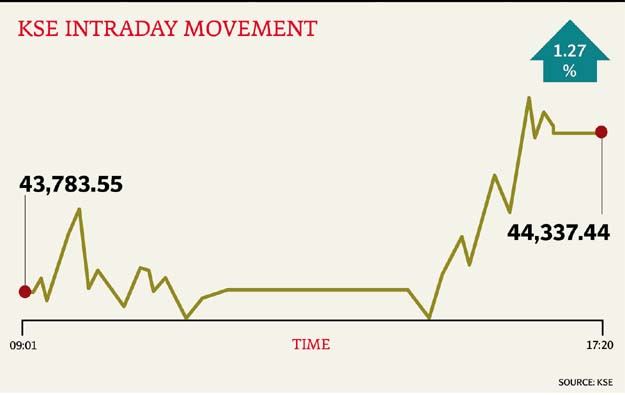

KSE-100 ends with 554-point gain amid low turnover

Benchmark-100 index rises 1.27% to end at 44,337.44 points

PHOTO: EXPRESS

The KSE-100 Index witnessed little activity in the early session and remained directionless; however, later it staged a recovery and climbed over 683 points to hit an intra-day high of 44,466.38.

At close, however, the benchmark KSE 100-share Index finished with an increase of 1.27%, or 553.89 points, to end at 44,337.44.

Elixir Securities, in its report, stated that Pakistan equities surged higher in late trading with benchmark KSE-100 Index settling over 44,300.

“The first session saw choppy trading as stocks continued to struggle for direction amid selective participation. Activity, however, improved from the onset of the second session as local institutions reportedly turned buyers and cherry-picked cements, financials and select index names,” stated Elixir.

Despite higher activity in the second half, turnover for the entire day remained muted with mainboards gathering a volume of only 58 million shares, down 24% from the previous day.

Financials outperformed led by Habib Bank (HBL PA +1.3%) and United Bank (UBL PA +2.4%), while in cement space, Lucky Cement (LUCK PA +%1.8), DG Khan Cement (DGKC PA +2.6%) and Maple Leaf (MLCF PA +4.5%) led the rally.

“[We] see investors closely monitoring and digesting developments on the political front over the weekend and hoping for a positive outcome on Monday, July 17, when the Supreme Court hears the case against the First Family,” the report added.

JS Global analyst Arhum Ghous said the KSE-100 index remained lacklustre during the day as the index traded between an intraday high of +683 points and low of -88 points.

“Substantial recovery was witnessed during the last hour of the session, as value-seeking investors started accumulating MSCI stocks, which led the market to enter the green zone,” said Ghous.

However, volumes remained low on Friday as well, with just about 112 million shares changing hands throughout the day.

Commercial banking sector contributed +156 points to the market as heavyweights including, MCB (+0.90%), NBP (+1.72%) and HBL (+1.28%) closed in the green zone.

PSMC (-1.02%), HCAR (-1.04%) and INDU (-1.56%) from the auto sector shed points on account of the negative impact from the revision of custom values of replacement auto parts. OGDC (+0.70%), POL (+1.51%) and PPL (+1.59%) were gainers from the E&P sector.

Despite political uncertainty market has stabilised to a certain level due to attractive price of value stocks.

“Accumulation of stocks for long-term investment is highly recommended at this level, while short-term positions shall be reduced on strength,” he added.

Overall, trading volumes fell to 112 million shares compared with Thursday’s tally of 165 million.

Shares of 340 companies were traded. At the end of the day, value of 240 stocks closed higher, 83 declined while 17 remained unchanged. The value of shares traded during the day was Rs5.9 billion.

Silk Bank was the volume leader with 8.3 million shares, gaining Rs0.01 to close at Rs1.49. It was followed by Power Cement with 8.2 million shares, gaining Rs0.18 to close at Rs12.15 and K-Electric with 8.1 million shares, losing Rs0.20 to close at Rs6.59.

Foreign institutional investors were net buyers of Rs56 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 15th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ