Several export products of Pakistan face MFN tariff in India

Tariff, non-tariff barriers constitute serious obstacle to Pakistan’s market access

From $402 million in 2013, exports went down to $392 million in 2014 and further to $312 million in 2015. In 2016, exports marginally increased to $348 million.

PHOTO:FILE

What are the factors which have hobbled trade between South Asia’s two largest economies?

At the time of birth of Pakistan, India was its largest trading partner. In 1948, when the General Agreement on Tariffs and Trade (GATT), the World Trade Organisation’s (WTO) predecessor, came into being, both Pakistan and India became its members and granted each other the Most Favoured Nation (MFN) status.

Contrary to its meaning as well as popular perception, the MFN status means only normal trading relationship. Bilateral trade relations were disrupted by the 1965 war and remained suspended till 1973.

When trade resumed, the MFN principle was disregarded by both countries and trade was conducted on the basis of positive lists. The positive list approach meant that only the specified goods could be traded.

ICCI stresses export promotion

In 1995, the WTO was born and adopted the MFN as its constitutional principle. Accordingly, in 1996 India restored Pakistan’s MFN status. Pakistan, however, continued to maintain the positive list, thus restricting imports from India. The positive list was gradually expanded and when in 2011, it was replaced with a negative list, it consisted of 1,963 products or tariff lines.

The replacement of the positive list with the negative list, which is less restrictive than the former, was part of Pakistan’s efforts to normalise trade with India. However, no further headway was made.

At present, Pakistan’s negative list for imports from India consists of 1,209 tariff lines.

Pakistan and India are also members of the South Asia Free Trade Agreement (Safta), under which they accord preferential tariff (between 5% and 8%) treatment to each other. However, in spite of Safta, the products placed on the negative list cannot be imported from India.

Moreover, under Safta, both countries maintain sensitive lists on which no tariff concessions are being offered. The sensitive lists of India and Pakistan consist of 614 and 936 tariff lines respectively at six-digit HS code. The foregoing gives the impression that whereas India has opened its market for Pakistani products, Pakistan has not reciprocated the gesture. Such an impression is only partly correct.

Trade imbalance

Before we explain why this is so, let’s look at the volume of bilateral trade in recent years.

Naya Pakistan needs new ideas for economic gains

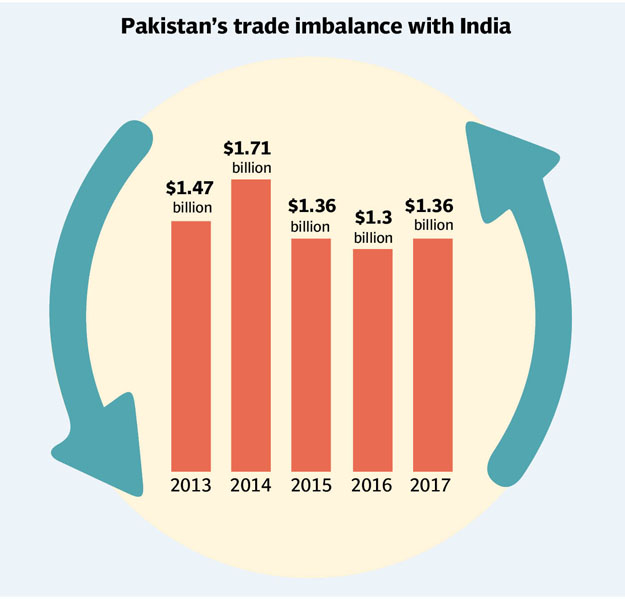

As per Comtrade data, in 2017 total Pakistan-India trade was $2.03 billion including $334 million in exports from Pakistan and $1.70 billion in imports from India. The $1.36-billion trade imbalance was in favour of India. The 2017 data reveals a persistent pattern in bilateral trade ie India running substantial trade surplus with Pakistan.

In 2013, Pakistan’s trade deficit with India was $1.47 billion, which increased to $1.71 billion in 2014 before falling to $1.36 billion in 2015 and to $1.30 billion in 2016.

Over the years, Pakistan’s exports to India have registered either decline or nominal growth.

From $402 million in 2013, exports went down to $392 million in 2014 and further to $312 million in 2015. In 2016, exports marginally increased to $348 million.

Imports from India have also shown a more or less similar pattern. From $1.87 billion in 2013, imports went up to $2.10 billion in 2014 before falling to $1.67 billion in 2015 and to $1.64 billion in 2016.

Between 2013 and 2017, Pakistan’s exports to India have declined 16.91%, while imports from India fell 9.1%. In total, bilateral trade has fallen 10.96% during the period. In the last five years (2013-17) on average, imports from Pakistan have accounted for merely 0.08% of India’s global imports while imports from India have made up 3.78% of Pakistan’s global imports.

Likewise, during the same period, on average, Pakistan has accounted for 0.29% of India’s global trade while India has accounted for 3.1% of Pakistan’s global trade and 6.1% of Pakistan’s total trade deficit. This shows that while Pakistan has a miniscule share in India’s global trade, by comparison India has a considerable share in Pakistan’s global trade as well as overall trade imbalance. It is Pakistan’s growing trade deficit with India that has been the major cause of concern. Hence, if bilateral trade is opened, cheaper Indian goods will flood Pakistan’s market. This will not only cause serious problems for the import-competing domestic industry and subsequently large-scale unemployment, but will also worsen Pakistan’s trade deficit with India and hence aggravate an already challenging current account position.

Major export goods

To delve deeper into bilateral trade, let’s look at the performance of Pakistan’s top exports in the Indian market.

Globally, Pakistan’s top 10 exports are home textiles ($3.95 billion), cotton fabrics ($3.49 billion), knitted garments ($2.51 billion), woven garments ($2.46 billion), cereals including rice ($1.75 billion), articles of leather ($0.631 billion), sugar and confectionary ($0.511 billion), medical and precision equipment ($0.410 billion), fish ($0.406 billion) and cement ($0.385 billion).

These products account for 80.46% of Pakistan’s global exports. However, they have a meagre presence in the Indian market. Home textile exports to India stood at $1.18 million, cotton fabrics $1.13 million, knitted garments $1.29 million, woven garments $2.69 million, articles of leather $0.920 million, sugar and confectionary $0.819 million, medical and precision equipment $11.78 million, fish $0.166 million and cement $87.18 million.

There was no rice export from Pakistan to India in 2017 despite the fact that India imported $1.28 billion of rice from other countries.

Out of the 614 tariff lines included in India’s sensitive list under Safta, 182 pertain to textile and clothing while 139 are agricultural. Textile and clothing and agriculture are the mainstay of Pakistan’s exports. Hence, several products of export interest to Pakistan face MFN tariffs in India, which are on the whole high.

For instance, on textile and clothing, India applies compound (both ad valorem and specific) tariffs, which in some cases are in excess of 100%. On leather products, fruits and vegetables, and cereals, maximum Indian-applied tariffs are 70%, 100% and 150% respectively.

Then there are non-tariff barriers (NTBs) maintained by India such as para tariffs (education cess for example), tariff rate quotas, cumbersome customs clearance and standard compliance procedures, restrictive routes through which merchandise can pass and frequent use of trade defence measures like anti-dumping duty.

By and large, Indian NTBs are more stringent for textile and clothing and agricultural products. Though these barriers are not Pakistan-specific and are applied on MFN basis, they do constitute a serious obstacle to Pakistan’s market access and by implication export growth.

The writer is an Islamabad-based columnist

Published in The Express Tribune, August 27th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ