In comparison, earnings stood at Rs9.13 billion in the previous year, according to profit and loss accounts sent by the oil and gas exploration firm to the Pakistan Stock Exchange (PSX).

Corporate Corner: Mari Petroleum, PGNiG ink MoU

Earnings per share surged to Rs139.45 in the year compared to Rs82.87 in the previous year. The board of directors has recommended a final cash dividend of Rs2.50 per share and 10% bonus shares (one share against 10 shares). The entitlements will be given to the shareholders whose names will appear in the register of members on October 11, 2018.

During the year, Mari Petroleum already paid an interim cash dividend of Rs3.50 per share. Mari Petroleum’s share price decreased 0.30%, or Rs4.59, to close at Rs1,539.79 with 13,360 shares changing hands on Thursday.

Topline Securities’ analyst Nabeel Khursheed said in a brief note that FY18 earnings surged “due to rise in average international Arab Light oil prices by 31% year-on-year to $63.28 per barrel coupled with rupee devaluation.”

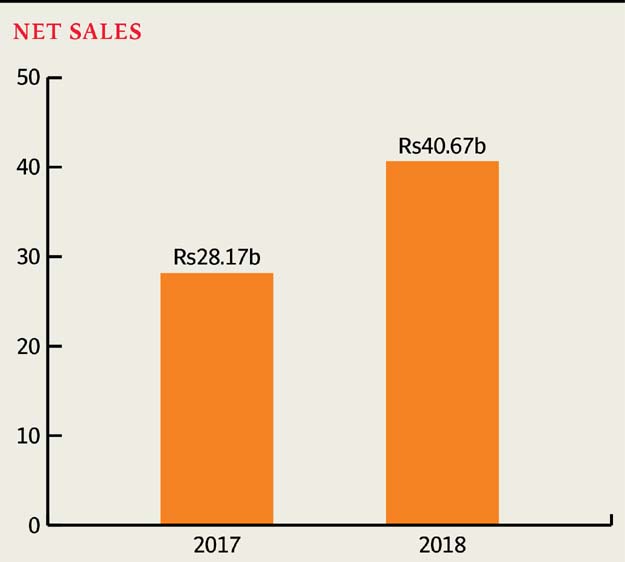

The net sales of the company stood at Rs40.67 billion, which was 44% higher than Rs28.17 billion booked last year. The royalty payment on utilisation of oil and gas reserves also surged 44% to Rs5.18 billion compared to Rs3.58 billion last year.

ECC expected to approve Rs60 billion bailout for PSO

The exploration and prospecting expenditure trimmed to Rs3.68 billion from Rs3.88 billion in the prior year.

Finance income increased to Rs766 million compared to Rs233 million. Also, the finance cost reduced to Rs640 million compared to Rs798 million.

Published in The Express Tribune, August 31st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ