KSE-100 hits nearly 1.5-year low in another bearish week

Political concerns, macroeconomic indicators keep the index under pressure

While political concerns continued to weigh on the market, a lack of clarity on the macroeconomic front also dented investor confidence. A major development during the week ending December 15, 2017 was the State Bank of Pakistan’s (SBP) move to let the rupee fall 4.9% against the US dollar.

Although the central bank addressed concerns to some extent, the depreciation failed to excite market participants as it fell short of the perceived currency value, stated a JS Global report.

The International Monetary Fund’s (IMF) positive comments on the rupee’s depreciation and decoupling of the economy and politics also could not spark investor interest in the market.

Market watch: Political noise drags KSE-100 back into the red zone

The bourse kicked off the week on a negative note as investors were jittery, resulting in the index dipping to new lows. Monday saw an intra-day plunge of over 1,000 points in the benchmark KSE-100 Index and it settled at the lowest level in 17 months.

In the following two sessions, the market fared better as institutional buying and resolution of some issues on the political front helped the KSE-100 recover.

However, in another dramatic turn of events, the index retreated once again on Thursday. The plunge came after National Assembly Speaker Sardar Ayaz Sadiq expressed doubt about whether parliament would be able to complete its current tenure. The news rattled investors, pushing the market lower by 1.5%.

Friday saw some respite from the downward trend as verdicts by the Supreme Court in two important cases including its rejection to reopen the Hudaibiya Paper Mills case and Imran Khan’s survival in the disqualification case, helped in the market’s recovery.

Of late, the rupee’s stability at 110 to a dollar also had a favourable impact.

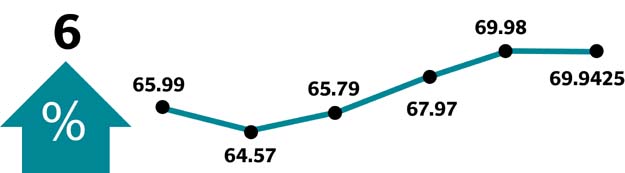

Market participation suffered somewhat with average daily traded volumes falling 4.4% week-on-week to 135 million shares, whereas average daily traded value rose 14% to $61 million.

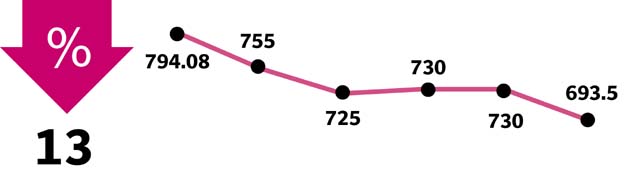

Across-the-board selling was noted in heavyweights such as cement stocks (down 6% week-on-week), oil marketing companies (-1.1%), banks (-0.5%) and autos (-3%).

Some gains were posted by exploration and production stocks (up 1.4%), but their performance could not fully counter the impact of across-the-board free-fall. Fertiliser and tobacco sectors were up 1% and 2%, respectively.

In terms of individual stocks, negative contribution came from Lucky Cement (-103 points), International Steels (-44 points), DG Khan Cement (-43 points), Searl (-34 points) and United Bank (-32 points).

On the other hand, Pakistan Petroleum (+51 points), Engro (+50 points) and Habib Bank (+41 points) took the index forward.

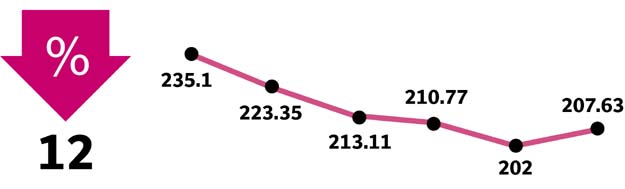

In the wake of political and macroeconomic concerns, foreign and domestic retail investors continued to shed their holdings with net selling of $17.8 million and $8.9 million respectively during the week.

Selling was concentrated in commercial banks ($13.1 million), other sectors ($2.4 million), telecom firms ($2.3 million) and cement companies ($2 million).

On the domestic front, banks/DFIs, companies and mutual funds absorbed most of the selling pressure with net buying of $11.3 million, $10.7 million and $6.5 million respectively.

Market watch: Stocks end little changed in range-bound trading

Among major highlights of the week were prime minister’s firm announcement that the government would complete its term at any cost, approval of a $700-million allocation under the Coalition Support Fund (CSF) programme, spotlight on cement manufacturers on the consumption of groundwater in the Potohar region and release of macro data that indicated a widening of the trade deficit (19.4%) and a drop in remittances (2.6%) in November 2017.

Winners of the week

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, pediatrics, surgical, obstetrics and gynecology, dentistry, rehabilitation services and ophthalmology.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres also owns an in-house power generation plant.

Losers of the week

Jubilee Life Insurance

Jubilee Life Insurance Company Ltd is a general insurance company, which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness, and investment insurance. Jubilee’s corporate products include group life, health, and pension schemes.

Hascol Petroleum

Hascol Petroleum Limited is a fully integrated Oil Marketing Company (OMC) engaged in the marketing and distribution of petroleum products through its petrol pumps and to industrial customers.

International Industries

International Industries Limited manufactures cold-rolled steel strips, steel tubes and galvanised piping products.

Published in The Express Tribune, December 17th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ