Market rallies on positive budget related news

Removal of the Capital Gains Tax likely after meeting between PBC and government.

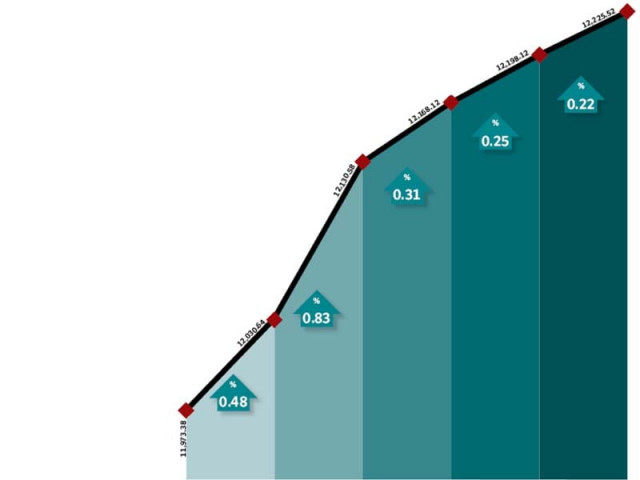

Budget-related news, as expected, dominated proceedings at the country’s stock markets during the week ended May 27, as a flurry of positive developments led the benchmark KSE-100 index to close with gains of 2.1 per cent (252 points).

The budget, which was due to be announced on May 28, has been delayed by a week and as final negotiations with stakeholders are made and adjustments are made accordingly.

The biggest and most relevant development for investors was the meeting between the Pakistan Business Council (PBC) and government officials. Recommendations were made to remove the much-criticised Capital Gains Tax (CGT), which has seen volumes dwindle in the previous year.

The PBC recommended that the withholding tax (WHT) be revived to replace the CGT and the news immediately had a positive impact as volumes improved dramatically in the days following the development.

Furthermore, it was also recommended that a 15 per cent tax credit for five years be given to companies that get freshly listed in the market and income tax rates be reduced for companies that distribute more than 50 per cent of their earnings in a given year. Another important development during the week was reports that the government will not reduce the deemed duty on oil refineries, which currently stands at 7.5 per cent, in the upcoming budget. The news came as a relief for refineries which had said that any reduction in the duty would deal a fatal blow to the sector.

News about Pakistan State Oil acquiring Pakistan Refinery Limited (PRL) also resurfaced during the week, which provided further impetus to the sector. PRL rose 3.6 per cent, NRL climbed 11.1 per cent, while Attock Refinery Limited rose 8.8 per cent during the week.

There was also positive news for the textile sector as Pakistan edged closer to gaining a waiver of duties on its textile products from the European Union, after Vietnam withdrew its opposition to the move. India and Peru are the only two remaining opponents of the proposed waiver.

As a result of these developments, volumes picked up dramatically and stood at an average 83 million shares per day, a rise of more than 80 per cent. Average traded value also picked up by 118 per cent and stood at Rs3.16 billion per day. The KSE’s market capitalisation also rose 2.1 per cent and stood at Rs3.24 trillion at the end of the week.

What to expect?

Budgetary news can be expected to dictate market direction in the coming weeks and investors will be keenly looking for news regarding taxation measures and sector-wise subsidies.

Details regarding the finalisation of the CGT issue will also be on the forefront for investors at the bourse. Members of the PBC will hold another meeting with government officials ahead of the budget and the outcome of the meeting will be looked upon closely.

Monday, May 23

The bourse firmed despite a deadly attack on a naval base in the city. A meeting of KSE members with President Asif Ali Zardari helped lift sentiments amid hopes of some positive developments on the tax front.

Tuesday, May 24

The stock market continued its march upwards primarily due to renewed hopes that the upcoming budget may have some positives for a trigger-starved capital market. High-profile meetings between stock market representatives and finance and tax officials over the past two days concentrating on increasing volumes and more listings have revived investor optimism.

Wednesday, May 25

Upbeat sentiment pushed the bourse to close at a three-month high amid surging volumes. Increasing optimism of relaxation in Capital Gains Tax stayed as the driving factor. Investor sentiment improve on the news as trade volumes rose 75 per cent to an 11-week high of 104 million shares compared with Tuesday’s tally of 61 million shares.

Thursday, May 26

The stock market continued its upward trend for the fifth straight day amid investor interest staying upbeat before the budget. The bourse climbed on expectation that the upcoming budget may bring good news for the capital market. The government is expected to announce the annual budget in the first week of June.

Friday, May 27

The stock market continued its upward trend for the sixth straight day led by the refinery sector stocks. Refinery stocks pulled up the market over rumours that deemed duty, a tax collected by refineries on sale of products, of 7.5 per cent on high speed diesel will remain intact against market expectation of a cut in the upcoming budget.

Published in The Express Tribune, May 29th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ