In a tumultuous week, KSE-100 loses another 887 points

Lack of clarity on economic issues, political developments drag the index below 41,000

Uncertainty over going to the International Monetary Fund for a bailout package and a lack of positive triggers led to further losses in the market.

PHOTO:FILE

A delay in decisions on key economic issues clouded the environment and dented investor sentiments. As a result, the market slipped below 41,000 points, wiping out gains made in the post-election period. At the start of the week on Monday, trading kicked off on a negative note, continuing the downtrend from the preceding session as mounting tensions between Pakistan and the United States amid suspension of $300 million in military aid dampened the mood.

However, things took a turn for the positive as a five-day losing streak came to an end on Tuesday. Pakistan Tehreek-e-Insaf’s (PTI) candidate Arif Alvi emerged victorious in presidential election, which lent support to the benchmark index.

However, bears once again returned to dominate the bourse as news of a decision on increasing gas prices by 46% adversely impacted the stock market. Investors resorted to selling in cement and fertiliser sectors.

Moreover, a decline in foreign exchange reserves held by the central bank and rise in circular debt restricted investment in stocks.

Uncertainty over going to the International Monetary Fund for a bailout package and a lack of positive triggers led to further losses in the market.

Investor participation was unimpressive as average daily volumes fell 22% in the outgoing week to 139 million shares while average daily traded value dropped 36% to $39 million.

Market watch: KSE-100 plunges over 1,200 points before minor recovery

Sector-wise breakdown shows that negative contribution came from cement (down 169 points) amid lower dispatches and weakening prices, fertiliser (140 points), oil and gas exploration (99 points) due to weakening international crude prices, oil and gas marketing (91 points) due to decline in petroleum sales and food and personal care products (57 points). On the other hand, positive contribution to the index came from stocks of commercial banks (up 27 points) and chemical manufacturers (3 points).

Scrip-wise, negative contribution came from DG Khan Cement (down 9.3%), Cherat Cement (down 9.1%) and Lucky Cement (down 5.3%). Pakistan State Oil and Pakistan Petroleum also erased 47 points and 44 points respectively from the index. Although any hike in gas prices could ease cash flow constraints for public gas utilities, investor interest in Sui Northern Gas Pipelines and Sui Southern Gas Company remained lacklustre.

Market watch: Amid political noise, KSE-100 sheds over 400 points

Foreign selling continued during the week under review, standing at $9.9 million compared to net selling of $10 million a week earlier.

Selling was witnessed in stocks of commercial banks ($5.8 million) and cement companies ($3 million). On the domestic front, major buying activity was reported by insurance companies ($8.6 million) and individuals ($6.2 million).

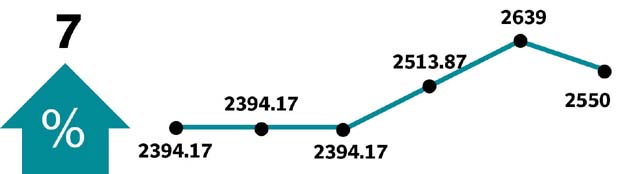

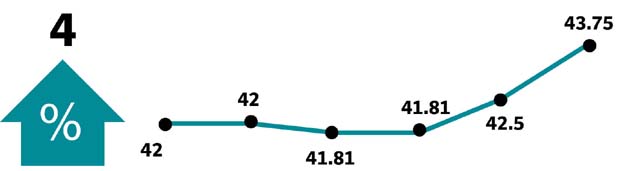

Winners of the week

Colgate Palmolive (Pakistan)

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene and a variety of other products.

Orix Leasing Pakistan

Orix Leasing Pakistan Limited is a leasing and diversified financial services company. The company offers full payout finance leases for machinery, office automation, computers, vessels, aircraft and automobiles. Orix financial service products include loans, rentals, security brokerage, options trading and life insurance products.

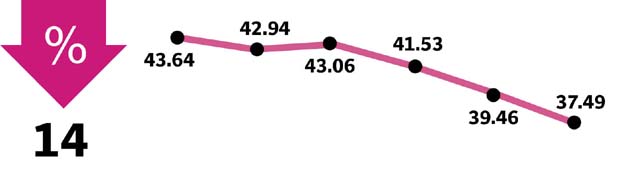

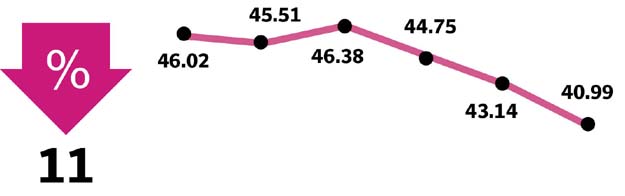

Losers of the week

Unity Foods

Unity Foods Ltd is an agri-business company, with an entire value chain from the procurement and crushing of multiple oilseeds.

Pioneer Cement

Pioneer Cement Limited produces ordinary portland cement and sulphate resistant cement.

Published in The Express Tribune, September 9th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ