Inflation jumps 4.2% on back of oil price hike, weak rupee

Prolonged spell of low inflation may have ended as inflationary pressures mount

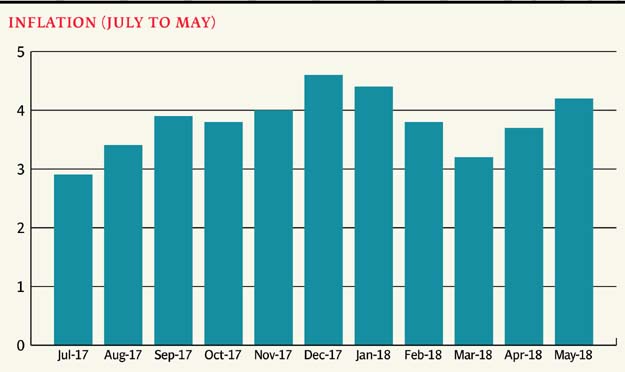

Average inflation in the first 11 months (July-May) of the current fiscal year remained at 3.8%, which was lower than the level recorded in the same period of previous fiscal year

PHOTO: EXPRESS

Measured by the Consumer Price Index (CPI), the inflation rate was 3.7% in April 2018, reported the Pakistan Bureau of Statistics (PBS) on Friday.

It was the second consecutive month when the headline inflation rose half a percentage point despite apprehensions that the official inflation barometer did not fully reflect actual prevailing prices.

Core inflation also remained firm at 7% for the second month in a row in May, showing consistent buildup of inflationary pressures.

Average inflation in the first 11 months (July-May) of the current fiscal year remained at 3.8%, which was lower than the level recorded in the same period of previous fiscal year.

Core inflation reaches 7% for first time in 41 months

In its latest monetary policy announcement, the State Bank of Pakistan (SBP) has listed reasons for the high core inflation, saying it was an indication of the build-up of inflationary pressures.

The central bank said a significant change in the outlook for international crude oil prices, with its impact on upward adjustment in domestic oil prices, strong demand, lagged pass-through of exchange rate adjustments and stoking of inflationary expectations would largely determine inflation path in the remaining period of current fiscal year as well as next fiscal year.

However, the SBP said inflation was expected to be marginally above the annual target of 6% in next fiscal year 2018-19.

Core inflation is measured through 43 non-food and non-energy goods. Commodities such as kerosene oil, petrol, diesel, compressed natural gas, electricity and natural gas as well as the food group are excluded from the core inflation.

On May 28, the central bank increased the key policy rate by 50 basis points to 6.5% to contain inflation and ease pressure from the external account.

In the previous policy announcement, the central bank had left the policy rate unchanged at 6% with majority votes of 6 to 3, according to minutes of March 30 meeting of the Monetary Policy Committee.

In that meeting, the Monetary Policy Department informed the committee that the Macro-Stability Index had marginally worsened in net terms primarily due to a marginal reduction in the import coverage of foreign exchange reserves.

Brace yourself for inflation as the rupee takes a hit

Inflation is also expected to accelerate further due to some budgetary measures that came into effect in May. An increase in customs duty will affect almost every household commodity.

The wide difference between the headline inflation and core inflation was mainly because of low food inflation. Prices of perishable food goods decreased 4.6% in May over a year ago. Prices of non-perishable food items, on average, increased 3.3%.

Kerosene oil price swelled 33.2% in May over a year ago. Education fee increased over 13%, construction wages rose 10.2% whereas motor fuel became expensive by over 12.4%. Water supply rates also increased 10.2%.

In March: Inflation slows down for 3rd successive month, stands at 3.2%

The CPI is calculated by assessing price movements only in urban centres, but now the government plans to capture price trends in rural areas as well. The new inflation basket will comprise 600 goods including 244 to be covered in rural areas.

In the food group, prices of chicken rose 21%, meat became expensive by almost 10%, rice 9.4%, dry fruits 8.7%, eggs 6.5%, milk products 5.2% and readymade food almost 5.6% in May over a year ago.

Published in The Express Tribune, June 2nd, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ