Fauji Fertilizer’s profit declines 14% to Rs2.4 billion

Earnings per share decrease to Rs1.90 in quarter ended June 2017

Fauji Fertilizer Bin Qasim. PHOTO: http://www.ffbl.com/

The company, which is one of the leading fertiliser makers in Pakistan, also declared an interim dividend of Rs1 per share, according to a company notice sent to the Pakistan Stock Exchange (PSX). However, the dividend was below expectations.

Earnings per share (EPS) also came down to Rs1.90 from an EPS of Rs2.20 in the period under review.

Hubco offers shareholding to Chinese company, Fauji Fertilizer

Fauji Fertilizer share price closed at Rs80.27, 4.5% lower on Monday while the KSE-100 Index closed at 46,010, up 98 points or 0.21%.

Sales grew 14% year-on-year in the second quarter of 2017 due to 21% and 196% increase in Urea and Di-ammonium Phosphate (DAP) off-take to 709,000 and 45,000 tons, respectively.

However, margins were under pressure as Urea/DAP sales weighted average prices have fallen 23% and 12% to Rs1,337 and Rs2,589 per bag, respectively. Gross margins contracted 12 percentage points year-on-year to 21%.

Administrative and distribution expenses rose 55% year-on-year to Rs2.6 billion likely due to aggressive incentives and promotions.

Fauji Fertilizer’s 118MW coal-fired power plant comes online

Consequently, operating profit was down by 59% year-on-year to Rs1.7 billion. Finance cost was contained at Rs892 million, up 3% year-on-year.

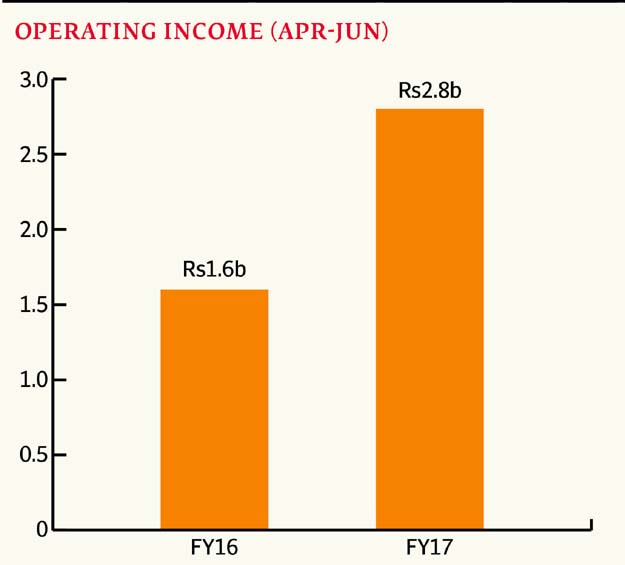

Other income surged 78% year-on-year to Rs2.8 billion likely due to higher subsidy claims along with higher short-term investments.

During the first half of 2017, revenue of the company posted an increase of 7% while gross margins declined by 8 percentage points to 22% due to a decline in urea prices.

Published in The Express Tribune, August 1st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ