Foreign direct investment in Pakistan hits six-month high

FDI increases 17% to $319.2m in December 2018

FDI increases 17% to $319.2m in December 2018. PHOTO: FILE

Foreign direct investment (FDI) increased 17% to $319.2 million in December 2018 compared to $272.8 million in the same month last year, the State Bank of Pakistan (SBP) reported on Wednesday.

This is also for the second consecutive month that the FDI has continued to surge on a month-on-month basis.

“The pending rupee devaluation was one of the biggest concerns of foreign direct investors. Now when Pakistan has addressed the concern, it has regained foreign investors’ trust on the country,” Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General M Abdul Aleem told The Express Tribune.

Despite heavy inflow from China, FDI fails to pick up in FY18

The SBP has devalued the rupee by a whopping 32% in the last 13 months to Rs138.90 to the US dollar on Wednesday.

Besides, the political uncertainty linked to the July 2018 general elections has come to an end and investors have gradually built trust on the recently installed government in the country as well, he added.

In the recent months, the foreigners squeezed investment in wait for clarity on economic policies of the new government. “The government has taken tough decisions over rupee devaluation and (key) interest rate hike. The initiatives have apparently won the investors’ confidence,” he said.

Unlink the previous five months when China remained the only healthy foreign investor in Pakistan, Netherlands and Norway also appeared as significant foreign direct investors in December 2018, according to SBP.

China alone has invested net FDI worth $120.6 million in December, while Norway and Netherlands have appeared as the second and third largest investor with $65.2 million and $47.6 million, respectively.

Sector-wise, it was financial business which attracted the single highest investment worth $137.3 million in the month. This was followed by chemicals with $50.9 million and construction $45.1 million.

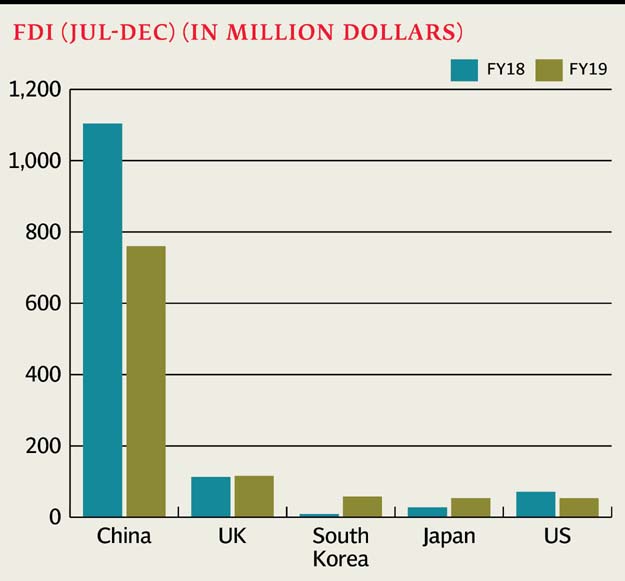

Cumulatively in the first six months (July-December) of the current fiscal year, FDIs have dropped 19% to $1.31 billion compared to $1.63 billion in the same period last year.

“The investment attracted in the six months is not bad keeping in view the then political uncertainty and investors waited for clarity on the government economic policies,” Aleem said.

“However, the much-awaited jump in FDIs is yet to come,” he said.

Clarity and confidence on the new government are gradually increasing. “The full-year FDIs should be much higher than $2.8 billion achieved in the previous fiscal year (ended June 30, 2018),” he said.

“The country may attract more foreign investment in oil and gas exploration, telecom, consumer goods, and CPEC-related new investment,” said the official, adding that CPEC-related investments had slowed down over the last seven-eight months.

The total foreign investment, including portfolio investment and public and private external debt, has dropped by a whopping 77% to $899.5 million in the six months compared to $3.95 billion in the same period last year.

The massive drop is seen due to adjustment of the debt Pakistan raised through sale of Sukuk and Eurobond worth $2.5 billion November 2017. The government has not raised debt during July-December 2018 period.

Published in The Express Tribune, January 17th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ