Mari Petroleum’s profit up 30.7% to Rs3.61b

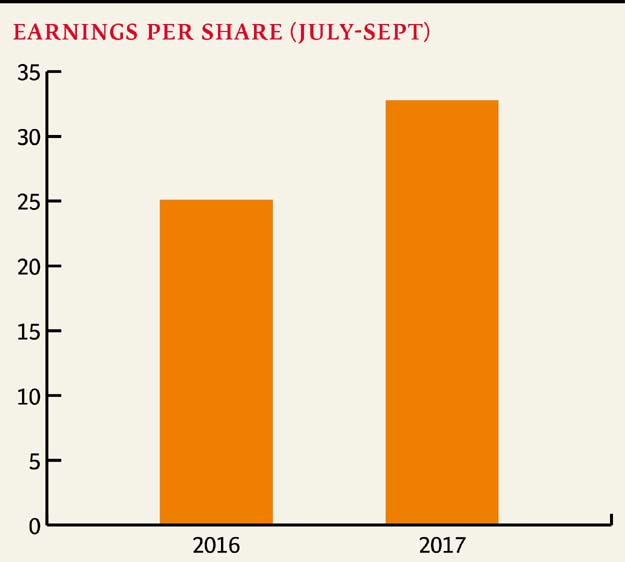

EPS stands at Rs32.77 for Jul-Sept, strong growth attributed to decline in exploration cost

Mari Petroleum HQ

PHOTO: MARI PETROLEUM

Analysts attribute the strong earnings to higher gas production from Mari field, rise in oil prices and decline in exploration cost. Earnings per share (EPS) stood at Rs32.77 in Jul-Sep 2017 compared with Rs25.09 in the corresponding quarter of the previous year.

Its share price closed at Rs1,450, up Rs29.96 or 2.1% on Tuesday with a turnover of 23,940 shares.

Mari Petroleum goes global in partnership with MOL

Revenues for the quarter increased by 29% year-on-year (YoY) to Rs9.34 billion compared to Rs7.26 billion in the corresponding period last year, likely on the back of higher production from Mari field and unwinding of discount on wellhead gas price for Mari field. A 17% YoY rise in oil price also contributed to increased revenues along with price incentivisation through the Petroleum Policy 2012 (PP12) for incremental production and lower benchmark during annual turn-around of customers plant.

Its operating costs, however, increased by 22% YoY to Rs1.93 billion during the period under review compared to Rs1.58 billion recorded in the same period last year.

Mari Petroleum makes second gas discovery in Ghotki

This was offset somewhat by a 48% YoY decline in exploration costs to Rs0.25 billion during 1QFY18, likely in the absence of dry well costs and lower seismic activity.

“However, Mari continued to record other loss mainly owing to lower income from Mari Seismic Unit (MSU) leading to other loss of Rs0.36 billion during the quarter compared with Rs0.04 billion in corresponding period of last year,” IGI Research said in its report.

Effective tax rate stood at 29% during 1QFY18 compared to 27% in the corresponding period last year.

Published in The Express Tribune, November 1st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ