Govt borrows Rs1.43tr from central bank in six months

State Bank prints new currency notes to finance govt expenditure

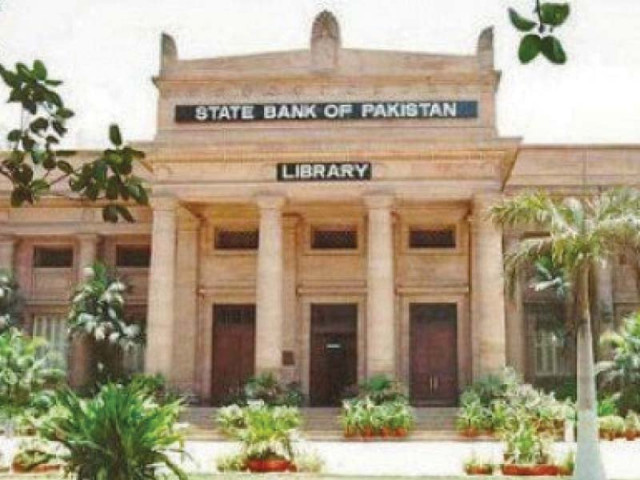

Government borrowing from the SBP shot up five times to Rs1.43 trillion in Jul-Dec 2018 compared to Rs288.09 billion in the same period of previous year. PHOTO: FILE

The State Bank of Pakistan (SBP) reported on Friday that it had lent Rs1.43 trillion to the federal government in the past six months (July-December 2018).

“Government borrowing from the State Bank is made through printing of new notes,” Arif Habib Limited Head of Research Samiullah Tariq told The Express Tribune.

Government borrowing from the central bank shot up five times to Rs1.43 trillion in Jul-Dec 2018 compared to Rs288.09 billion in the same period last year, according to the SBP.

Govt seeks approval for nearly $1b polio eradication plan

The government borrows to meet its budgetary shortfall. The exponential surge in borrowing comes in the wake of additional expenditure and revenue gap after a court prevented the government from collecting taxes of billions of rupees on mobile phone pre-paid cards and the government partially absorbed the surge in international crude oil prices and partially passed the impact on to end-consumers, he said.

The expenditure and income gap may further widen following announcement of a subsidy of Rs44 billion on the supply of imported liquefied natural gas (LNG) to five zero-rated export industries and the reduction in power tariff.

It will lead to an increase in the budget deficit, which the government has targeted at 5.1% of gross domestic product (GDP) for the current fiscal year. “We estimate the fiscal deficit at 6% (Rs2.2-2.3 trillion) in FY19,” he said.

The government has set an ambitious tax collection target of Rs4.398 trillion for FY19 to keep its borrowing low. However, the Federal Board of Revenue (FBR) has missed the first-half revenue target by a significant Rs170 billion.

State Minister for Revenue Hammad Azhar has reportedly sought explanation from tax authorities for the shortfall in tax collection. The printing of banknotes would also fuel inflation and slow down real economic growth.

Parallel economy

He said the cumulative value of currency notes under circulation in the country had soared six times to Rs217.55 billion in Jul-Dec 2018 compared to Rs37.58 billion in the corresponding period of previous year.

However, the growth is not reflected in bank deposits. This suggests that undocumented businesses have preferred to keep the money out of the banking system by nurturing the parallel economy.

“The trend has surged after the government increased the tax rate for cash withdrawal (and online transfer) from banks on non-filers of tax returns,” Tariq added.

He said the trend may further widen as the government was considering further increasing the tax rate in the second mini-budget expected in the current month.

Economists have estimated the volume of parallel economy at equal or more than the documented formal economy, which was recorded at $313 billion in the previous fiscal year ended June 2018.

Govt to get weaker by next budget: Sana

Impact of rupee depreciation

The massive rupee deprecation against the US dollar has also caused the widening of fiscal deficit in the ongoing fiscal year.

The SBP has let the rupee depreciate by a massive 32% since December 2017 to narrow down the current account deficit. But the move has widened the fiscal deficit by Rs654.77 billion in the past six months.

Net foreign assets of the banking system dropped Rs654.77 billion in the six months compared to Rs172.05 billion in the same period of last year. “This is because of the rupee devaluation,” he said.

Pakistan has experienced six rounds of currency depreciation since December 2017 in which the central bank let the rupee drop to Rs138.86 to the US dollar on Friday compared to Rs105.54 in the first week of December 2017.

Published in The Express Tribune, January 5th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ