Depletion of foreign currency reserves was the primary dampener of investor sentiments during the week ended on March 9.

The International Monetary Fund’s (IMF) post-programme monitoring discussions also cast serious doubt on the government’s ability to repay the Fund “amidst growing external/fiscal financing requirements and depleting foreign exchange reserves,” an Elixir Securities’ report stated.

The IMF in its report, while appreciating the rupee’s depreciation in December, stressed greater exchange rate flexibility as a permanent policy measure rather than a temporary move, while also underscoring the need for containing the current expenditure.

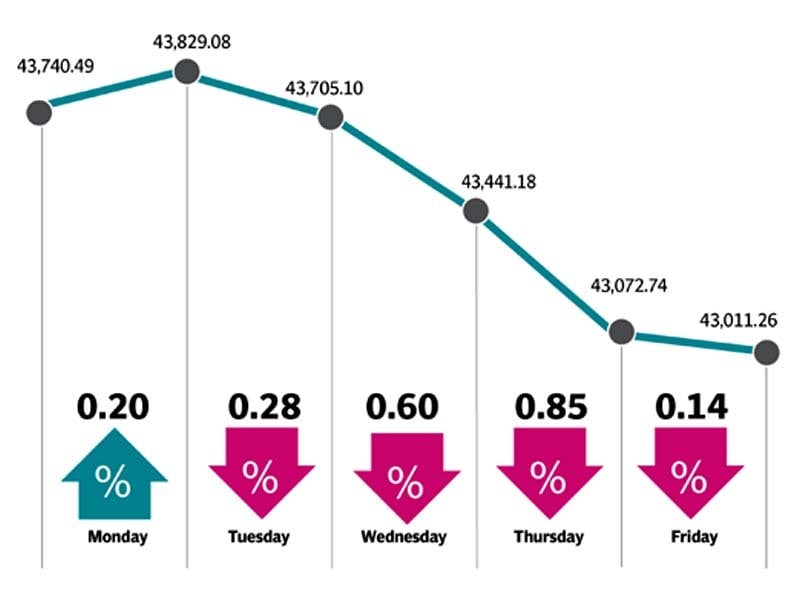

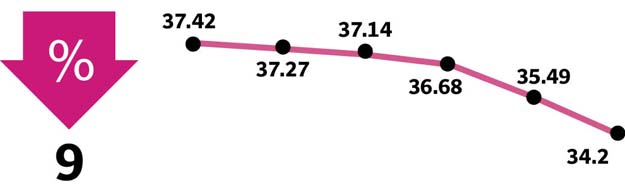

Despite starting the week on a positive note, the bourse was unable to maintain the momentum for the rest of the week. The cement sector, despite being the main driver of growth during the previous week, fell prey to profit-booking on Tuesday, causing an overall loss of 123 points to the index.

The release of IMF’s report on Wednesday further dented the index which lost over 300 points. The last two days of the week were not much different as profit-booking kept piling pressure on the stock market.

Among the sectors, commercial banks (-180 points) and fertiliser companies (-120 points) led the downturn followed by cement (-101 points), oil and gas exploration companies (-55 points) and oil and gas marketing companies (-52 points).

Minor positive contribution came from chemical and leather and tanneries’ stocks (10 points each).

Overall activity fell sharply with average daily volumes recording a decline of 16% week-on-week at 152 million shares whereas average traded value dipped 19% to $60 million.

According to Arif Habib Limited, negative contributions came primarily from selling in blue chip companies. Pressure on the bourse was led by Habib Bank (-83 points), Engro (-80 points), MCB (-56 points), TRG Pakistan (-31 points) and DG Khan Cement (-29 points). Support was provided by Bank Alfalah (18 points), Colgate (14 points) and Bata (10 points).

Foreigners offloaded stocks worth $3.9 million compared to net selling of $11.4 million in the previous week. Major foreign selling was witnessed in commercial banks ($16.4 million) and oil and gas exploration and production companies ($1.1 million).

Domestically, major buying was reported by insurance companies ($8.2 million) and banks/DFIs ($4 million). Local selling was largely executed by mutual funds ($6.6 million) and companies ($4.7 million).

Other major news during the week included Nashpa oil and gas and LPG project inauguration, an international bank downgrading Pakistan’s credit outlook, approval by the ECC of a plan to settle Rs80 billion worth of power sector’s circular debt, approval of PIA and PSM privatisation plans by the cabinet and Shabbir Tiles’ plans to invest Rs1.25 billion in expansion.

Winners of the week

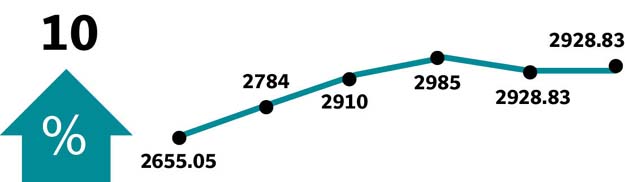

Bata (Pakistan)

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

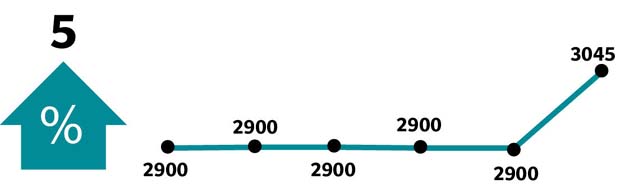

Colgate-Palmolive Pakistan

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene and a variety of other products.

Losers of the week

Punjab Oil Mills

Punjab Oil Mills Ltd manufactures and sells vegetable ghee, cooking oil, and laundry soap.

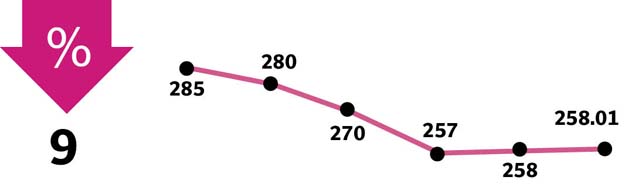

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Published in The Express Tribune, March 11th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ