KSE-100 recovers amid institutional investors’ interest

Benchmark 100-share index finishes with 560.01-point gain after 5-day losing streak

PHOTO: AFP

However, it was not all that simple.

Market watch: KSE-100 index rises slightly, crosses 51,100 barrier

The KSE-100, which has been under severe pressure for the past several sessions, opened lower once again and went as low as 1,088 points in intra-day trading after opening at 44,914.44. But cheap valuations attracted institutional investors that eventually helped the KSE-100 surpass the 45,750-point barrier. The volatile ride saw the index trade in a range of over 1,930 points during the day.

At close of trading, the benchmark KSE 100-share Index finished with a rise of 560.01 points or 1.25% to close at 45,474.46.

Elixir Securities, in its report, stated that strong institutional buying of favoured stocks helped counteract losses.

“Pakistan equities snapped a five-day losing streak and closed a highly volatile session in green on a day that saw a clear tussle between bulls and bears as the KSE-100 Index swung sharply on both sides in a wide range of over 1,900 points,” stated the report.

“Market opened gap down as the wider market carried bearish momentum on domestic and geo-political concerns with major dent in early trading coming from index-heavy oils as participants tracked overnight losses in global crude.

“Early index decline, however, was underscored by low volumes that led to the market quickly recovering to fill the gap within the first hour of trading.

“Market then witnessed another round of hammering that pulled the index down as much as 2.4% or (-1086 points), followed by a surge of over 4.4% from its intra-day low as investors primarily institutional investors cherry-picked names across major sectors.

“We see flows continuing to guide broader market direction albeit on low volumes as participants get into holiday mood ahead of long Eid holidays,” the report added.

JS Global analyst Arhum Ghous said that redemptions of local mutual funds contributed to massive movements with the index fluctuating between -1,088 and +851 points.

“Market had been astonishingly volatile in today’s trading session, repeatedly going to extreme ends throughout the day. The benchmark index fluctuated between -1,088 points and +851 points to close at +560 points,” said Ghous.

The decline came from redemptions of local mutual funds, where increase came in the latter hours with buying interest on attractive valuations.

NML (+4.8%), HUBC (+3.8%), ISL (+4.3%) and SNGP (+4.8%) from the KSE-100 index closed close to their respective upper circuits, cumulatively contributing 161 points to the index.

Heavyweight stocks from the banking sector all closed in the green zone, including HBL (+0.8%), UBL (+2.5%), MCB (+2.3%), ABL (+0.5%) and NBP (+0.3%) with total contribution of +169 points to the KSE-100 index.

“Further recovery is possible on the last trading session before Eid holidays, however, investors are recommended to avoid intraday positions and maintain a cautious stance,” Ghous added.

Overall, trading volumes rose to 346 million shares compared with Tuesday’s tally of 294 million.

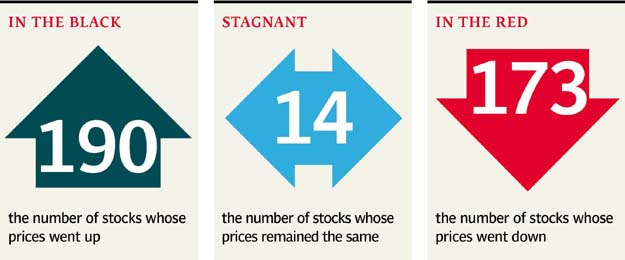

Shares of 377 companies were traded. At the end of the day, 190 stocks closed higher and 173 declined while 14 remained unchanged. The value of shares traded during the day was Rs16.6 billion.

KSE-100 Index shoots up over 1,000 points, closes at record high

TRG Pak was the volume leader with 23.2 million shares, losing Rs0.14 to close at Rs42.72. It was followed by Bank of Punjab with 20.2 million shares, losing Rs0.05 to close at Rs10.81 and K-Electric with 20 million shares, losing Rs0.12 to close at Rs6.85.

Foreign institutional investors were net buyers of Rs999 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, June 22nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ