The decline comes after the Pakistan Stock Exchange (PSX) was upgraded to the MSCI Emerging Markets status, with investors factoring in the country's weightage and addition/deletion of stocks in the MSCI Pakistan Index.

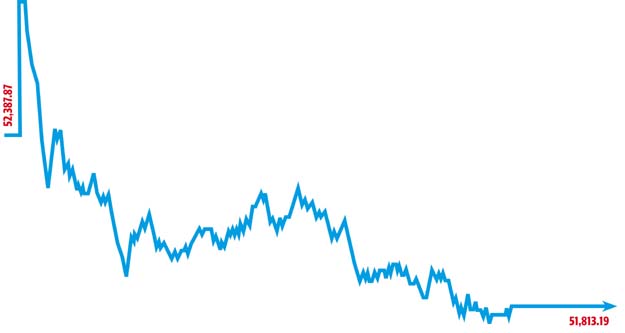

At close, the Pakistan Stock Exchange's (PSX) benchmark KSE 100-share Index recorded a fall of 574.68 points or 1.1%, to end at 51,813.19.

According to Elixir Securities, Pakistan equities closed lower with the benchmark KSE-100 Index settling as much as 1,000 points down from its intra-day record high on profit-taking.

Pakistan upgraded to MSCI Emerging Markets Index

"Market opened gap up over MSCI inclusion euphoria, however, the index - that gained 488 points in the initial surge - nosedived with stocks across-the-board witnessing selling pressure as market participants came to realisation that pro-forma weightage of Pakistan in MSCI Emerging Market Index would be less than earlier expectations," said analyst Ali Raza.

"Hence, understandably major dent came from six MSCI EM candidates namely Habib Bank (HBL PA -3.3%), United Bank (UBL PA -2.6%), MCB Bank (MCB PA -3%), Engro Corp (ENGRO PA -2.6%), Lucky Cement (LUCK PA -2.2%) and Oil and Gas Development Company (OGDC PA -2%) all cumulatively responsible for over 70% to the Index downturn.

"On the other hand, small cap names to the likes of EPCL, DSL, DFML, LOTCHEM, DCL attracted attention and topped the volumes chart on retail interest," he remarked.

Market watch: KSE-100 ends shy of 52,400, gains over 600 points

"We expect the market to enter a consolidation phase and see volatile and range-bound trading in the near-term with Tuesday's high likely providing immediate resistance to KSE-100 Index on the upside," Raza added.

JS Global Nabeel Haroon said the local bourse remained volatile as KSE-100 index traded between an intraday high of +459 points and intraday low of -634 points to finally close at 51,813.

"Banking sector led the decline in the market as they cumulatively contributed -294 points to the index. HBL (-3.34%), UBL (-2.62%) and MCB (-3.02%) were the major laggards of the aforementioned sector," said Haroon.

"Profit taking was witnessed in the fertiliser sector as sector heavy weights, FFC (-3.28%) and FFBL (-0.67%), closed in the red zone," he said.

"However, E&P sector continued its previous day's momentum as crude oil prices surged to trade at $49.18/bbl level. POL (+1.55%) and PPL (+0.55%) were the major gainers of the mentioned sector.

"Moving forward, we expect the market to continue its bullish momentum and recommend investors to accumulate MSCI EM stocks on dips," the analyst added.

The downside of PSX’s emerging market status

Overall, trading volumes rose to 378 million shares compared with Monday's tally of 352 million.

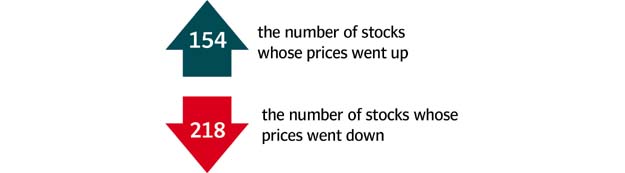

Shares of 397 companies were traded. At the end of the day, 154 stocks closed higher and 218 declined while 25 remained unchanged. The value of shares traded during the day was Rs23.4 billion.

Engro Polymer was the volume leader with 42.4 million shares, gaining Rs0.30 to close at Rs31.48. It was followed by Dost Steels Limited with 41.7 million shares, gaining Rs0.77 to close at Rs14.97 and Dewan Farooque Motors with 20.2 million shares, gaining Rs2.60 to close at Rs54.6.

Foreign institutional investors were net sellers of Rs239 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ