More foreign loans only way to sustain reserves: Rana Afzal

Says will leave foreign exchange reserves at comfortable level for next govt

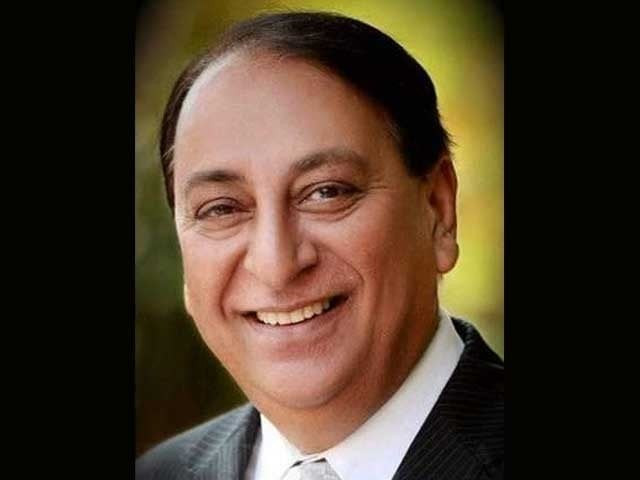

We will start meeting on the issue of FATF after March 1 to see what can we do on this and what strategy we can devise, says Finance Minister Rana Afzal Khan. PHOTO: FILE

The widening current account deficit is the biggest challenge and the only option is to “arrange dollars to meet financing requirements’, said Rana Afzal while speaking at the Express Group’s Budget Seminar.

The government plans to take commercial loans and in addition it has sent requests to friendly countries to place more deposits in the State Bank of Pakistan, according to sources in the Ministry of Finance. Friendly countries have already placed $1.7 billion as deposits with the central bank under currency swap arrangements, which are part of the $11.8 billion gross official reserves.

The government is eying to tap more commercial loans at a time when interest rates in capital markets have started increasing.

The SBP has also dropped a hint about these arrangements in its latest Monetary Policy announcement. The government’s plans to timely mobilise external inflows, both official and commercial, will play a pivotal role in maintaining adequate level of SBP’s foreign exchange reserves and anchoring sentiments in foreign exchange markets, according to the central bank.

Due to ever widening current account deficit, the SBP’s foreign exchange reserves declined to $11.78 billion as of March 22, which are hardly sufficient for two months of future import bill. Due to low reserves levels, the World Bank and the Asian Development Bank have already suspended budgetary support for Pakistan.

The current account deficit has already reached $10.8 billion during July-February period of this fiscal year, which is about 50% more than it was during the same period in the last fiscal year.

In its latest report, the IMF said that Pakistan’s net official foreign currency reserves were negative $724 million as of mid-February. It has estimated Pakistan’s gross financing requirements at $24.5 billion for this fiscal year.

Rana Afzal defended high debt levels and said that the government did not have an option but to borrow to run its affairs. He said that high spending on security was also the reason behind the growing debt burden.

Rana Afzal advocated continuity of the political system that he said would help address the governance issues in the country. In India, there is one political system for last 70 years but we have not yet decided what is good for Pakistan, he added.

He appealed that there should be no politics on the issue of economy and the political parties should sign the charter of economy.

The current socio-economic conditions will create enormous difficulties for the next government, said Omar Ayub, former minister of state for finance. Ayub also highlighted flaws in negotiations of the China-Pakistan Economic Corridor.

In its current shape, the CPEC is just a trade route that will massively reduce the transportation cost for the Chinese but it would not create jobs for Pakistanis, said Ayub. He said that the government should strive to create more jobs opportunities by renegotiating CPEC terms.

Published in The Express Tribune, April 4th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1735506669-0/image-(16)1735506669-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ