KSE-100 gains 0.96% as correction kicks in

Foreign buying helps take index forward despite selling resistance

Despite mounting tensions, and the constant back-and-forth remarks between the US and Pakistan, the stock market remained strong and surged to cross the 43,000-point barrier on Monday. However, Tuesday brought a turn of events, as the KSE-100 Index dipped on account of profit-taking, and an overdue correction - thus ending the 13-day winning streak. Lack of negative triggers kept the investors at the forefront who continued their buying activity, which rejuvenated the stock market. Volume and share prices soared on Wednesday as stocks bounced back with renewed vigour taking the index up 816 points. Attractive valuations and positive sentiments kept the market within a range of 42,000 to 43,000 points throughout the week.

Unfortunately, the market was unable to sustain its bullish momentum, owing to Pakistan Awami Tehreek Chairman Tahirul Qadri’s announcement of countrywide protests against the government. Matters were further aggravated when Pakistan Tehreek-e-Insaaf announced their support of the protest. The political turmoil sent the market into a spiral and the last two trading days of the week saw the market decline 697 points cumulatively.

Meanwhile, average daily volumes increased by 29.8% to 276 million shares, while average daily value which went up by 43.8% to $110 million.

Sectors that contributed positively to the market were banks (178 points), OMCs (137 points), fertilisers (87 points); on expectations of a new fertiliser policy and measures to reduce urea prices in the country ahead of the general elections, engineering (41 points) and technology and communication (34 points).

Gas Utilities (SNGP +18.7% week-on-week, SSGC +6.7% week-on-week) and some steel companies (CSAP +19% week-on-week) garnered investors’ interest on ECC approving Rs175 billion for third LNG pipeline. On the other hand, sectors that dragged the index down were cements, E&Ps and autos.

Stock-wise, HBL (+136pts), SNGP (+110pts), FFC (+86pts), MCB (+53pts) and TRG (+37pts) contributed positively to the index. While PSO (-3.9%), DGKC (-4.9%), OGDC (-1.4%), ENGRO (-1.7%) and UBL (-1.1%) withheld 159 points

Foreigners remained net buyers during all ten trading sessions of the ongoing year as rupee depreciation and attractive valuations opened buying opportunities in the market. Foreign investors purchased stocks worth $26 million during the week compared to net buying of $23 million last week.

Major buying was witnessed in commercial banks ($7.4 million), cement ($5.8 million) and power generation & distribution ($3.8 million). On the local front banks/ DFIs led the bearish sentiments resorting to selling of $18.5 million followed by other organisations ($7.8 million) and companies ($7.5 million).

Among major news of the week was Honda increased prices of cars, the SBP lifted ceiling on dollar imports, Nepra unlikely to revise K-Electric’s MYT upward, Rs175 billion financing approved for third LNG pipeline, growth projections for Pakistan by the World Bank (+5.5% in FY18), and Attock Cements’ new production line in south starting commercial operations.

Winners of the week

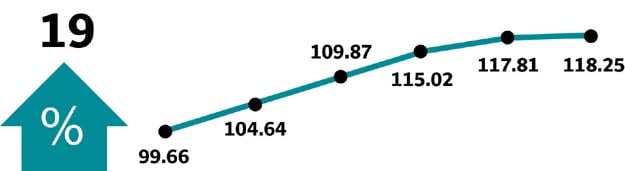

Sui Northern Gas Pipelines

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes and supplies natural gas, in addition to marketing liquefied petroleum gas.

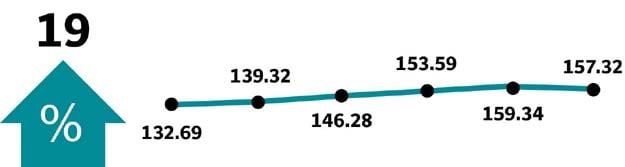

Crescent Steel

Crescent Steel & Allied Products Limited manufactures steel-lined pipes and multi-layer pipe coatings, which are used for water, oil and gas transmission. The company also has a cotton division that manufactures cotton yarn.

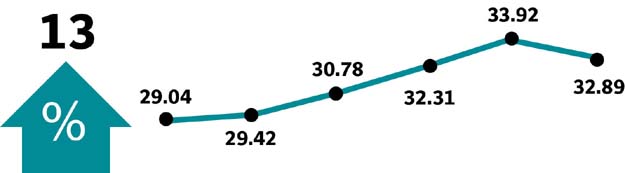

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Losers of the week

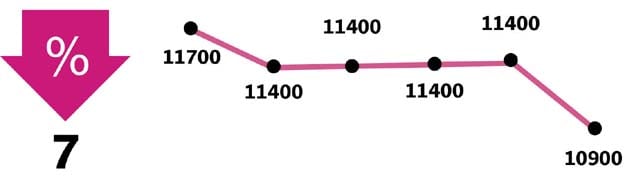

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Atlas Honda

Atlas Honda Limited manufactures and sells motorcycles and spare parts. The company operates in Pakistan.

Nestle Pakistan

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Published in The Express Tribune, January 14th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ