The cost of every notable consumer item including medicines, beef, house rent, gold and cars increased significantly last month, affecting all types of income groups of consumers. Prices are hurting consumers at a time when the economy is slowing down and many professional groups in the salaried class are facing job cuts. The latest inflation bulletin has endorsed the central bank’s apprehension about persistent inflationary pressures, which have now led to the reversal of the two-month-old downslide in the inflation index.

As core inflation stays high, SBP hikes interest rate

The headline inflation raced to 7.2% in January 2019 compared to 6.2% in the preceding month, reported the national data collecting agency. It was the highest level since August 2014, when the headline inflation stood at 7%. Core inflation accelerated from 8.4% to 8.7% in January - the highest level since June 2014.

The increase in inflation to the level from where the index had started coming down suggests that goods prices would keep rising in coming months due to high rates of almost every consumer item, except for perishable food.

The higher core inflation, which is the target of the central bank while deciding the monetary policy, suggested that the State Bank took a prudent decision by further tightening the monetary policy a day ago. However, the monetary tightening is rendered ineffective by the finance ministry’s hefty borrowing, which increased 430% in the past seven months.

After the recent decision, the central bank has cumulatively increased the key interest rate by 4.5% since January last year aimed at curtailing aggregate demand in the economy.

The accelerated inflation was contrary to the public expectation, captured in the recent IBA-SBP’s consumer confidence survey, which indicated some moderation in the households’ inflation expectations.

The central bank governor warned on Thursday that the second round impact of exchange rate movements, upward adjustment in gas and electricity tariffs, and higher government borrowing from the SBP would be offset by the lagged impact of increase in the policy rate and fall in international crude oil prices on inflation. The governor also warned that the finance ministry’s borrowing for budget financing would keep inflationary pressures high.

Data showed that inflation surged to 7.2% due to increase in the cost of beverages, housing, water, gas and electricity charges and transport fares. Average inflation in first seven months (July-January) of the current fiscal year also rose 6.2%. The average inflation is above the government’s annual target but is close to the range given by the central bank.

The continued increase in interest rate has made it difficult to offer housing facilities under Prime Minister Imran Khan’s affordable housing programme and has also pushed up the government’s cost of debt servicing.

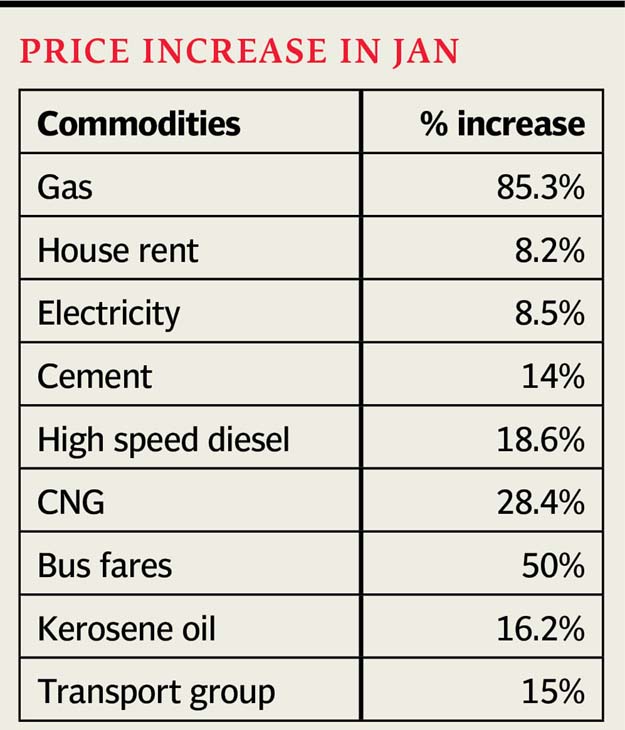

In January, gas prices went up 85.3% on an annual basis, bus fares increased over 50%, prices of basic medicines, like Calpol syrup, shot up 31.2%, CNG price increased 28.4%, Flagyl tablet became expensive by over 26% and cigarettes by 20.7%.

In seven months: FBR collects Rs2.07tr in taxes, misses target by Rs187b

Car prices increased nearly 20% in January over a year ago, iron bar rates rose 19%, high-speed diesel 18.6%, gold 18.6% and tea prices over 17%. The kerosene oil price jumped 16.2%, beef 14.3%, cement 14%, electricity 8.5% and house rent 8.2%.

After July, the government has also levied more regulatory duties, in addition to letting the rupee depreciate further against the US currency. The impact of these measures is becoming visible.

Overall, prices of the housing, water, electricity and gas group increased 11.6% in January over a year ago. The group has a 29.4% weight in the overall inflation basket - the second largest group after food. The cost of educational services increased 10%. Transport group prices surged almost 15% due to continued increase in prices of high-speed diesel and motor fuels.

Published in The Express Tribune, February 2nd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1734951821-0/Copy-of-Untitled-(88)1734951821-0-270x192.webp)

1734899716-0/image-(15)1734899716-0-270x192.webp)

1734778885-0/Untitled-(10)1734778885-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ