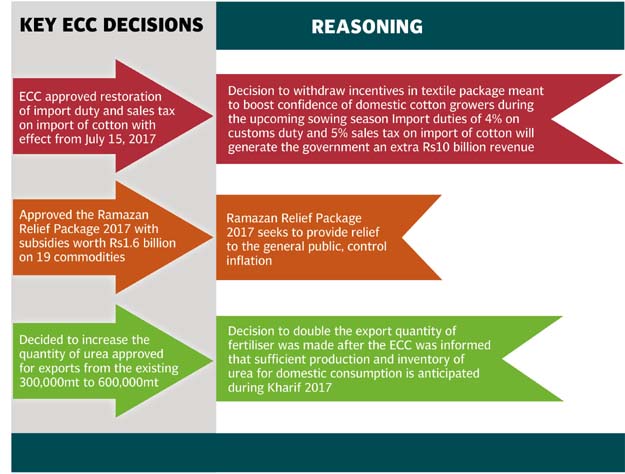

On a proposal by the Finance Division, the Economic Coordination Committee of the Cabinet (ECC) approved the restoration of import duty and sales tax on import of cotton with effect from July 15, 2017. The ECC also approved to double the export quantity of fertiliser to 600,000 metric tons in order to clear glut of the commodity caused by manufacturing and excess imports. It also approved a Ramazan package to provide subsidy on 19 essential commodities.

Awaited: Rs180 billion package still not implemented

The ECC took the decision to impose duties on import of cotton despite the country facing a shortfall in production this year against the annual target. Pakistan has been a net importer of cotton since 1998 and yet the government has been charging taxes under one pretext or the other.

CREATIVE COMMONS

The decision has been made to boost the confidence of domestic cotton growers during the upcoming sowing season, according to a handout issued by the finance ministry after the ECC meeting.

The Ministry of Finance requested the ECC that the government should restore 4% customs duty and 5% sales tax on import of cotton. With the restoration of duties and taxes, the government will be able to generate an extra Rs10 billion in revenue; by charging total 9% duties and taxes on imported cotton. The industry is compelled to import cotton due to shortfall of the commodity in the domestic market.

Pakistan does not produce long staple cotton, which is an important component of value-added textile products.

The decision to restore duties and taxes would encourage growers to cultivate cotton in the current season, said Hasan Iqbal, Secretary Textile Division. He said that his division managed to delay the restoration of the duties and taxes till mid-July to facilitate industries to import cotton as per their requirements. Iqbal said that the government has to watch the interests of both the farmers and industrialists.

On January 10 this year, Prime Minister Nawaz Sharif had announced the textile package in an attempt to boost exports that have been declining for the last four years. Under the package, sales tax, customs duty on import of textile machinery and cotton had been abolished.

However, the government’s decision to partially withdraw these incentives within four months indicates growing fiscal constraints and inconsistency in policies.

The decision has been taken at a time when the textile industry is facing huge challenges to enhance its exports. The exports plunged 2.3% to only $16.9 billion during July-April period of this year, according to the Pakistan Bureau of Statistics.

During the ongoing fiscal year, cotton production stood at only 10.54 million bales - which was 25% less than 14.1 million target set for this fiscal year. There is a minimum of 3 million bales’ shortfall that the industry will have to meet by importing cotton. The industry needs imported cotton until the next crop arrives.

Business confidence in Pakistan declines, says OICCI survey

In the last fiscal year, the industry had imported 2.6 million bales while the local production had been estimated at 9.7 million bales.

However, the finance ministry moved the summary on the plea that the agriculture sector has started reviving therefore; there was a need to support it by making imports expensive.

Urea export

The ECC also decided to increase the quantity of urea approved for exports from the existing 300,000 metric tons to 600,000 metric tons, said the finance ministry. The cabinet body also extended the deadline for export of urea from April 28, 2017 to October 31, 2017.

These decisions were made by the ECC after considering the proposal of the Ministry of Commerce, based on the recommendations of the Fertilizer Review Committee. The ECC was informed that sufficient production and inventory of urea of domestic consumption is anticipated during Kharif 2017 for allowing export.

Published in The Express Tribune, May 17th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1731570357-0/elon-musk-(1)1731570357-0-405x300.webp)

-(1)1717678110-0/Kendrick-(1)-(1)1717678110-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ