Pakistan’s stock market: from Asia’s best to Asia’s worst

Index’s downfall to continue till general elections, says brokerage house

File photo

PHOTO: EXPRESS TRIBUNE

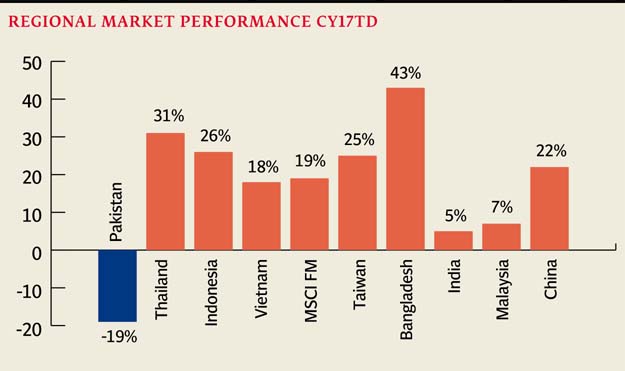

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index has fallen 20% since January 1, 2017 to date and 28% from its peak - 52,876.46 points - it achieved on May 24, 2017.

“Factors in the run up to elections will cause further jitters in the market,” Taurus Securities Limited, a subsidiary of the state-owned National Bank of Pakistan, anticipated in a detailed report on ‘Pakistan Investment Strategy 2018.’

“However, we feel that investor confidence will be restored after the new government is formed,” the report added. Sectors in the limelight are expected to be oil and gas exploration and production (E&P), independent power producers (IPPs), textiles, technology, and banks - largely due to the positive implication from the recent rupee “devaluation,” the brokerage house said.

Market watch: KSE-100 falls with trading volumes lowest since July 2014

The rupee has depreciated 4.67% to Rs110.43 to the US dollar. Given that it will be the election year, cyclical sectors including cement, steel, and autos cannot be ignored, it said. “We take heart in knowing that since 2000, the three times the market has returned negatively in a year, the following year has been one of amends and solid recoveries,” it said.

SOURCE: BLOOMBERG & TSL RESEARCH

Foreign investment - the main trigger

The brokerage house believes that foreign flows are nearing exhaustion levels and may soon be on the buying front as “their main concern of currency devaluation gets addressed,” it said.

Over the last nine years foreign flows have played a significant role in determining market direction. Major accumulation post-2008 crisis was witnessed in 2009 where an inflow of $526 million came resulting in a 60% return for the year. From calendar year 2009 to 2014 (barring 2011), each year there was a net positive inflow, and cumulatively, $1.32 billion were invested.

The sell-off began from 2015 and since then has resulted in a net outflow of $1.16 billion. Again, 2017 is the year where selling has peaked with net selling of $491 million to date, it said.

“Cements have taken the brunt of this selling with a net outflow of $169 million followed by banks ($97 million). Power sector and E&Ps followed suit with sell-offs worth $51 million and $44 million, respectively,” it added.

2017 recap

Acute political uncertainty, which kept growing due to ‘Panama leaks’ and the eventual disqualification of Nawaz Sharif, has played a leading role in the market’s fall in 2017.

KSE-100 hits nearly 1.5-year low in another bearish week

The main economic events during the year were the current account deficit rising 1.56-times in fiscal year 2017 and foreign exchange reserves decreasing 20%, the report said.

The banking sector posted a negative return of 26% since January to date due to the exhaustion of PIB-driven capital gains, cement sector lost 49% due to changing dynamics and automobile sector dropped 15% in the outgoing year to date due to new players entering the market.

Moreover, foreign portfolio investors divested another $490 million from the local stock market from January to date. In 2016, the market posted a handsome return of 46% and emerged as the best Asian stock market ahead of PSX’s return to the MSCI Emerging Markets Index with effect from June 1, 2017.

Published in The Express Tribune, December 19th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ