Govt retains restrictions on non-filers as NA passes mini-budget

Overseas Pakistanis, people inheriting property and those earning through informal means are exempted

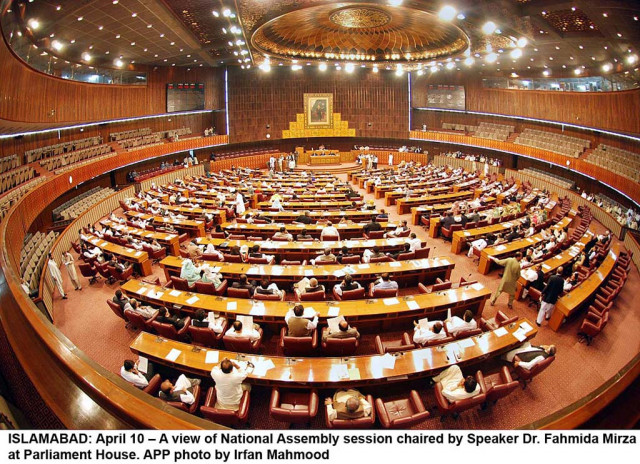

PHOTO: FILE

While winding up the debate on the budget, Finance Minister Asad Umar also announced to impose penalties on manufacturers for selling vehicles to non-filers. The persons who would register properties in the name of non-filers would also be liable to pay penalties. Banks will now be legally bound to share details of filers and non-filers who earn hefty profits on debts with the Federal Board of Revenue (FBR).

All these steps are aimed at broadening the tax net and increasing tax collection – the two fundamental challenges that are now threatening the fiscal sustainability of the country. In the last fiscal year 1.4 million individuals filed income tax returns –a number that dropped to 350,000 till September 30.

Pakistan needs $9b for running domestic economy: Umar

The finance minister also appealed to those belonging to the affluent class to file their tax returns. "We have extended the time for those who still want to file their returns." He warned that the state has the muscles to collect due taxes from the people.

The Lower House of the Parliament passed these amendments to the Supplementary Finance (Amendment) Bill 2018 with a majority vote of 158-120. The government rejected all the amendments proposed by the opposition.

The government had earlier proposed to withdraw a ban imposed on purchase of vehicles and property by non-filers. The ban had been introduced by the last Pakistan Muslim League-Nawaz (PML-N) government in its sixth budget.

The new amendment introduced in the Income Tax Ordinance 2001 says the ban will not be applicable on purchase of motorcycle having engine capacity of less than 200cc, motorcycle-rickshaw, agriculture tractor or any other motor vehicle of less than 200cc.

A person holding a Pakistani origin card or a national identity card for overseas Pakistani who produces a certificate from a scheduled bank of receipt of foreign exchange remitted from outside Pakistan through normal banking channels during a period of 60 days prior to the date of booking, registration or purchase of motor vehicle will also be exempted from the ban.

The legal heirs acquiring property in inheritance or overseas Pakistanis who have remitted money through banking channels will be permitted to own properties, according to the legal amendment.

The finance minister said the State Bank of Pakistan (SBP) has been contacted to inquire details of withholding tax deducted from account holders. "We only want information of those who keep large sums of money in their accounts but are non-filers."

According to another legal amendment, where any manufacturer of a motor vehicle accepts or processes any application for booking or purchases of a locally manufactured motor vehicle in violation of the ban, such person shall pay a penalty of 5% of the value of motor vehicle.

Asad Umar briefs PM on state of economy

Where any registering authority of excise and taxation department accepts, processes or registers any application for registration of a locally manufactured motor vehicle or for the first registration of an imported vehicle or immovable property in violation of the provision of section 227, such person shall pay a penalty of 3% of the value of the vehicle and property,.

Asad Umar said the government would make use of modern methods to identify tax evaders. A day earlier, the FBR sent tax notices to top 75 tax dodgers – a number that Umar said change into thousands in the coming months.

The government has also brought certain changes in the income tax law to use information to enhance revenue collection. The commercial banks will be bound to share a "list of persons receiving profit on debt exceeding Rs1 million for filers and Rs500,000 for non-filers and tax deductions thereon during preceding financial year".

But the NA approved to omit the requirement for the banks to provide a copy of each currency transactions report and suspicious transactions report generated and submitted by it to the Financial Monitoring Unit under the Anti-Money Laundering Act, 2010 (VII of 2010).

It also abolished the requirement for the banks to provide to the FBR a consolidated list of loans exceeding Rs1 million written-off during a calendar year.

The government has also made certain relaxations in its ban on public servant on disclosure of information. Now the FBR can provide data to any person approved by the government to process and analyse such data for broadening of tax base or for checking tax evasion.

However, the FBR will keep identity of the taxpayers confidential. The finance minister criticised the economic management of the PML-N, saying the worst economic management of the Pakistan Peoples Party (PPP) was even far better than the PML-N economic management.

Umar said the circular debt at the end of the PPP tenure was Rs480 billion that at the end of the PML-N term surged to Rs1.2 trillion. The last government also left behind circular debt in the gas sector, which was non-existent during the tenure of the PPP, he added.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ