After close to 1,200-point surge, KSE-100 ends marginally positive

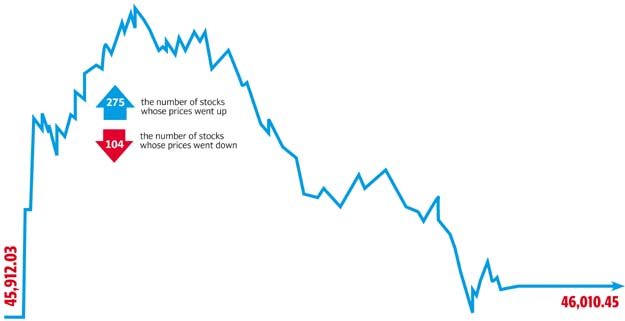

Benchmark index increases 98.42 points to end at 46,010.45

Stock exchange. PHOTO: AFP

The stock market, which opened for the first time in the absence of a prime minister, shot up from the word go, signalling that the worst was now over. However, amid still some uncertainty and the way forward, investors were keen to book whatever profits they made. At close, the benchmark KSE 100-share Index recorded a rise of 98.42 points or 0.21% to finish at 46,010.45.

According to Elixir Securities, Pakistan equities closed little higher after profit-taking kicked in over 47,000 level and wiped almost all of the morning gains, while turnover in wider market witnessed a notable improvement.

Market watch: KSE-100 ends in the green for third consecutive day

“Market opened gap up with Index gaining by 2.4% or 1,200 points as investors celebrated the end to the political stalemate after ruling PML-N nominated a replacement prime minister and avoided any agitation,” stated the report.

Buying primarily by local institutions drove early gains, however, as Index crossed 47,000 level, stocks met resistance and witnessed profit-taking with foreign investors reportedly taking advantage of the surge and driving selling action in key Index names across major sectors.

Habib Bank (HBL PA -5%) spoilt the party and led most declines after sentiments were dented on rumours that the bank’s New York branch has been fined on non-compliance; rumour that we couldn’t confirm till the writing of this note while bank notified of successfully closing sale of assets in Kenya.

Fauji Fertilizers (FFC PA -4.6%) also closed near the lower price limit on poor earnings announcements while witnessing most volumes since early June. Lucky Cement (LUCK PA -0.9%) ended the day in red with FY17 earnings that came higher than expectations hitting the exchange after market close.

“We see turnover to continue to improve with direction guided by institutional flows. We recommend buying value plays with ENGRO, PPL, GATM, DGKC among the top picks and expect resistance on benchmark KSE-100 Index near 48,000 in days ahead,” the report added.

JS Global analyst Maaz Mulla said the market opened with a jump and continued its upside to make an intraday high of 1,200 points, however, it closed nearly flat at 46,010.

HBL (-5%) closed at its lower circuit on account of rumours of penalty imposed on the bank due to compliance issues in its New York branch. LUCK (-0.50%) posted its financial results for FY17 in which the company reported an EPS of Rs42.34 and a dividend of Rs12/share, in-line with our expectation, said Mulla.

FFC (-4.50%) shed points as financial results for 1H2017 announced by the company did not meet investor expectations. FFC reported an EPS of Rs2.82 and interim dividend of Rs1/share. “Market has come down to attractive levels and value investors are accumulating stocks, however, we recommend investors to sell on strength.”

After wild ride, KSE-100 manages a positive finish

Overall, trading volumes fell to 319 million shares compared with Friday’s tally of 327 million. Shares of 396 companies were traded. At the end of the day, 275 stocks closed higher, 104 declined while 17 remained unchanged. The value of shares traded during the day was Rs18.7 billion.

Azgard Nine was the volume leader with 33.1 million shares, gaining Rs0.46 to close at Rs15.11. It was followed by K-Electric Limited with 19.7 million shares, losing Rs0.03 to close at Rs6.56 and Sui South Gas with 18.2 million shares, losing Rs1.38 to close at Rs41.25.

Foreign institutional investors were net sellers of Rs1.878 billion during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, August 1st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ