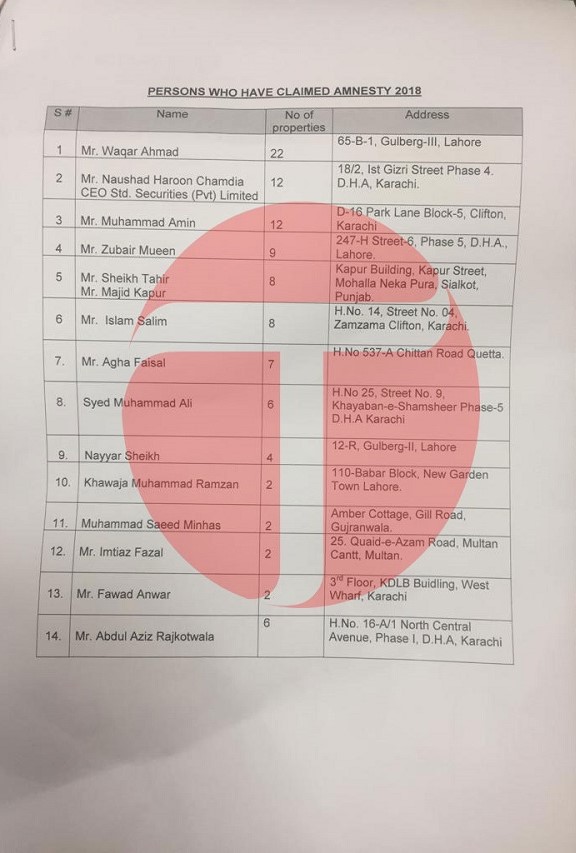

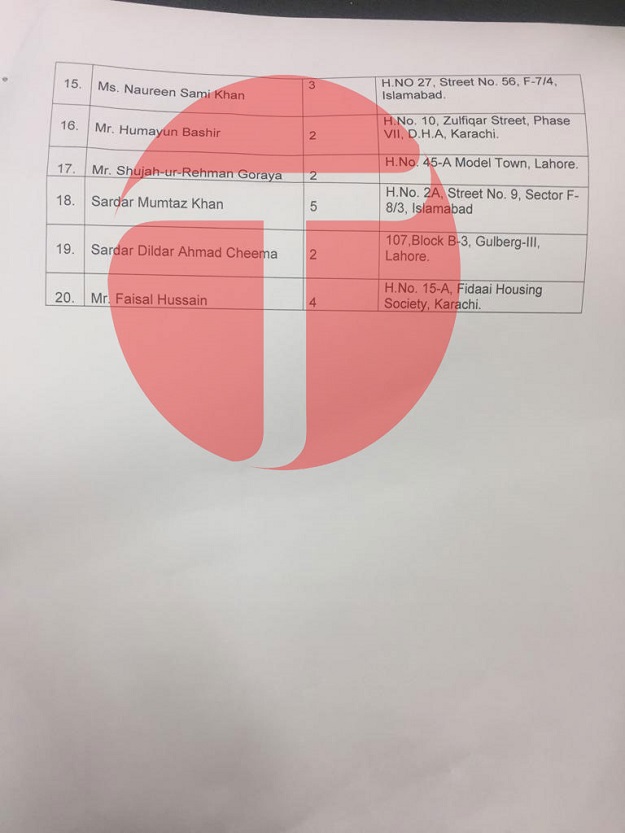

The list of the individual was provided to the court by the Attorney General for Pakistan (AGP).

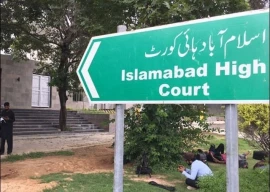

Chief Justice of Pakistan Mian Saqib Nisar issued the order while heading a three-judge bench, hearing a suo motu case with regard to retrieval of Pakistanis unlawful assets stashed abroad.

Earlier, the bench had expressed concern over slow progress of federal departments in retrieval of those assets.

When AGP Anwar Mansoor Khan sought time to proceed against the individuals who have properties in foreign countries, especially the UAE, the chief justice, who is set to retire on January 17, said: “Even January will pass but you will keep seeking new dates.”

The attorney general told the bench that the government could not arrest those who did not disclose their foreign properties, but the chief justice said the judiciary could at least ask them about the properties.

The Federal Board of Revenue (FBR) chairman informed the court that it could not prosecute those individuals under the tax regime. The chief justice said if they cannot prosecute them, then they may get tax from them.

But State Bank of Pakistan (SBP) Governor Tariq Bajwa informed the court they could not collect even taxes from them, if they were paying tax in a foreign country.

To a query of the bench, Bajwa said banks situated in the foreign countries cannot provide details of account holders. The chief justice wondered what the FBR was doing when it could not get details of foreign accounts.

The CJP said in view of a recent agreement with the United Kingdom, Pakistan can only get details of the properties situated in England “but there is nothing about sharing the details of accounts holders”.

PM seeks suggestions to recover wealth stashed abroad

The bench was informed that the UK shared the details of approximately 200 properties of Pakistanis situated in the UK. But the FBR chairman said they could not prosecute individuals under the tax regime.

During the hearing, the chief justice said the Federal Investigation Agency (FIA) had identified foreign properties worth Rs1,000 billion. The amount is sufficient to build a dam.”

FIA Director General (DG) Bashir Memon said Pakistanis own 894 properties in Dubai, while 374 individuals took advantage of the amnesty scheme and disclosed their assets. However, 150 individuals did not disclose their properties and 82 individuals denied ownership of the properties.

He said an inquiry into the matter was halted for two months, when an amnesty scheme was introduced by the federal government, adding now the inquiry process is restarted.

The director general said 150 individuals possess 203 properties and each property is worth more than Rs50 million.

The bench asked the AGP to submit list of 20 individuals so that they could be asked to explain as to how they got these properties in UAE. “Those who laundered the money abroad are enemy of the country,” the top judge noted.

When the AGP said these individuals, who are possessing properties abroad cannot be arrested, the CJP said then the nation should not be under the impression that this is any illegal money

“If someone earned money abroad and purchased properties abroad then there is no problem but if the assets have been made by the money, sent from Pakistan then they should be probed,” he said.

The AGP said the Asset Recovery Unit is working on ways to retrieve money of Pakistanis hidden in foreign countries. The SBP governor said it was not easy now to send money abroad after the steps taken in view of suo motu proceedings. The hearing of the case was later adjourned till November 1.

The apex court had initiated the suo motu proceedings for retrieval of unlawful assets on February 1. Later, different committees were constituted to give proposals to stop money laundering as well as retrieval of amounts.

Several proceedings were conducted, in which a number of financial experts also gave their input. The court on March 26 constituted a committee of 12 experts having insight into the process of accumulation of undeclared foreign movable and immovable assets by Pakistani citizens.

They were tasked with deliberating and recommending legislative and executive measures for tracing and retrieving such assets held abroad. However, the committee had advised the top court to 'be pragmatic' in its approach, cautioning against any aggressive steps.

Wealthy people seek just 2% tax on hidden assets

In its 28-page-long report, the committee said an all-out and uncompromising drive to retrieve untaxed funds stashed abroad might create panic and compromise economic recovery.

“Such a course becomes even more unattractive in view of the modest chances of success of such an initiative in the context of the limitations of the existing legal framework and the challenges of tracing and taxing the funds in offshore havens and other jurisdiction,” it said.

Later, a three-member committee led by the SBP governor and comprising secretary finance and the FBR chairman was formed for this purpose of achieving objective of suo motu proceedings about retrieving alleged ill-gotten foreign assets of Pakistanis. The committee submitted proposals but the SC bench was visibly not satisfied with the steps taken for retrieval of money.

People summoned

According to the AGP list, Waqar Ahmad holds 22 properties in UAE; Naushad Haroon Chamdia 12; Muhammad Amin 12; Zubair Mueen 9; Sheikh Tahir Majid Kapur 8; Islam Salim 8; Agha Faisal 7; Muhammad Ali 6; Nayyar Sheikh 4; Khawaja Muhammad Ramzan 2; Saeed Minhas 3; Imtiaz Fazal 2; Fawad Anwar 2; Abdul Aziz Rajkotwala 6; Naureen Sami Khan 3; Humayun Bashir 2; Shujah ur Rehman Goraya 2; Sardar Mumtaz Khan 5; Sardar Dildar Ahmad Cheema 2 and Faisal Hussain 4 properties.

1732781717-0/BeFunky-collage-(2)1732781717-0-165x106.webp)

1732780655-0/Express-Tribune-(5)1732780655-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ