“The unit will work under the Counter Terrorism Department (CTD) and function under the Anti-Terrorism Act 1997 as a specialized unit,” SSP (Operations) Counter Terrorism Department (CTD) Sajjad Khan told The Express Tribune.

The SSP investigation will head the unit supported by a dedicated team of professionals, he added.

Khan said, “Standard Operating Procedure (SOP) has been devised to probe terror financing cases.”

Taskforce brainstorms plan to stem terror financing

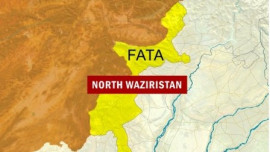

In June 2018, the FATF — an international anti-terrorism financing watchdog — had found "strategic deficiencies" in Pakistan's ability to prevent terror financing and money laundering.

The watchdog had subsequently demoted Pakistan to its grey list, putting the country just one step away from its dreaded blacklist, which brings with it international sanctions and economic repercussions among other things.

On Saturday, the FIA conducted a covert operation targeting a currency market in Peshawar's Chowk Yadgar area, from where it claimed funds were laundered all over the world.

District heads of the K-P CTD investigation have been given briefing and training on cases related to terror financing. The Anti-Terrorism Act’s Section 11 deals with such offences.

“It applies to fund raising, providing support in fund raising and money laundering. Punishment under the law ranges from five to 10 years and fine,” Khan explained.

Pakistan had presented 26-point plan of action to be implemented in 15-months to avoid being placed on the FATF Black List.

“Since then, the K-P CTD has greatly emphasised this important aspect of terrorism,” officials said and added, “Resultantly, the number of cases registered have increased.”

So far about 80 cases have been registered and more than 112 suspects arrested. Special attention is now being paid to investigation and prosecution in order to achieve results in the shape of denying finances to the banned outfits.

The CTD has been coordinating with other LEAs -- including FIA and district police along with the Intelligence Bureau (IB) to ensure proper action under the ATA 1997 and the AMLA 2010 in terror financing offences.

“The same shall go a long way towards country's evaluation by FATF,” said officials.

SSP Khan said terror financing was also done through predicate offences -- like kidnapping for ransom and extortion, besides donations.

Pakistan asked to make terror financing, money laundering extraditable offences

“A major case of Terror Financing was worked out by the CTD Peshawar when a kidnap case of a trader in which an amount of Rs30 million was paid and later on used for financing the terrorist attack on the Agriculture Training Institute,” he said, and added the two cases were clubbed together and now under trial and are a classic example of the efforts of the K-P CTD.

Fearing further downgrading and imposition of economic sanctions, the Ministry of Interior has directed to initiate crackdown against illicit money trade.

“A joint raid on hundies/hawala system was carried out recently in Chok Yadgar, Peshawar by FIA in coordination with capital city police and district administration and was also an effort in the same direction,” he said.

Source on the other hand said a high-level meeting was held in Peshawar following the raids and a plan was chalked out along with a legal framework on expanding the operation.

1731655243-0/BeFunky-collage-(61)1731655243-0-165x106.webp)

1731656720-0/Copy-of-Untitled-(44)1731656720-0-270x192.webp)

1731651715-0/Express-Tribune-(1)1731651715-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ