Oil and gas sector likely to generate Rs391.5 billion in revenue for government

In outgoing year, receipts are 7% lower than the Rs394.8b target

PHOTO: EXPRESS

K-P govt for inclusion of 9 projects in CPEC

In FY17, though the government set a revenue target of Rs394.8 billion from the oil and gas sector - a major revenue-spinner for the state, actual receipts stood 7% lower at Rs366.29 billion as Gas Infrastructure Development Cess (GIDC) collection was not up to the mark. The government has set targets for the collection of royalty, petroleum levy, gas development surcharge and GIDC, but it puts aside targeted general sales tax receipts.

Sales tax collection on sale of petroleum products rose from Rs25 billion to Rs30 billion in FY17 following increase in the tax rate. To avoid revenue loss, the government set the sales tax in percentage terms and later revised it upwards.

Royalty collection in FY18 is projected to go up to Rs78.5 billion, up 21% from the original target in FY17, in the wake of spillover effects of higher international crude oil prices on locally produced crude oil and gas. In FY17, the government had set the target of royalty on oil and gas, discount on local crude oil, windfall levy on crude oil and petroleum levy on liquefied petroleum gas (LPG) at Rs64.89 billion. However, it was later revised upwards to Rs66.29 billion because of increase in royalty on crude oil.

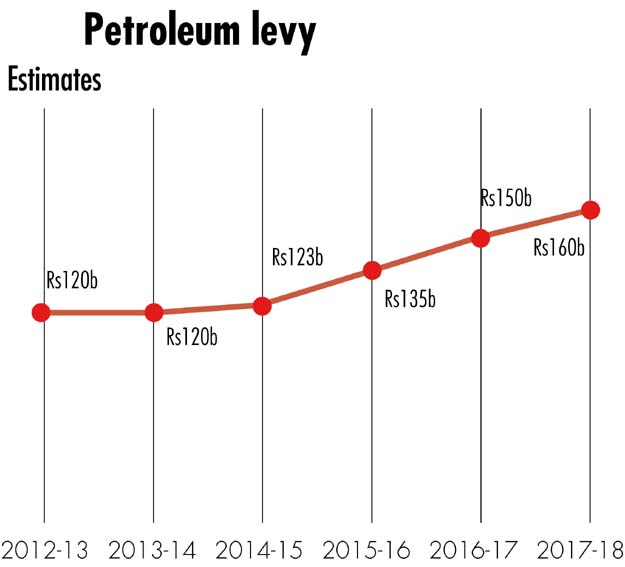

The government, encouraged by the rise in consumption of petroleum products, has fixed a 6.6% higher target at Rs160 billion for petroleum levy in FY18. For the outgoing year, the target was Rs150 billion, but collection advanced to Rs155 billion.

For GIDC collection, the government has pushed the target down by 24% to Rs110 billion for FY18 after lower receipts in the outgoing year. In FY17, the target was Rs145 billion, but actual receipts amounted to only Rs80 billion.

Funds gathered from this source were supposed to be spent on gas import projects like liquefied natural gas (LNG) and laying of pipelines for gas supply from Iran and Turkmenistan, but the government utilised the money to bridge the yawning budget gap.

Gas development surcharge, which is the difference between prescribed and selling prices of gas that goes to provinces, is expected to generate revenues of Rs43 billion in FY18.

OGRA continues to function without a quorum, raises legal challenges

The amount is 23% higher than the target of Rs35 billion for FY17. Actual collection in the outgoing year was, however, substantially fatter at Rs65 billion due to revision in prescribed gas prices.

The collection of royalty on crude oil production, which has jumped to between 80,000 and 100,000 barrels per day, is expected to rise 77% to Rs19.12 billion in the upcoming financial year.

For FY17, the government had set the target at Rs10.8 billion, however, actual receipts swelled to Rs15.6 billion.

The royalty on natural gas has been targeted at Rs39.4 billion as opposed to Rs32.09 billion for the outgoing financial year.

Published in The Express Tribune, May 27th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ