Market watch: KSE-100 continues to bleed, ends with 489-point fall

Benchmark index finishes at 40,610.72, K-Electric dominates volume

Market talk suggests economic and political uncertainty have now been compounded. PHOTO: PPI / FILE

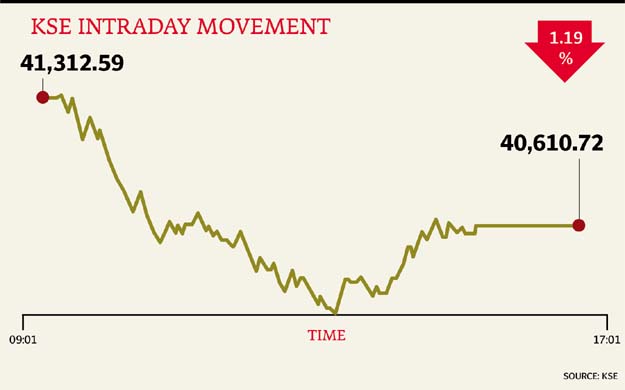

The KSE-100 Index continued its ride in the red on Tuesday, ending with a fall of 489 points or 1.19% as political uncertainty and worrying macroeconomic indicators dampened investor sentiment.

The benchmark was on a downward trajectory from the word go, shedding over 800 points in intra-day trading to hit a low of 40,287.26, with selling in index-heavy names contributing most to the losses.

Value picking at attractive levels meant the KSE-100 recovered close to half its losses, but still ended at 40,610.72 by close.

Elixir Securities, in its report, stated equities closed lower with benchmark KSE-100 Index plunging 1.19%.

“The market started the day on a weaker note and continued to fall as the day progressed with heavy selling in index names and thin trading volumes contributing to losses on the KSE-100 index,” the report said.

“The session’s highlight was K-Electric (KEL PA -7.5%) coming under heavy selling pressure after sentiments were dented due to release of new multi-year tariff that failed to meet the company’s demand.

Market watch: Politics continues to drag stocks down

“Stock churned most volumes since end of January and contributed more than half to total volumes on the KSE-100 index.

“National Refinery (NRL PA +1.2%) recovered over 5% from its intra-day low as the company notified of commencement of its isomerisation unit that would almost double its current production of motor gasoline going forward.

“We expect volatile trading to continue this week with investors tracking flows in absence of major triggers in order to get sense of market direction,” the report added.

Topline analyst Adnan Sami Sheikh said a general lack of triggers, low volumes and overall weak sentiments coupled with National Electric Power Regulatory Authority’s (Nepra) decision regarding tariff petition by K-Electric, initial impressions of which are negative, stifled the market.

“Resultantly, the KSE-100 index continued on its downward spiral, shedding another 1.2% or 489 points to close at 40,611.

“Participation expanded 49% from Monday’s levels amid heavy turnover of 76.7 million shares in KEL (42% of total volumes) as participants were busy scouring through the 111-page document to best position themselves.

“Sector wise; fertiliser shed 89 points amid uncertainties over export deadline and looming penalty, cements shed 77.1 points as investors remained wary of the pricing pressure ahead due to supply addition, OMCs were down 71 points and power sector shed 57 points led by KEL and HUBC.”

Market watch: KSE-100 climbs 844 points as investors return

Overall, trading volumes rose to 184 million shares compared with Monday’s tally of 123 million.

Shares of 386 companies were traded. At the end of the day, 64 stocks closed higher, 303 declined while 19 remained unchanged. The value of shares traded during the day was Rs6.5 billion.

K-Electric was the volume leader with 76.7 million shares, losing Rs0.52 to close at Rs6.40. It was followed by TRG Pak with 7.6 million shares, losing Rs0.05 to close at Rs34.48 and JS Bank with 6.1 million shares, gaining Rs0.04 to close at Rs7.99.

Foreign institutional investors were net buyers of Rs544 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 11th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ