Defence, interest payments consume over three-fourths of tax revenue

Spending pattern suggests country likely to surpass full-year’s budgeted numbers

Pakistan Army soldiers. PHOTO: AFP / FILE

However, the more worrying bit was that barring Federal Board of Revenue’s (FBR) tax revenue, the other two sources witnessed negative growth in collection during July-September.

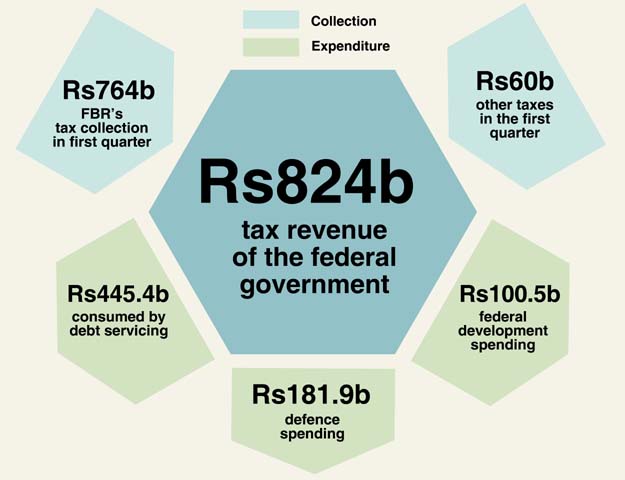

Debt servicing alone consumed Rs445.4 billion, which was 54% of the Rs824.5 billion revenues of the federal government during July-September period, according to the fiscal operations summary the finance ministry released on Wednesday.

When food businesses eat up a chunk of tax revenue

Spending worth Rs445.4 billion was in addition to the repayment of principal loans the government is retiring by taking more loans. For instance, the federal government retired Rs142.2 billion in foreign loans by taking new loans amounting to Rs150.1 billion.

The interest payments were up by 7.5% when compared with the debt servicing cost in the same period of the previous fiscal year. An amount of Rs417.6 billion was spent on domestic debt servicing and another Rs27.8 billion on foreign debt servicing in the first quarter.

For the current fiscal year 2017-18, the federal government has earmarked Rs1.363 trillion for domestic and foreign debt servicing. The federal government has already consumed one-third of it in the first quarter, suggesting that there could be some slippages by the year end.

The central government’s debt and liabilities increased to Rs21.4 trillion by June this year, which were about 68% of the total national output and is considered a dangerous level.

Defence spending in the first quarter stood at Rs181.9 billion, consuming 22% of the federal government’s revenues.

Defence and debt servicing combined consumed 76% of the total revenues in the first quarter.

Federal development spending in the first quarter amounted to only Rs100.5 billion or one-tenth of the annual budget. This is Rs100 billion less than the limit set for the first quarter by the National Economic Council. The federal development spending should have been over Rs200 billion.

A significant chunk of the federal development spending has gone to parliamentarian schemes.

Resultantly, the federal government’s budget deficit widened to Rs488.4 billion or 1.4% of the GDP in the first quarter. Due to Rs51.5 billion cash surpluses generated by the four provinces, the overall budget deficit stood at Rs440.8 billion or 1.2% of the GDP in the first quarter, according to the fiscal operations summary.

The government’s total tax revenues stood at Rs824.5 billion in the first quarter - up by Rs138 billion or 20.1% over the same period of the previous fiscal year. The entire increase came on account of FBR’s tax collection that surged to Rs764.8 billion in the first quarter.

Collection of other taxes stood at Rs60 billion in the first quarter - down by 2.5% over the same period of the previous fiscal year. Collection was about one-fifth of the annual budgetary estimates.

Non-tax revenue collection stood at only Rs90 billion in the first quarter - down by almost one-tenth. It was only 9% of the annual budgetary estimates of Rs980 billion, suggesting that the government will not be able to achieve this target, primarily because of non-disbursements of the Coalition Support Fund by the United States.

The trend suggests that the annual budget deficit target of 4.1% of the GDP or Rs1.480 trillion has already become unrealistic in the first quarter.

K-P tax collection misses target by 50% in FY17

The total federal government’s expenditures during the first quarter stood at Rs974.1 billion - up by Rs125 billion or 14.7%.

The pace of increase in spending was far higher than what the finance ministry had assumed while making the fiscal year 2017-18 budget. The total outlay of this fiscal year budget is only 4.3% higher than the previous year’s budget.

The current expenditures were 11.3% higher than the previous fiscal year, standing at Rs851.8 billion in the first quarter of this fiscal year.

Published in The Express Tribune, November 30th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ