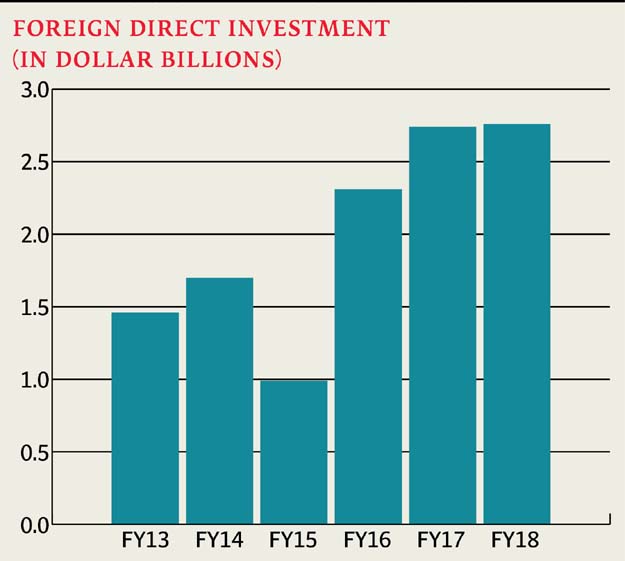

In fiscal 2016-17, FDI stood at $2.74 billion, increasing a meagre $20.8 million, or 0.8%, in FY18.

China remained the single largest foreign investor with its share standing at more than half in the total amount Pakistan received during the year. FDI would have been much worse if it had not made heavy investments under the China-Pakistan Economic Corridor (CPEC).

FDI grows 132% to $340.8m as China dominates

Accordingly, the power and construction sectors attracted more than half the total investment, which comes to slightly higher than what China invested in the two sectors.

The insignificant growth in investment is attributed to rising political noise as Pakistan braces for general elections, as the nation is all set to cast its vote to elect the new government on July 25, an official of the Overseas Investors Chamber of Commerce and Industry (OICCI) said the other day.

He anticipated improvement in FDI after the next government comes into power; sometime in August. “We expect improvement in FDI from October onwards. By that time, the next government would have formed its [economic] team and announced policies to address issues,” OICCI Secretary Abdul Aleem said.

“Foreigners are just sending investment for their ongoing projects at present. The country would see enhanced investment with initiative of some new foreign projects from October,” he added.

Pakistan poses huge potential to attract foreign investment keeping in view the size of its growing middle-income group. However, messages to world investors are usually demotivated. “Pakistan has remained high on foreign investors’ radar,” he added.

Country-wise FDI

China invested a net $1.58 billion in FY18, followed by United Kingdom that injected a net $278.7 million in the year. Hong Kong stood as the third largest investor with a net FDI of $140.8 million.

Among other notable investors were Malaysia ($127.7 million) and Switzerland ($88.1 million) in the year. Kuwait divested a net $79.6 million. Canada, Norway, Oman, Qatar, and South Africa divested in the range of $1.7 million to $11.1 million in the year.

Pakistan needs to improve competitiveness to attract FDI

Sector-wise FDI

The country’s power production sector attracted the single largest investment (net) of $885.3 million, followed by construction, which attracted $707.3 million in FY18.

Among others were financial business ($276 million), oil and gas explorations sector ($194.8 million) and food sector ($105.7 million) during the year.

Outflow of foreign investment at the Pakistan Stock Exchange (PSX) slowed down during the year, as they sold shares worth $240.7 million compared to $512.87 million in the prior fiscal year 2017.

Cumulative foreign investment, including public and private, doubled to $4.97 billion in the year compared to $2.49 billion in the previous fiscal year 2017. The growth in the investment is largely driven by accumulation of new debt worth $2.45 billion through sale of Euro bonds and Sukuk (Islamic bond) during the year.

Published in The Express Tribune, July 18th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ