Stock market participants in Pakistan far from satisfactory

Experts and PSX can bring locals on board through awareness campaigns

Experts and PSX can bring locals on board through awareness campaigns.

PHOTO: FILE

Even during the Stone Age, humans used to gather food, wood and other precious stuff to hold on to them in case something bad happens. Historically, in the financial world, investors usually sought comfort in gold at times of financial uncertainty.

However, the correlation of gold as a hedge against various risks such as inflation, economic slowdown or currency devaluation is not very well established in recent times. In Pakistan, there is another venue where investors usually seek refuge which is the US dollars.

The famous French philosopher Voltaire once said, “Paper money will eventually return to its intrinsic value, which is zero.”

After the demolition of Bretton Wood system in 1971, the currency held by any sovereign government is not backed by some asset such as gold. With the demise of gold standard and introduction of FIAT money, central banks can print the money based on the demand and supply condition and the threat of it becoming worthless, as predicted by the French philosopher, does not sound too fictional.

The recent examples of currency routs, which can be found in the emerging market currencies including Brazil, Argentina, Turkey and India, are a clear sign of the vulnerabilities attached to investing in any currency even the US dollar. The biggest threat to the US dollar is the trillion-dollar debt held by China which, if sold (even partially) as a counter-measure of trade war, can wreak havoc on the US dollar itself.

Market watch: KSE-100 slips as trading volumes stand low

Gold, on the other hand, has negative correlation with the US dollar and a stronger dollar usually results in weaker gold prices as witnessed in recent days with falling gold prices.

Also, gold is a dead asset and generates no return. However, there is a cost involved in maintaining the physical gold. Although there are low-cost solutions available to get exposure in gold like by investing in gold ETFs (exchange-traded funds), this option is not available in the Pakistan Stock Exchange (PSX) so far. Although there are some mutual funds that have recently launched commodity funds and energy funds, they are yet to attract any significant interest from the investors.

The other untapped avenue for Pakistani investors could be investment in the stock market, but due to various stigmas attached to investment in shares, an average investor is usually shy of associating his savings with the so-called “exclusive speculation club for the rich”.

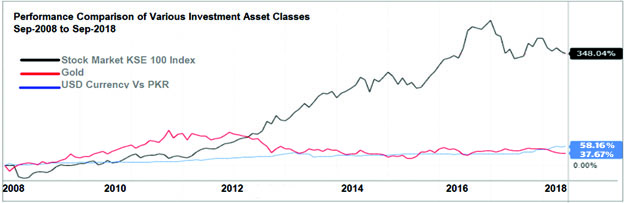

If one compares the performance of the last 10 years, then it is quite clear that the equity market outperformed both, the investment in gold and the US dollar, with cumulative return of 348%. However, if we compare the active stock market participants in Pakistan of around 0.28 million (0.14% of the population) with the neighbouring countries such as India (4.5%) and Bangladesh (1.5%), then it is fairly visible that situation is far from satisfactory.

Market watch: Stocks continue their losing streak, end below 41,000

A lot of expectations are associated with seasoned capital market experts and PSX MD Richard Morin to chalk out plans for bringing locals on board through a series of awareness campaigns and road shows.

Currently, staggered efforts by individual brokerage houses are only targeting potential foreign clients to earn the premium commission fee. However, attracting local investors to the bourse will not only provide a constant depth and liquidity in the market, but will also strengthen the price discovery mechanism.

Also introducing a new trading platform to offer new products such as ETFs at the local bourse will help local investors to diversify their investments.

The writer is a financial market enthusiast and attached to Pakistan stock, commodity and debt markets

Published in The Express Tribune, October 29th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ