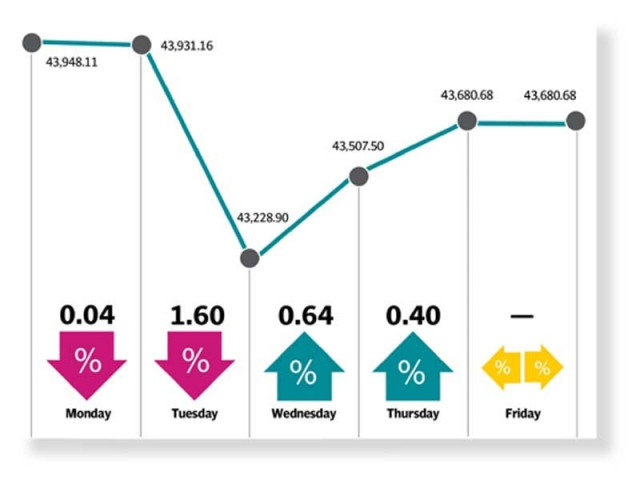

KSE-100 slips 267 points as weaker rupee takes toll

Currency devaluation, worrying economic indicators and thin volumes drag index lower

KSE-100 slips 267 points as weaker rupee takes toll

Sentiments were dented as concern over macroeconomic indicators took toll, leading investors to book profits and remain on the sidelines. Additionally, the central bank’s third round of rupee devaluation against the US dollar also impacted the market with some sectors remaining under pressure. Engineering, cements and automobile sectors were down 5-6% during the week on fear of margin dilution owing to rupee devaluation. In contrast, oil & gas exploration (E&Ps) rose 3% on the back of higher oil prices (up 2% WoW to $66/bbl).

Depleting foreign exchange reserves also did not help the situation and dragged the index lower along with continued foreign selling.

The KSE-100 kicked off Monday on a negative note, with activity remaining dull. The bearish trend continued in the following session with the index plunging 700 points on the back of re-emergence of political noise and interim finance minister hinting towards economic challenges. However, things took a turn for the better, as Wednesday witnessed a slight recovery. News of Supreme Court’s approval of the amnesty scheme improved the mood as investors resumed buying on expectations that the amnesty scheme would generate large capital inflows into the market. The upward trajectory continued and the index finished its last trading day of the week in the green.

Participation during the week slowed to a crawl, on account of last days of Ramazan, with average daily volumes and traded value declining 28% and 30%, clocking-in at 132 million and $54.5 million, respectively.

In terms of sectors, negative contribution to the index came from; cements (down 237 points) given international coal prices have breached $106/ton, engineering (54 points), automobile assemblers (45 points) commercial banks (61 points), and cables and electrical goods (16 points).

On the other hand, sectors providing support to the index included; oil and gas exploration companies (up 155 points) as this sector remains a major beneficiary of PKR depreciation and fertiliser (36 points).

Scrip wise major laggards during the week were LUCK (down 98 points), MCB (61 points), HBL (55 points), DGKC (49 points) and DAWH (34 points). Whereas, BAHL (up 67 points), ENGRO (67 points) and OGDC (62 points) contributed positively to the index.

Foreigners remained net sellers for the six successive week, amounting to $4.4 million vs net selling of $29.5 million last week. Major foreign divestment was witnessed in cement ($3.59 million) and fertiliser ($2.65 million). On the other hand, amongst local investors, companies were net buyers of $10.6 million and mutual funds were net buyers of $2.1 million.

Among major highlights of the week were; Pak rupee was devalued against the greenback for the third time within 12 months, exports surged by 32%, trade deficit rose to $34 billion, Pakistan uses Chinese trade finance to repay foreign debt, Pakistan finalised deal for $1 billion SAFE deposits from China, caretaker government raised POL prices up to 8.9%, Supreme Court announced it has no objection to amnesty scheme.

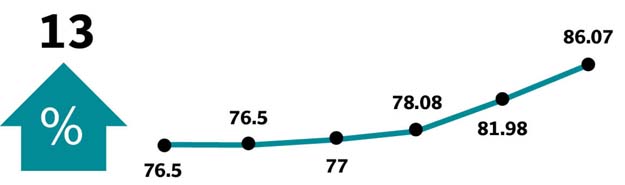

Winners of the week

Meezan Bank

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans and other products through offices located throughout Pakistan.

Unity Foods Limited

Unity Foods Limited is principally engaged in oil-processing business. The company has its solvent extraction plant located in Kotri, Sindh and edible oil refinery located at a site area, Karachi.

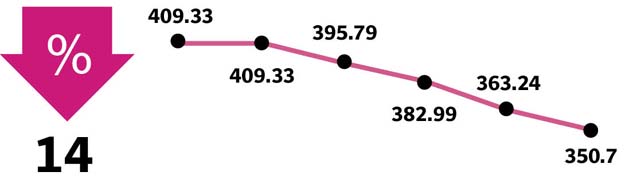

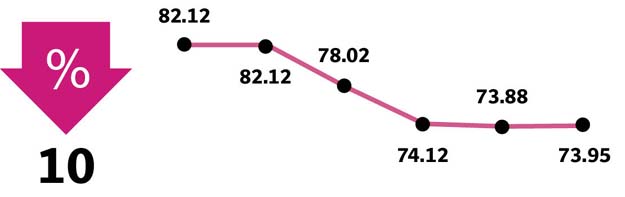

Losers of the week

Honda Atlas Cars

Honda Atlas Cars Pakistan Limited manufactures, assembles and sells Honda vehicles through its many divisions within Pakistan.

Amreli Steels

Amreli Steels Limited is a Pakistan-based steel manufacturing company. The company is engaged in the manufacture and sale of steel bars and billets. The company offers a range of steel bars for all construction needs.

Published in The Express Tribune, June 16th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ