MPs business interests prevail over state polices

JUI-F senator wants govt to increase import duty on batteries

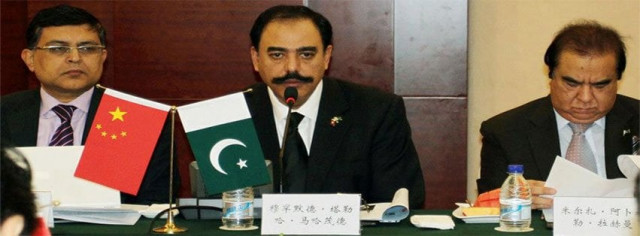

PHOTO: SENATOR MUHAMMAD TALHA MAHMOOD FACEBOOK PAGE

In a latest episode, JUI-F Senator Muhammad Talha Mehmood on Friday brought the case of his batteries business to a meeting of the Senate Standing Committee on Finance that is currently discussing taxation measures proposed by the government in the finance bill 2017-18.

Senator Mehmood, who is also a member of the standing committee, wanted to use the powers of the committee to stop the government from reducing customs duties on the import of batteries.

Senate panel opposes extending Super Tax for another year

In the budget, the government has proposed abolition of customs duties on items being used for solar system, including batteries to promote clean energy in the country.

He objected to the proposal, saying the import of batteries would flood the market and edge out local manufacturers.

The batteries are used in vehicles, telephone exchanges, solar panels and more importantly in homes and offices as alternate to electricity supply during load-shedding.

Eurobond debt paid off with Chinese loan

Due to a huge demand, the manufacturers have over the years compromised on the quality of their products.

“Senator Talha is in the batteries business,” said Senator Saleem Mandviwalla, the chairman of the standing committee.

In order to protect his business interests, Senator Mehmood also made recommendations to the Senate on the matters having direct impact on his business interests. He did not even hesitate from using the name of his company in the budget proposals submitted in the Senate for its consideration.

Senate panel refuses to validate disputed tax orders

Senator Mehmood used the name of Pakistan Accumulators Private Limited. The company’s website shows that it focuses in various battery types under brands ‘Volta’ and ‘Osaka’.

The affluent senator wanted the government to increase import duties on four types of batteries being produced by his factories from the existing 11% and 20% to a uniform rate of 35%.

The senator claimed that at present the battery manufacturing industry was having Rs55 billion annual turnover and consumers were paying Rs10 billion in sales tax on the purchase of batteries.

Senate panel opposes cabinet’s powers for Dar

“Ethically, it is a wrong precedent that members discuss their personal business matters at the committee forum,” confessed Senator Mandviwalla while responding to a question.

Just a day earlier, the committee had supported the government’s proposal to lower duties on solar and related equipment, including batteries.

Duty-free imports threaten Pakistan’s first can manufacturing plant

The committee members were of the unanimous view that locally produced batteries were of extremely low quality. At one point, Senator Madviwalla appeared sympathetic to his colleague, although he said people might not prefer lead-acid batteries due to better lifetime of imported lithium batteries.

On Friday, PML-N Senator Saud Majeed took a bold stance against his fellow colleague, lamenting that the committee should not have again discussed the issue after supporting the government proposal a day earlier.

“Their batteries are of very low quality, as four locally produced batteries are equal to one imported battery and we should not punish consumers,” said Senator Majeed after Senator Mehmood left the venue.

Senate body stops FBR from raiding business premises

FBR Chairman Dr Mohammad Irshad revealed that even before the announcement of the budget, Finance Minister Ishaq Dar had taken Senator Mehmood into confidence about reduction in duties on batteries and solar panels.

It was not an isolated case as another committee member, Senator Ilyas Bilour of the ANP, often pleads his tax cases at the committee forum. For the past two days, Senator Bilour has been seeking changes in tax laws aimed at getting some competitive advantage for his vegetable ghee business.

“I agree that parliamentarians should not bring their personal business matters at the committee forum,” said Senator Ayehsa Raza Farooq of the PML-N.

Inquiry into circular debt payments suggested

Earlier, Chairman National Assembly Standing Committee on Finance Qaiser Ahamd Sheikh misused his public office to get competitive advantage for his chemical business.

The FBR reduced the duty structure for Nimir Chemicals – the competitor of Sheikh’s industry. This disturbed the business plan of the Nimir Chemicals Pakistan Limited and due to Sheikh’s influence the Nimir’s owners are unable to get justice from any parliamentary or government forum.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ