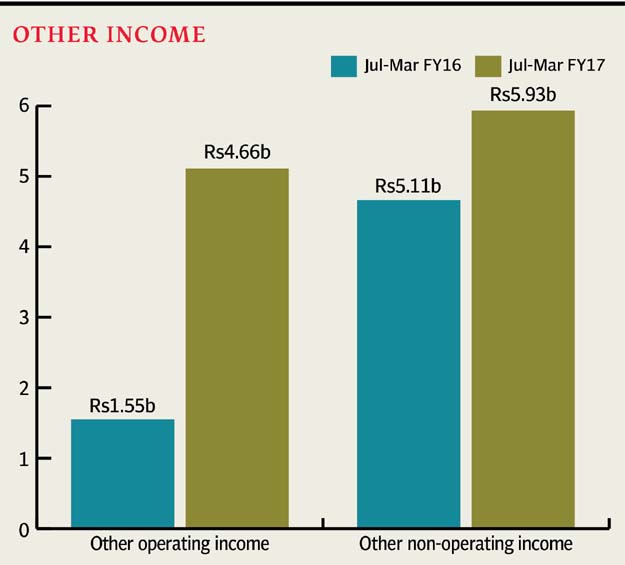

Its other operating income came in at Rs4.66 billion in nine months, which was three times higher than the Rs1.55 billion recorded in the corresponding period of previous year.

Other non-operating income increased 16% to Rs5.93 billion compared to Rs5.11 billion in the previous year. Finance cost fell five-fold and stood at Rs1.65 billion compared to Rs8.57 billion earlier.

SSGC reports profit of Rs1.47 billion

SSGC recorded net sales of Rs102.31 billion. However, the exorbitant cost of sales at Rs103.93 billion, which was higher than the net sales, resulted in an operating loss of Rs1.61 billion.

In the same period of FY16, the company had booked net sales of Rs117.13 billion whereas the cost of sales came in at Rs124.06 billion.

Moreover, in the quarter ended March 31, 2017, the company recorded a consolidated loss of Rs1.75 billion (loss per share Rs1.99) compared to the loss of Rs3.47 billion (loss per share Rs3.95) in the same quarter of previous year.

Published in The Express Tribune, February 14th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ