News that China had assured $2 billion worth of assistance to Pakistan to boost the country’s foreign exchange reserves bolstered mood at the bourse. Moreover, the delay in former president’s trial and the Supreme Court’s directive to the government to review the list of people placed on the Exit Control List also fuelled the market’s advance.

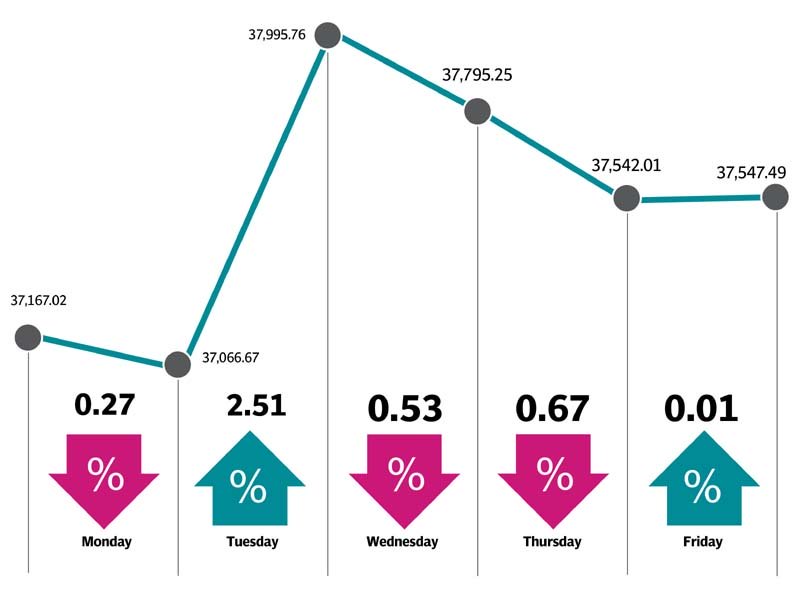

Market watch: KSE-100 remains flat amid volatile trading

In contrast to the announcement made at the beginning of previous year, US President Donald Trump at the start of 2019 expressed his desire to meet Pakistan’s new leadership soon in order to strengthen ties between the two countries.

Despite some optimistic developments, concerns over a rising circular debt and fast depleting foreign exchange reserves restricted the momentum. The stock market endured volatile trading on Monday as political tensions in the country dragged the index down. But Tuesday brought a drastic change as the index surged over 900 points in a remarkable rally.

Unfortunately, the momentum could not be sustained and the index finished the following two sessions in the red. After a highly volatile session, the last trading day of the week ended almost flat due to a lack of positive triggers.

Trading activity picked up slightly as average daily volumes were up 7% during the week, settling at 118 million shares while average daily value increased 14% to $41 million.

Sector-wise positive contribution came from commercial banks (up 245 points), oil and gas exploration companies (131 points) amid increase in crude prices, fertiliser (95 points), textile composite (23 points) and insurance (15 points).

On the flipside, the sectors that contributed negatively included food and personal care products (down 53 points), auto assemblers (27 points) and oil and gas marketing companies (26 points) because of a decline in petroleum product sales.

Stock-wise top performers were Bank AL Habib (up 111 points), Engro (96 points), Habib Bank (81 points), Bank Alfalah (47 points) and Pakistan Oilfields (41 points).

Foreign selling continued during the outgoing week as well, coming in at $0.5 million compared to net selling of $1.1 million in the previous week.

China-US trade talks spark rally in world markets

On the domestic front, major buying was reported by mutual funds worth $13.4 million and companies ($3.5 million) while individuals and insurance companies offloaded stocks worth $17.7 million cumulatively.

Major highlights of the week were petrol price going down by Rs4.86 per litre at the start of the year, the ECC approving gas supply of 25mmcfd to Sui Northern Gas Pipelines, Suzuki and Indus Motor announcing a fresh hike in vehicle prices, expected start of offshore gas exploration next week and Pakistan sending the terror financing risk assessment report to the FATF.

Published in The Express Tribune, January 6th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1736942026-0/fizza-(33)1736942026-0-405x300.webp)

1736941045-0/fizza-(32)1736941045-0-165x106.webp)

1736940015-0/BeFunky-collage-(53)1736940015-0-165x106.webp)

1732012115-0/Untitled-design-(14)1732012115-0-270x192.webp)

1736844405-0/Express-Tribune-(2)1736844405-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ