Weekly review: Stocks gain 272 points in range-bound trading

MSCI announcement, confirmation of Saudi fund release influence index movements

MSCI announcement, confirmation of Saudi fund release influence index movements.

PHOTO: FILE

At the start of the week, the trading began on a negative note as investors had doubts about the success of Prime Minister Imran Khan’s visit to China, followed by another round of negotiations between the two countries. However, they did not yield any major positive outcome.

Moreover, investors remained on the back foot, wary of the MSCI’s semi-annual index review, announced on November 13, 2018, which sparked a wave of foreign selling.

However, in line with expectations, the global standard index reduced Pakistan’s weight to 0.046% after downgrading Lucky Cement and United Bank from the main index to the small-cap index and removed Honda Atlas Cars and Maple Leaf Cement from the small index.

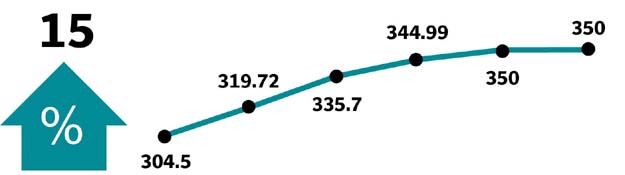

The index rebounded following the MSCI announcement on the last two trading days due to the interest shown by local investors, who pushed the index upwards.

Weekly review: KSE-100 advances 3.57% as buying euphoria continues

Later during the week, after confirmation by a Saudi envoy that the kingdom would release $3 billion, as part of the $6-billion financial package for Pakistan, in the next few days, investors’ confidence revived.

Furthermore, modalities of a Chinese assistance to Pakistan were also being worked out as experts of both sides were in contact to thrash out details of the package, which also enhanced investors’ confidence.

Along with updates on ongoing meetings between the International Monetary Fund (IMF) and government officials, developments about the prime minister’s upcoming visits to Malaysia and the UAE also surfaced.

On the economic front, the bourse received further support from plunging oil and coal prices, which investors believe would provide support to the local industry and curtail the oil import bill.

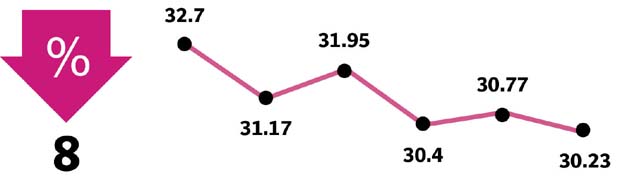

Investor participation improved during the week as average daily volumes improved 8.5% to 214 million shares, while the average daily value dipped 2.1% to $72 million on a weekly basis.

Sector-wise positive contribution came from commercial banks (193 points) amid expectations of a rate hike by 100 basis points in the upcoming monetary policy announcement, cement (94 points) due to declining international coal prices, chemical (42 points) due to healthy margins, pharmaceutical (35 points) and oil and gas marketing companies (23 points).

On the other hand, the negative contribution was led by oil and gas exploration and production companies (78 points) due to a 9% slump in international oil prices, technology and communications (32 points) and food and personal care (16 points).

Scrip-wise, major gainers were HBL (91 points), MCB Bank (81 points), Lucky Cement (52 points), Colgate Palmolive (28 points) and UBL (26 points).

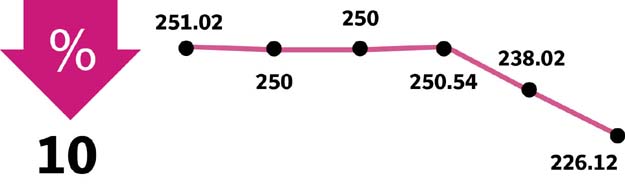

Foreign selling continued during the week, which came in at $24.1 million compared to net selling of $9.4 million last week.

Weekly review: Stock market ends three-week rally, falls 615 points

Selling was witnessed in cement stocks ($9.1 million) and commercial banks ($8.3 million). On the domestic front, major buying was reported by companies ($9.9 million) and mutual funds ($4.7 million).

Among major highlights of the week were the current account deficit widening 34% to $1.21 billion in October, foreign exchange reserves dipping $196 million to stand at $7.48 billion, Moody’s warning of rising external financing risks, FDI slipping 46.4% year-on-year in July-October 2018 and revision in the inflation rate for October to 6.78%.

Winners of the week

Gatron Industries

Gatron Industries Limited manufactures polyester filament and synthetic yarn.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Losers of the week

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Published in The Express Tribune, November 18th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ