The startling figures speak volumes about the inefficiency of the FBR that has a strong Inland Revenue Service, comprising over 16,000 employees.

Official data showed that during the first quarter (July-September) of this fiscal year, the FBR collected Rs765 billion in revenues. But Rs707 billion were collected on account of withholding taxes, sales tax, federal excise duties and custom duties.

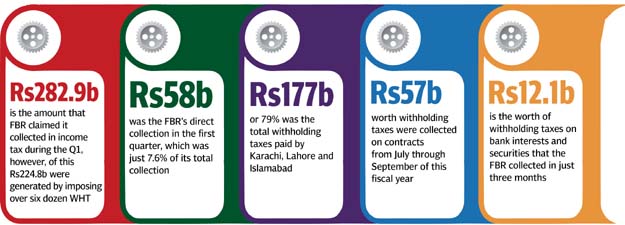

The FBR has claimed that it collected Rs282.9 billion in income tax during the first quarter but Rs224.8 billion of the amount was generated by imposing over six dozen withholding taxes.

The FBR’s net direct collection was only Rs58 billion in the first quarter, which was just 7.6% of total collection.

The Rs224.8 billion withholding taxes collection was 80% of direct income tax collection. The trend was consistent with the results of the first quarter of the last fiscal year, showed the FBR’s documents. Three big cities, Karachi, Lahore and Islamabad, paid Rs177 billion or 79% of the total withholding taxes. Karachi alone paid roughly half or Rs108.6 billion of the total withholding taxes.

FBR refuses to disclose cash rewards paid to officers

Withholding of taxes is an act of deduction or collection of tax at source and over a period of time the FBR has made it an easy source of revenue generation. The important withholding provisions relate to salary, imports, exports, commission and brokerage, dividend incomes, contracts, profit on debt, electricity and gas utilities, property transactions, vehicles tax, stock exchange-related provisions and tax non-residents with varying rates.

Although the government claims that its tax collection increased 72% to Rs3.361 trillion in the last four years, majority of the revenues came either from those who were already in the net or by using indirect sources.

Recently, Prime Minister Shahid Khaqan Abbasi asked FBR Chairman Tariq Pasha to improve his department’s performance and use the data of withholding taxes for broadening the tax base instead of making it a source of revenue generation, the officials said.

People prefer to pay withholding taxes instead of coming in the tax net in order to avoid both payment of full income tax based on income and harassment at the hands of FBR officials.

According to the World Bank Report Ease of Doing Business in Pakistan 2017, it takes 311.5 hours to pay taxes in Pakistan every year and there are 47 types of payments, which increases burden on taxpayers. The “field units of FBR hide behind the facade of withholding taxes to show overall tax collection of their unit and this misrepresents the actual effort of the field units in tax collections”, according to a report of the Tax Reforms Commission that largely remains unimplemented.

The TRC recommended that proper exercise should be carried out by the FBR to gather data from the banks and other authorities to identify cases where people prefer to pay higher rate of withholding taxes instead of coming in the tax net.

One-fourth or Rs57 billion worth withholding taxes were collected on contracts from July through September of this fiscal year. About 22.6% or Rs51 billion of Rs224.8 billion withholding taxes were collected on imports alone, which the importers likely passed on to the end consumers. The government has not even spared pulses from the withholding taxes, which are largely consumed by low and middle income groups.

Elusive targets trigger major reshuffle in FBR

The FBR collected Rs12.1 billion worth withholding taxes on bank interests and securities in just three months. On cash withdrawals from banks the FBR collected Rs7.1 billion in the first quarter. In addition, Rs3.8 billion was collected by charging 0.4% of the value of the banking transactions.

On registration of new cars, the FBR collected Rs2.5 billion in the first quarter.

The FBR collected Rs6 billion by imposing withholding taxes on electricity bills and Rs12.1 billion from telephone and mobile phone users.

The FBR has not spared education expenses from the levy of withholding taxes and is charging the tax on expenses incurred both in Pakistan and abroad. It generated Rs530 million from Pakistani educational institutions and Rs111.8 million from those who remitted money abroad to pay fees of their children.

There are also withholding taxes on functions and gatherings, on producing dramas & films and on cable operators.

Published in The Express Tribune, October 24th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ