FDI in Pakistan drops massive 71.5% in Dec

Country attracts only $197.4m, compared to $692.1m in 2016

Country attracts only $197.4m, compared to $692.1m in 2016. PHOTO: FILE

December was the first month of the current fiscal year that saw a fall in foreign direct investment (FDI).

Majority of the foreign investors seem to have taken a wait-and-see approach in making new injections in Pakistan considering mounting political tension ahead of the planned next generation elections this year. Additionally, worrying macroeconomic indicators are keeping investors at bay, say analysts.

Malaysia leads as FDI in Pakistan jumps 162%

EFG Hermes Chief Executive Officer Muzammil Aslam said Pakistan has become a less attractive avenue for foreign investment due to inconsistency in taxation policies and increased cost of doing business.

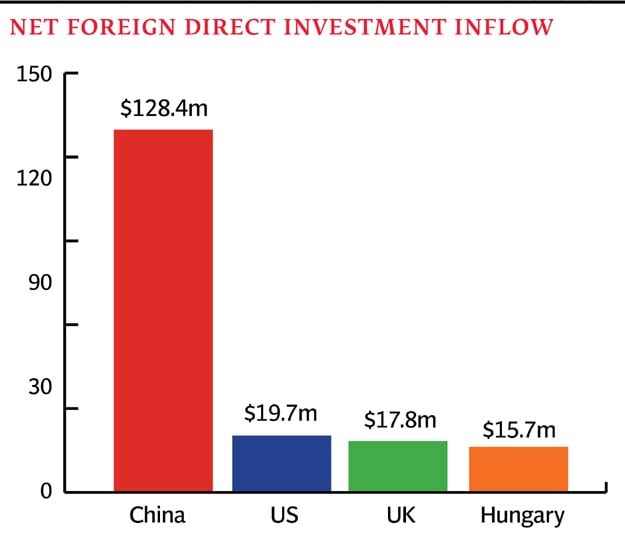

China leads

The country-wise breakdown showed China stood as the single largest net investor of $128.4 million in December, followed by United States ($19.7 million), United Kingdom ($17.8 million) and Hungary ($15.7 million). Other countries made almost next to zero investment in Pakistan. At the same time, there were no major outflows. This can be gauged from the fact that South Africa, which made the single largest divestment, repatriated only $11 million, followed by Kuwait at $4 million.

China’s investments come as multi-billion dollar infrastructure and power projects under the China-Pakistan Economic Corridor (CPEC) gather pace.

Energy sector attracts FDI

Energy, construction and financial businesses attracted the largest chunk of FDI in December. Oil and gas explorations attracted a net $26.2 million, power projects $25 million, construction $78.6 million and financial business $31.5 million.

The electronics’ segment received $16.8 million, while over 90% ($15.5 million) of this came in the sub-sector of consumer/households, according to the central bank data. Trade and telecommunication sectors cumulatively made a net outflow of $11.3 million.

Cumulatively, in the first-half of the current fiscal year, FDI decreased around 2.8% to $1.38 billion from $1.42 billion in the same half of the previous year.

Investment in securities

Meanwhile, total foreign investment - including short-to-long term non-productive investments in stocks market and government securities - rose a massive 71% to $3.7 billion in the half-year from $2.16 billion in the same half last year.

China continues to dominate as FDI jumps 150% in Oct

The SBP data shows divestment in stocks market slowed down as investors made a net outflow of $128.4 million in six months as compared to $254.4 million in the same six months in 2016. However, government securities attracted massive $2.45 billion in six months as compared to $998.1 million in the corresponding period.

Published in The Express Tribune, January 17th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ