Foreign loans contracted by government cross $40b

Figure shared by EAD last month was $34.2 billion, excluded amount from IMF programme

Figure shared by EAD last month was $34.2 billion, excluded amount from IMF programme. PHOTO: FILE

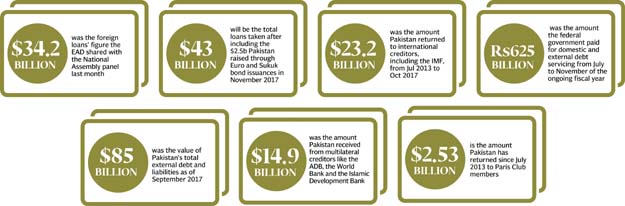

The Economic Affairs Division (EAD), the main window that deals with external creditors, had informed the National Assembly Standing Committee on Finance and Economic Affairs that gross foreign loan disbursements from July 2013 to October 2017 stood at $34.2 billion.

However, the figure is lower by $6.2 billion since the EAD did not include the loans taken by the International Monetary Fund (IMF) in its calculations. The confusion is a result of lack of coordination between the Finance Division and the EAD, the two main divisions of the finance ministry. The IMF loans are contracted mainly for balance of payments support, and are dealt by the State Bank of Pakistan.

On December 29, the NA Standing Committee on Finance and Economic Affairs was briefed on the functioning of the EAD along with details of foreign loans. The EAD secretary had given a detailed briefing on loan disbursements, outstanding public sector external debt and external debt servicing requirements for the next five years.

By including the borrowings from the IMF under the three-year Extended Fund Facility programme, gross foreign loans that the PML-N government took till October 2017 amount to $40.4 billion. After including the $2.5 billion Pakistan raised through Euro and Sukuk bond issuances in November 2017, the figure would jump to nearly $43 billion.

Pakistan’s total external debt and liabilities as of September 2017 stood at $85 billion. Out of the total, the government’s direct obligations are equal to $67.2 billion, which exclude guaranteed and public sector enterprises’ debt.

These figures are very alarming, which indicate the PML-N government’s inability to ensure enough non-debt creating inflows to meet external account requirements. Due to huge domestic and foreign borrowings, debt servicing is now the single largest charge on the federal budget.

From July through November of the ongoing fiscal year, the federal government paid Rs625 billion for domestic and external debt servicing.

Although the EAD has not included the IMF loans in its gross borrowings, it included the IMF debt servicing cost in the presentation.

From July 2013 to October 2017, Pakistan returned $23.2 billion to international creditors including the IMF. This means that the PML-N government has so far added a net $17.2 billion in the country’s external debt - the highest by any government since 1947.

Pakistan received $6.2 billion IMF loan but has returned the global lender $1.936 billion, according to the EAD. Major payments were made in fiscal years 2013-14 and 2014-15 on account of $7.7 billion loans the country had obtained under a 2008 stand-by arrangement.

Pakistan received over $14.9 billion from multilateral creditors like the Asian Development Bank, the World Bank and the Islamic Development Bank. It returned $7.8 billion to these creditors in the past almost four and a half years.

The country also received $7.3 billion in fresh loans from bilateral creditors - mainly from China, during the past four and a half years. Most of these loans will mature in the coming years. But the country has started repaying the Paris Club loans that former president General (retired) Pervez Musharraf got frozen under a deal struck in return of becoming an ally in the US-led war on terrorism.

Since July 2013, Pakistan has so far returned $2.536 billion to Paris Club members. Another amount of $2.84 billion was returned to non-Paris Club members.

The PML-N government also obtained $7.5 billion in foreign commercial loans till October 2017 as part of its policy to meet external financing needs instead of undertaking structural reforms that would have ensured flow of non-debt creating inflows. Out of this $7.5 billion, the government either returned or rolled over $5.34 billion it took from commercial banks or as short-term loans.

During the past four and a half years, the PML-N government has floated $7 billion worth Euro and Sukuk bonds. It serviced $2.6 billion as bonds, which were issued during Musharraf’s era.

For the next five years (2018-19 to 2022-23), the EAD has estimated Pakistan’s debt servicing cost at $31.4 billion. One-third of it, $10.7 billion, will be returned to multilateral creditors, $5.6 billion to Paris Club members, $4.5 billion to non-Paris Club members, $5.8 billion to commercial banks and $4.3 billion as bond repayments.

Published in The Express Tribune, January 7th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ