Profit repatriation increases 15.74% in FY18

Rupee devaluation major reason behind higher outflow

A person walks out of a Western Union branch in New York. PHOTO: REUTERS

The repatriation of profit increased by 15.74% compared to FDI’s meagre growth of 0.8% in fiscal year 2018.

The businesses repatriated $2 billion to their parent companies and made FDI worth $2.76 billion in the year - showing a net inflow of $0.76 billion.

“The growth in repatriation may be attributed to rupee depreciation,” Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General M Abdul Aleem told The Express Tribune.

SBP revises manual for open-market foreign currency dealers

The rupee has depreciated 17.74% to Rs124.22 against the US dollar in the inter-bank market since December 2017.

The depreciation would have convinced businesses to repatriate a higher amount to take benefit of the rupee-dollar parity and avoid any unfavourable situation on the exchange rate front in the near future, he added.

He, however, said OICCI members have reinvested in Pakistan during the year.

“Our members have reinvested $2.7 billion in FY18 that is equivalent to FDI received during the year,” he said. “The reinvested amount would not have fully reflected in FDI as many [OICCI] members have opted to retain the profit in Pakistan and then reinvest.”

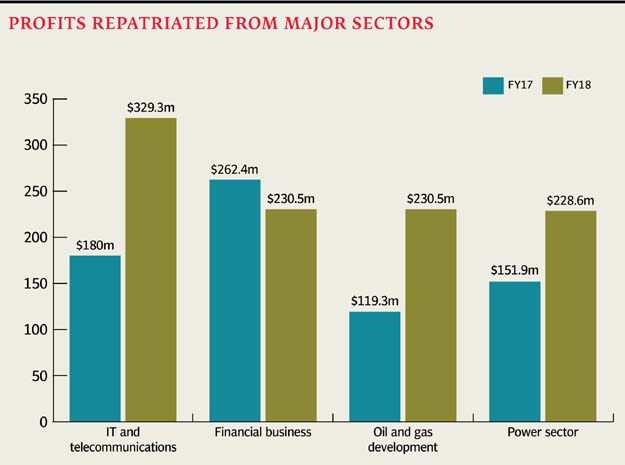

Sector-wise repatriation

The IT and telecommunication sector made the single largest repatriation of profit worth $329.3 million during the year. This was 83% higher than $180 million made last year.

On the other hand, the sector received the second highest FDI worth $707.3 million in the year.

The financial business and oil and gas development exploration sectors made second highest repatriation of $230.5 million each compared to $262.4 million and $119.3 million, respectively, last year. The two sectors received FDIs worth $276 million and $194.8 million, respectively, during the year.

Dealers traded $8b worth of foreign currency in 2017: SBP

The power sector made the third largest repatriation of profit of $228.6 million compared to $151.9 million last year. The sector received the highest FDI of $885.3 million in the year.

The foods sector dispatched a profit of $211.1 million, which was 21% lower than $265.9 million last year. The sector received FDI of $105.7 million in the year.

PSX repatriation

Besides, foreign investors at the Pakistan Stock Exchange (PSX) repatriated a dividend of $311.5 million in the year that was 16.80% lower than $374.4 million dispatched in the previous fiscal year of 2017, the central bank reported.

SBP expected to hike interest rate, but analysts divided over how much

The drop in dispatch of dividend was in contrast to foreign investors selling stocks worth $240.7 million in the year compared to $512.8 million in the previous year.

Published in The Express Tribune, August 7th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ