Weekly review: KSE-100 ends positive, but uncertainty remains

Benchmark 100-share index increases 0.9% to 41,435 points

During the week, global crude oil prices rose steeply due to political turbulence in Saudi Arabia which increased investor interest in oil companies and contributed to the market’s overall growth.

A similar effect was provided by the Securities and Exchange Commission of Pakistan (SECP) withdrawing the 5% cash limit restriction on mutual funds that is expected to increase inflows into the stock market.

Weekly review: KSE-100 succumbs to political apprehensions, 1,097 points wiped off

Topline Securities also credited State Bank Deputy Governor Jameel Ahmad’s statements while addressing Bloomberg Pakistan Economic Forum for generating positive sentiment. “Recent taxes imposed by the government are expected to curb unnecessary imports,” Jameel had said, adding that “things on the external front are improving.

“Macro-economic picture is positive, outlook is encouraging and Sukuk, Eurobond issuance will help bring stability on the external front,” the brokerage house quoted Jameel as saying.

The World Bank’s report on Pakistan was the only significant dampener during the week, apart from the recurring ones including political instability and increasing current account deficit.

Till SECP’s announcement of relaxation on Thursday, which led to the index gaining 531 points, the market remained flattish owing to low turnover at the exchange. The bearish trend returned on the last day of the week however, with 354 points lost to profit-taking.

That said, average volumes during the week were 113 million shares, down by 0.03% week-on-week, whereas the average traded value decreased by 12% to $60 million. Japan Power Generation dominated the volumes with 41.8 million shares traded.

Sectors that boosted the index included oil and gas exploration (+106 points), automobile assemblers (+80 points), fertilisers (+61 points), pharmaceuticals and oil and gas marketing. Stock-wise, the top five gainers were Dawood Hercules, Pakistan Petroleum, Searl, Millat Tractors and Honda Atlas, that contributed 225 points to the market combined.

Weekly review: Uncertainty erodes away gains, KSE-100 ends almost flat

During the week, foreigners sold stocks worth $1.78 million, significantly lesser than the $30.73 million worth of stocks sold last week. Major offloading by foreign investors was concentrated in commercial banks ($5.36 million) and fertiliser companies ($2.6 million).

On the local front, selling was countersigned in mutual funds ($17.3 million).

Among major highlights of the week; remittances rise to $6.44 billion in July-Oct, Cherat Packaging’s fifth paper sack plant commissioned, government urged to renegotiate Iran-Pakistan gas pipeline project’s price, FBR examines impact of import tax incentives on exports and PSX likely to lose weightage in MSCI emerging market Index.

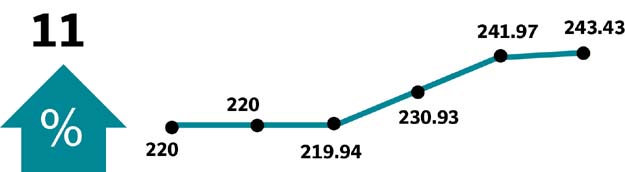

Winners of the week

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation and ophthalmology.

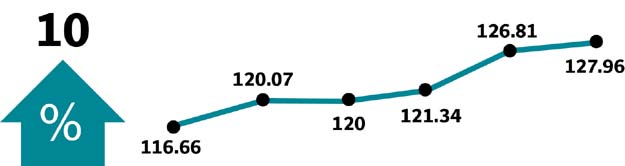

Dawood Hercules Corporation

Dawood Hercules Corporation Ltd produces urea fertilisers. The company also produces anhydrous ammonia for manufacturers of soda ash, fructose and other chemicals.

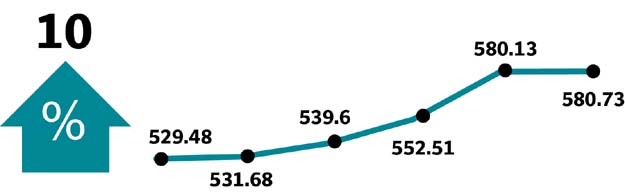

Honda Atlas Cars Pakistan

Honda Atlas Cars Pakistan Limited manufactures, assembles and sells Honda vehicles through its many divisions within Pakistan.

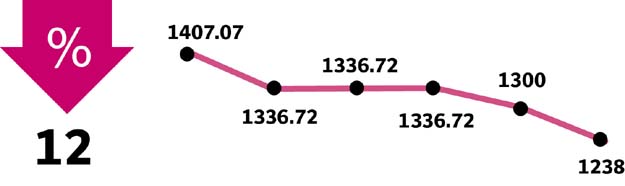

Losers of the week

Pakistan Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Kohinoor Textile Mills

Kohinoor Textile Mills produces textiles. The company weaves, dyes and prints natural and synthetic fibres.

Nishat Chunian

Nishat Chunian Limited manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing and finishing units.

Published in The Express Tribune, November 12th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ