In a surprise, dollar reserves of commercial banks rise

People are converting their savings into the greenback to ward off impact of further rupee depreciation

People are converting their savings into the greenback to ward off impact of further rupee depreciation

PHOTO: AFP

According to the State Bank of Pakistan (SBP), the reserves held by commercial banks have increased over 24%, or $1.19 billion, in the past 13 months to $6.12 billion at the end of January 2018 from $4.93 billion in December 2016.

After eating up $2.5b, Pakistan to float another $1b Eurobond

In the same period, the country's total foreign exchange reserves dropped 16.58%, or $3.84 billion, to $19.35 billion as on January 26, 2018 from $23.20 billion in December 2016, said the SBP.

Experts said people were fast converting their savings into US dollars to escape further depreciation of the rupee, which had weakened significantly against the dollar and other major currencies recently.

They added some of the people were buying the greenback ahead of the expected issue of dollar-denominated bonds for overseas Pakistani workers and Pakistani residents to finance the widening current account deficit and avoid balance of payments crisis.

NUST Islamabad School of Sciences and Humanities Principal and Dean Dr Ashfaque Hasan Khan said, "There are two to three reasons for the surge in dollar savings. On the top is people's concern that the rupee may further depreciate against the greenback, which is seen as a continuing trend due to worsening balance of payments situation."

The rupee has depreciated 5% against the US dollar since December 2017. The depreciation surged to 10% when the US dollar's weakness against world's major currencies (like euro, pound and Chinese yuan) in the ongoing currency war was taken into account, SBP Governor Tariq Bajwa said recently.

The rupee closed at Rs110.55 to the US dollar in the inter-bank market on Friday. According to a brief survey conducted by The Express Tribune recently, securities brokerage houses are anticipating the rupee will fall to Rs112-118 to the US dollar by the end of June 2018.

"Pakistan's current account deficit is estimated at $18 billion for the current fiscal year," Khan said, which would take the country's total reserves down to around $6-6.5 billion by the time the current government would complete its five-year tenure.

"The [outgoing] government may float a third Eurobond worth around $1 billion in the international market by May 2018 to finance the current account deficit," he said.

This may put further pressure on the rupee and force people to convert their savings into dollars, he said.

At present, the government is preparing to float a second Eurobond worth $1 billion in world markets in a span of around two months. Earlier, it borrowed $2.5 billion through the Eurobond and Sukuk (Islamic bond).

Currency: Rupee strengthens against dollar

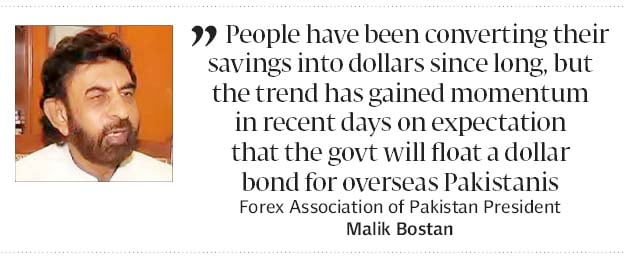

Forex Association of Pakistan President Malik Bostan said people had been converting their savings into dollars since long, but the trend gained momentum in recent days probably on expectation that the government would offer dollar-denominated bonds to expatriate and resident Pakistanis.

Then finance minister Ishaq Dar announced in the budget for FY18 the possible launch of the bond for Pakistani workers working abroad.

Published in The Express Tribune, February 3rd, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ