KSE-100 ends positive with buying spree in the afternoon

Benchmark index increases 234.46 points to end at 45,294.39

PHOTO: EXPRESS TRIBUNE

The KSE-100 Index fell after the opening bell, declining 500 points in intra-day trading, however, the later session saw a remarkable recovery as the index shot up and closed in the green.

At close on Friday, the benchmark KSE 100-share Index recorded a rise of 234.46 points or 0.52%, to finish at 45,294.39.

Elixir Securities, in its report, stated Pakistan equities finished higher after seeing volatile trading and dull volumes amid heightened political noise.

Stocks had a weak start in the morning with uncertainty on domestic politics mainly contributing to lacklustre volumes.

“The benchmark KSE-100 Index initially traded in a narrow range and afterwards witnessed sharp swings on both sides in a 500-point range with investors reacting negatively to news of arrest of Securities and Exchange Commission of Pakistan chairman on record tampering in Panama case as the morning session neared close,” stated Elixir.

Another key news; of Supreme Court completing hearing on case against prime minister and his family and reserving verdict for a later date also made headlines during the mid-session break and fuelled anxiety among participants.

Contrary to expectations of sharp losses in PM session by many, wider market managed to end on a modest note albeit witnessing wild swings as KSE-100 Index settled over 45,200 level, up 0.5%.

Oils, financials and select industrials mainly contributed to day’s gains while cements witnessed profit-taking and closed lower.

“[We] expect monetary policy decision over the weekend to likely be a non-event for the market next week as most expect no change in discount rate.

“Flows are expected to mainly guide the market direction while news flow on domestic politics will continue to keep investors on the lookout,” the report added.

JS Global analyst Maaz Mulla said the market opened on a negative note and continued its previous day trend with extremely low volumes in the first half of the trading session.

However, in the second half, market showed speedy recovery making an intra-day high of +322 points to finally close at 45,294 level, 234 points above the previous day close.

“Positivity in the market came as SC concluded the hearing of the Panama gate case and reserved its judgment for the same,” said Mulla.

Volumes also recovered in the second half and totalled at 122 million for the day, as buying spree begun in the market.

Moreover, news of Rs185 billion loans to be paid off to DISCOs did not bring much impact to the power sector as scrips in the aforementioned sector witnessed a mixed trend in Friday’s trading session.

Investors interest was seen in steel sector where ISL (+3.10%), INIL (+2.10%) and ASL (+1.34%) closed in the green zone.

“Moving forward, we recommend a cautious approach in the market at current levels due to the rollover week and volatility from the pending decision on the political issue,” the analyst added.

Overall, trading volumes fell to 122 million shares compared with Thursday’s tally of 148 million.

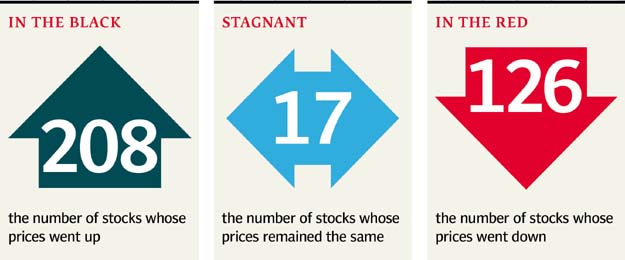

Shares of 351 companies were traded. At the end of the day, 208 stocks closed higher, 126 declined while 17 remained unchanged. The value of shares traded during the day was Rs6.9 billion.

TRG Pakistan was the volume leader with 12.5 million shares, gaining Rs1.76 to close at Rs38.63. It was followed by Dewan Motors with 8.3 million shares, gaining Rs1.46 to close at Rs40.09 and Azgard Nine with 6.3 million shares, gaining Rs0.63 to close at Rs11.97.

Foreign institutional investors were net sellers of Rs14.7 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 22nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ