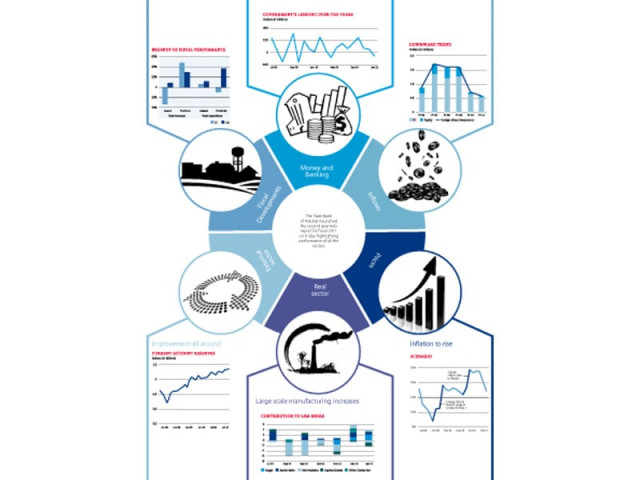

SBP quarterly report: Economy at a glance

Fiscal deficit increased to 2.9 per cent of GDP.

SBP quarterly report: Economy at a glance

As a result of government borrowing in the first half, total domestic debt and liabilities increased by 1.3 percentage points to 35.4 per cent of GDP in December 2010. Trends show an increasing reliance on short-term floating debt, particularly from the banking sector, the central bank stated in the report. In response, the SBP introduced some important initiatives in the first half of fiscal 2011 to facilitate non-banking investment in the government by treasury bills and Pakistan Investment Bonds.

Deficit target to be missed

Fiscal deficit increased to 2.9 per cent of GDP from 2.7 per cent in the same period last year. Persistent growth in expenditures driven primarily by flood relief activities and failure to implement tax reforms, have rendered the fiscal imbalance unsustainable. As such, achieving the deficit target of 4.7 per cent set for fiscal 2011 seems highly unlikely in the absence of a clear strategy to increase the tax base by bringing untaxed sectors into the tax net.

The country’s external accounts posted a surplus of $1.6 billion during the first eight months of fiscal 2011 (July 2010 to February 2011) compared with a surplus of $0.5 billion in the corresponding period of the previous year owing to the significant fall in the current account deficit.

The current account deficit improved massively and was just $98 million during the period under review against $3 billion in the corresponding period last year.

The improvement in the country’s external accounts was also reflected in the buildup of foreign exchange reserves, which reached a new peak of $18.1billion in February.

Remittances continued to perform as well by posting a growth of 20.3 per cent on top of a 17.6 per cent last year. The monthly remittances surpassed the $900 million mark three times in the seven months under review.

Diversified borrowing

The government’s borrowing from the banking system increased 16.2 per cent during the first eight months of fiscal 2011 (July 2010 to February 2011) as borrowing from non-banking and external sources dried up.

Although the government kept its borrowing from the central bank in check, it has only been partially successful in undertaking necessary revenue generation and expenditure reduction measures.

The persistent increase in demand pressures the fiscal deficit called for three successive 50 basis points hike in the policy rate during the first half of fiscal 2011.

Loans

Credit to the public sector enterprises declined sharply to Rs21.5 billion during the first eight months of fiscal 2011 from Rs89.2 billion last year. Private demand for credit picked up to Rs208.8 billion during July to February fiscal 2011 compared with Rs137.9 billion in the same period last year.

After recording flood-related production declines for four consecutive months, Large scale manufacturing (LSM) posted positive growth in December 2010 onwards despite chronic energy shortages and weak textiles performance. Recovery in LSM was expected given the improvement in sugar and robust growth in automobiles loans during October to November 2010, which strengthened expectations of a rise in automobile production in subsequent months.

Agricultural performance during rabi season fiscal 2011 is likely to compensate for some of the flood related losses sustained during kharif.

Prospects for rabi season seem good amid better availability of water and higher prices of most agricultural produce – particularly wheat.

The country is likely to see a record wheat crop of 25 million tons - barring unfavorable weather at the time of harvest. Agri-credit disbursement fell by 4.4 per cent in the first half of fiscal 2011 compared with a 6.9 per cent increase in the same period last year largely due to a decline seen in one specialised bank which more than offset the rise in disbursements made by commercial banks.

The wrong direction

Foreign Direct Investment (FDI) to South and South-East Asian economies rose by 18 per cent in 2010. Surge in profits of foreign affiliates due to improved economic condition in the region significantly increased the level of reinvested earnings. Despite these encouraging developments in the region, factors like weak economic growth, poor security situation, circular debt and energy crisis have limited the profitability of foreign investors in Pakistan. This is reflected by the sharp fall in reinvested earnings that accounted for 36 per cent fall in FDI flows during fiscal 2011 (July to February).

Trade gap widens

Despite the decent growth in exports, trade deficit widened by 7.9 per cent and touched the level of $10.3 billion. This deterioration in trade account is mainly due to an increase of $3.8 billion in the import bill which more than offset the rise of $3 billion in export earnings.

Inflationary pressures remained strong during the first half of fiscal 2011 driven by flood related supply shock and the rising global commodity prices. Although inflation moderated during the first two months of fiscal 2011, this was largely due to the wearing out of flood related rise in food inflation and delays in increasing domestic retail fuel prices in line with the international oil prices. This trend is therefore unlikely to be sustained in the months ahead.

Moreover, the need to resume the International Monetary Fund loan programme would require additional revenue measures, and upward adjustment in power tariffs. These measures would initially add to inflationary pressures. Hence, SBP’s inflation forecast is in the range of 14.5 to 15.5 per cent.

Published in The Express Tribune, April 9th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ