Focus on financial inclusion vital to boost economic activity

Compared to other developing economies, Pakistan lags far behind

Representional image. PHOTO: REUTERS

One of the most important factors of growth for any economic activity has been finance. Financial inclusion acts as a bridge that facilitates fuller participation of the financially excluded sections of the country. Financial inclusion is a mechanism through which a developing country like Pakistan can achieve inclusive growth by connecting the contribution of marginalised and the rural population segment of the country with rest of the economy.

The next step is to measure the financial inclusion performance at its baseline year. Globally financial inclusion is on the rise. According to the 2017 Global Findex database, 1.2 billion adults have obtained an account since 2011, including 515 million since 2014. Between 2014 and 2017, the share of adults who have an account with a financial institution or through a mobile money service rose globally from 62% to 69%. In developing economies, the share rose from 54% to 63%. But women in developing economies remain nine percentage points less likely than men to have a bank account.

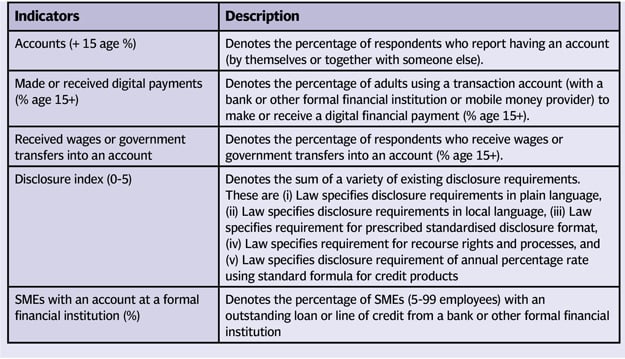

The data illustrated in the article is extracted from the G20 financial inclusion indicators, although the State Bank of Pakistan has comprehensive data on some of these variables, to create a comparative analysis it is important to use similar indicator measurements. The table is the list of key indicators and their description.

The article explains the standing of Pakistan in comparison to other economies looking into these indicators. The first indicator highlights the percentage of the formal bank accounts. According to this indicator Pakistan has the lowest percentage of accounts compared to other economies, the highest percentage of accounts are in Malaysia.

The second indicator illustrates the percentage of formal bank accounts. Pakistan’s digital economy is increasing, but there is a lack of consumer confidence on digital payments. 9% of the population above the age 15 made or received digital payments. The third indicator shows the percentage of the formal bank accounts; it is the percentage of population receiving wages or government transfers into an account. 3% of the population received wages or government transfers into an account.

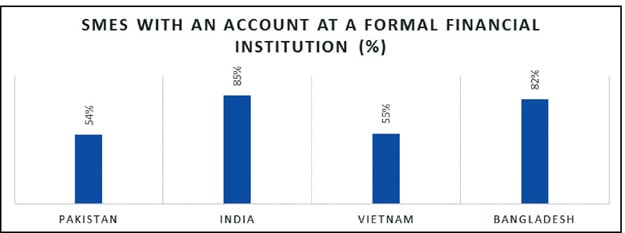

54% of the SMEs in Pakistan have an account at a formal financial institution, this also represents that a significant amount of informal economy. About 82% of SMEs in Bangladesh have formal accounts.

5% of the SMEs in Pakistan are with an outstanding loan or line of credit from a bank or other formal financial institution. The highest percentage of outstanding loan line credit is for Vietnam.

Achieving SDGs through financial inclusion

It is difficult to achieve the sustainable development goals (SDG) goals if people are not brought into the banking system, the link between financial inclusion and development is essential. There are series of evidence, how financial inclusion offers greater security and privacy over their money.

People who can access financial services have greater security and privacy over their money. Savings accounts make it easier to save, so people save more and earn more. In the case of India, increasing the outreach of banks in rural areas cut poverty by up to 17 percentage points. A case study from Malawi illustrates how farmers were able to increase their earnings by depositing them into a new bank account, the farmers manage to spend 13% more on equipment, and this resulted in increase in their crop output by 21%.

Challenges and lessons from other economies

There are issues related to financial inclusion especially for the developing countries. Firstly, the financial literacy is essential, there should be programs to ensure people can make sound financial decisions, choose financial products, which are according to their needs, and know how to use related mediums, such as ATMs or mobile banking. Many developing countries have been working on financial literacy strategies.

Furthermore, another important factor to ensure is the usefulness. Opening a bank account is just the first step, not the end goal. Transaction accounts must be useful and serve as a gateway to other financial products such as savings, credit and insurance. Governments and the private sector can play a significant role in accelerating usage by depositing wages into accounts versus paying cash. Essential issue related to financial inclusion policies is keeping track of how the policy interventions are creating impact on financial and social performance indicators. For this, there needs to be a monitoring and evaluation mechanism.

Another obstacle for financial inclusion is the consumer protection and regulation. Although there are many payment services like mobile money and e-money, it is critical to establish secure and reliable platforms to protect data privacy and funds. According to the National Financial Inclusion strategy the target is to increase from 10% of adults with transactions or other type of formal account to 50% by 2020. The NFIS predicts that 25% of adult females will have a formal account by 2020, up from 2.9% in 2014.

These are ambitious targets, in order to achieve them it is important to cater for the gender barriers. It is not possible for Pakistan to achieve these goals if the accessibility issues are not dealt with.

Another important factor is to understand and address the social barriers that prevent females from participating in the financial sector. The NFIS is a positive step towards development of an ecosystem, where there is an outreach of the financial access. In order to keep track of the targets the government should set a baseline for using indicators. So that, over a period of time the performance can be monitored and a comparative analysis across the region can be done. The monitoring and evaluation of the implementation framework is essential to create a positive impact.

Rai Nasir Ali Khan is the joint chief economist and M Mubashir Ehsan is Young Development Fellow at Ministry Planning Development and Reform

Published in The Express Tribune, January 14th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ